Get the free Equity Schemes

Show details

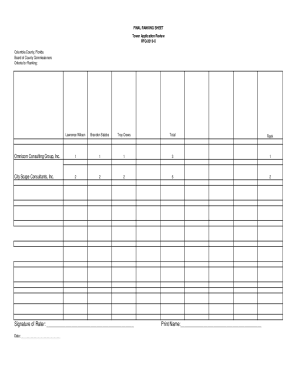

A detailed document providing information about various equity schemes offered by Religare Mutual Fund, including investment objectives, asset allocation patterns, risk profiles, performance, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equity schemes

Edit your equity schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equity schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equity schemes online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit equity schemes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equity schemes

How to fill out equity schemes:

01

Gather all necessary information about the company or project in which you are investing. This includes financial statements, business plans, and any other relevant documents.

02

Analyze the risks and potential returns of the investment. Consider factors such as market conditions, industry trends, and the company's competitive advantage.

03

Evaluate the credibility and expertise of the management team. Look for experienced and successful individuals who have a track record of making sound business decisions.

04

Determine your investment goals and risk tolerance. Establish the amount of money you are willing to invest and the desired return on investment.

05

Choose the appropriate equity scheme based on your investment goals and risk appetite. There are various types of equity schemes available, such as growth funds, value funds, and sector-specific funds.

06

Fill out the necessary application forms provided by the investment company or financial institution offering the equity scheme. Provide accurate and complete information to ensure a smooth investment process.

07

Review and understand the terms and conditions of the equity scheme. Pay attention to fees, charges, and redemption policies.

08

Submit the filled-out application forms along with the required documents, such as identification proof and address verification, if required.

09

Keep track of your investments and regularly monitor the performance of the equity scheme. Stay updated with any news or changes that may impact your investment.

10

Seek professional advice if needed. Consulting a financial advisor can provide valuable insights and guidance throughout the investment process.

Who needs equity schemes:

01

Individuals looking to invest in hopes of earning significant returns over the long term.

02

Investors who are willing to take on a certain level of risk in exchange for potentially higher rewards.

03

Those who have a thorough understanding of the investment market and can actively manage their investment portfolio.

04

Individuals who have a diversified investment strategy and want to incorporate equities as part of their overall portfolio.

05

People who believe in the growth potential of a particular industry or company and want to participate in their success.

06

Investors with a long-term investment horizon, as equity schemes tend to perform better over extended periods.

07

Individuals who are comfortable with market volatility and can tolerate fluctuations in the value of their investments.

08

Those who have done thorough research on the equity scheme and believe it aligns with their investment goals and risk tolerance.

09

Investors who are looking for tax-efficient investment options, as some equity schemes offer tax benefits.

10

Individuals who are interested in participating in the ownership and growth of businesses by investing in shares.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify equity schemes without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your equity schemes into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete equity schemes online?

With pdfFiller, you may easily complete and sign equity schemes online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit equity schemes on an iOS device?

Create, modify, and share equity schemes using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is equity schemes?

Equity schemes refer to investment schemes where the funds are primarily invested in stocks and shares of companies.

Who is required to file equity schemes?

Asset management companies and mutual funds are required to file equity schemes.

How to fill out equity schemes?

Equity schemes can be filled out by providing details of the invested stocks and shares, along with other relevant information, as per the specified format.

What is the purpose of equity schemes?

The purpose of equity schemes is to provide investors with the opportunity to invest in a diversified portfolio of stocks and shares, which have the potential for higher returns.

What information must be reported on equity schemes?

Information such as the name of the scheme, its objective, investment strategy, assets under management, performance history, and associated risks must be reported on equity schemes.

Fill out your equity schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equity Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.