Get the free Advice Letter 4163-E

Show details

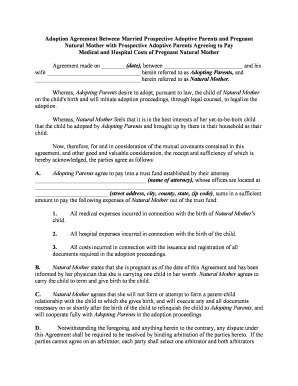

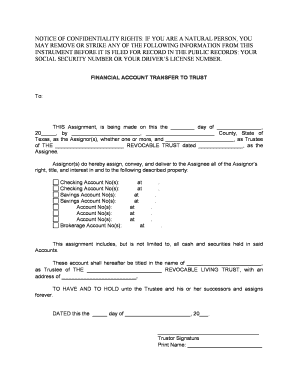

This document outlines the proposals by Pacific Gas and Electric Company for modifications to the Rate Schedule RES-BCT to simplify the true-up process for Local Government Renewable Energy Self-Generation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign advice letter 4163-e

Edit your advice letter 4163-e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your advice letter 4163-e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing advice letter 4163-e online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit advice letter 4163-e. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out advice letter 4163-e

How to fill out Advice Letter 4163-E

01

Obtain a copy of Advice Letter 4163-E from the relevant regulatory agency.

02

Read the instructions provided with the letter to understand the context.

03

Fill in the necessary details such as your name, address, and account number.

04

Provide a clear explanation of the purpose of the letter and any relevant background information.

05

Include any supporting documents that may bolster your case.

06

Review the completed letter for accuracy and clarity.

07

Submit the letter according to the specified submission guidelines.

Who needs Advice Letter 4163-E?

01

Individuals or organizations affected by utility rate changes.

02

Stakeholders seeking to express concerns or provide input on proposed utility actions.

03

Anyone intending to formally communicate with the regulatory agency regarding specific utility matters.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to fix an e-file rejection?

But what if you complete your taxes by the due date and an issue causes your e-file to be rejected? If you receive a rejection of your e-filed return by the day after the filing deadline (usually April 15), the IRS gives you a rejection grace period of five days to refile a timely filed rejected return.

How long does it take to process return after e-verification?

Refund processing by the tax department starts only after the return is e-verified by the taxpayer. Usually, it takes 4-5 weeks for the refund to be credited to the account of the taxpayer.

What is ERO in business terms?

Definition. The Electronic Return Originator (ERO) is the authorized IRS e-file provider who originates the electronic submission of a return to the IRS.

How do I get an ero pin?

An ERO PIN (Practitioner PIN) is used when a preparer is including Form 8879 IRS e-file Signature Authorization in the submission of a client's return. The number is created by the preparer following the IRS criteria listed in the IRS Self-Select PIN Method for Forms 1040 and 4868 Modernized e-File (MeF) webpage.

How many times can I fix a rejected return?

(updated January 2, 2024) You can electronically file up to three amended returns per tax year.

What is the perfection period for e-file rejection?

Per Publication 4163, Modernized E-file (MeF) business returns have a “perfection period” of 10 days from the date of rejection.

How do I fix a rejected e-file?

Your return will be rejected if your Social Security Number, name, or a number from your Form W-2 was incorrectly typed. Review and correct your personal information entries in the Basic Information section of the Federal Q&A Topics. Repeat the Filing steps to resubmit your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Advice Letter 4163-E?

Advice Letter 4163-E is a communication document filed by utility companies to inform the California Public Utilities Commission (CPUC) about proposed changes in rates, services, or tariffs.

Who is required to file Advice Letter 4163-E?

Utilities that are regulated by the CPUC and want to propose changes related to rates or services must file Advice Letter 4163-E.

How to fill out Advice Letter 4163-E?

To fill out Advice Letter 4163-E, a utility must include details such as the proposed changes, justification for the changes, impacts on customers, and any related appendices or supporting documentation.

What is the purpose of Advice Letter 4163-E?

The purpose of Advice Letter 4163-E is to provide the CPUC with the necessary information to evaluate and approve or deny proposed changes by the utility regarding tariffs or services.

What information must be reported on Advice Letter 4163-E?

Advice Letter 4163-E must report information including the utility's name, proposed effective date, detailed description of changes, relevant calculations, and customer impact analysis.

Fill out your advice letter 4163-e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Advice Letter 4163-E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.