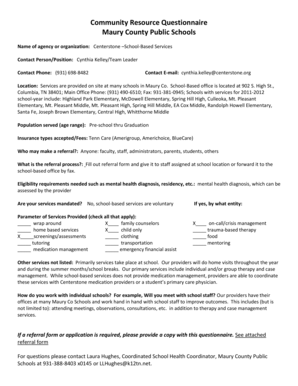

Get the free 6999 per night tax Code 110950 Or Just say Ivy Dragoons - ivydragoons

Show details

3050 Mountain Green Drive Branson, MO 65616 ×417× 3354700 ×417× 3354912 fax (800× 6776906 toll-free HOTEL REGISTRATION FORM Ivy Dragoons The special room rate for the Ivy Dragoons is: $69.99

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 6999 per night tax

Edit your 6999 per night tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 6999 per night tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 6999 per night tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 6999 per night tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 6999 per night tax

How to fill out 6999 per night tax:

01

Begin by gathering all relevant financial documents and receipts related to the accommodations for which the tax applies.

02

Ensure that you have the appropriate tax form or document required to report the 6999 per night tax. This may vary depending on your jurisdiction or country's tax laws.

03

Fill out the tax form accurately, providing all necessary information such as the name and contact details of the taxpayer, the duration of the accommodations, and the amount of tax owed per night.

04

Double-check the form for any errors or omissions before submitting it. Incorrect or incomplete information may lead to penalties or delays in processing.

05

If required, attach any supporting documents or receipts to verify the accuracy of the reported tax amount. This may include invoices or booking confirmations from the accommodations provider.

06

Submit the completed tax form and any accompanying documents through the appropriate channels as specified by your local tax authority. This may involve mailing the forms, submitting them electronically, or visiting a tax office in person.

Who needs 6999 per night tax:

01

The 6999 per night tax is typically required by individuals or businesses who provide accommodations for a fee. This may include hotels, motels, vacation rentals, or other lodging establishments.

02

Depending on the jurisdiction, the tax may apply to both residents and non-residents who offer accommodations for a certain number of nights. It is important to consult the local tax regulations to determine who specifically needs to pay this tax.

03

Accommodations providers should familiarize themselves with the tax laws applicable to their location to ensure compliance and avoid any potential penalties or legal issues.

It is important to note that the provided content is a sample and may not accurately reflect the specific requirements or regulations of the 6999 per night tax. Tax laws and procedures can vary between jurisdictions, so it is advisable to consult with a tax professional or the appropriate tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out 6999 per night tax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 6999 per night tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit 6999 per night tax on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 6999 per night tax. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out 6999 per night tax on an Android device?

Use the pdfFiller Android app to finish your 6999 per night tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is 6999 per night tax?

The 6999 per night tax is a tax imposed on accommodations rented out for 6999 per night.

Who is required to file 6999 per night tax?

Anyone who rents out accommodations for 6999 per night must file the tax.

How to fill out 6999 per night tax?

To fill out the 6999 per night tax, one must report the total number of nights rented out at 6999 and calculate the corresponding tax amount.

What is the purpose of 6999 per night tax?

The purpose of the 6999 per night tax is to generate revenue for the government from accommodation rentals at that specific rate.

What information must be reported on 6999 per night tax?

The information that must be reported on the 6999 per night tax includes the total number of nights rented out at 6999, the amount of tax owed, and any other relevant details.

Fill out your 6999 per night tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

6999 Per Night Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.