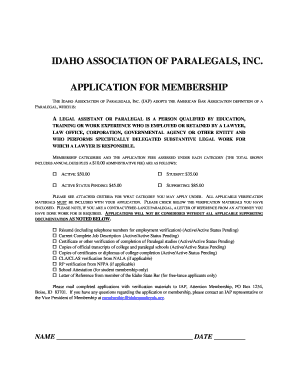

Get the free Nebraska Rules of Bankruptcy Procedure

Show details

The document outlines the rules and procedures for bankruptcy cases in Nebraska, detailing local rules, application processes, and requirements for both debtors and creditors.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska rules of bankruptcy

Edit your nebraska rules of bankruptcy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska rules of bankruptcy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska rules of bankruptcy online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nebraska rules of bankruptcy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska rules of bankruptcy

How to fill out Nebraska Rules of Bankruptcy Procedure

01

Obtain the Nebraska Rules of Bankruptcy Procedure document from the court's website or local courthouse.

02

Read through the document to understand the structure and requirements.

03

Gather necessary personal and financial information, including income, debts, and assets.

04

Fill out the required forms step by step, ensuring accuracy in all details provided.

05

Review the filled-out forms for any errors or missing information before submission.

06

File the completed forms with the appropriate court, adhering to any specified deadlines.

07

Pay any required filing fees, or apply for a fee waiver if necessary.

Who needs Nebraska Rules of Bankruptcy Procedure?

01

Individuals or businesses filing for bankruptcy in Nebraska.

02

Attorneys representing clients in bankruptcy cases.

03

Trustees handling bankruptcy estates.

04

Creditors seeking to understand the processes involved in bankruptcy cases.

Fill

form

: Try Risk Free

People Also Ask about

What will I lose if I declare bankruptcy?

Don't worry — you won't lose everything in bankruptcy. Most people can keep household furnishings, a retirement account, and some equity in a house and car in bankruptcy. But you might lose unnecessary luxury items, like your fishing boat or a flashy car, or have to pay to keep them.

How often can you file bankruptcy in Nebraska?

There is no limit to the number of times individuals can declare bankruptcy in Nebraska. There are limits, however, on how often you may file. For Chapter 7, you must wait eight years to have another case discharged. Chapter 13 is two years, but most plans for Chapter 13 take three to five years to resolve.

What is the most common bankruptcy procedure?

The most common types of bankruptcy are chapter 7, which are liquidating bankruptcy, and chapter 13 cases, often used by individuals who want to catch up on past due mortgage or car loan payments and keep their assets.

What happens if you file for bankruptcy in Nebraska?

What Happens After Filing for Bankruptcy? Your creditors will stop bothering you soon after you file. It takes a few days because the court mails your creditors notice of the "automatic stay" order that prevents most creditors from continuing to ask you to pay them.

What is the income limit for bankruptcy in Nebraska?

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

What cannot be wiped out by bankruptcies?

Special debts like child support, alimony and student loans, will not be eliminated when filing for bankruptcy. Not all debts are treated the same. The law takes some debts very seriously and these cannot be wiped out by filing for bankruptcy.

How much do you pay monthly for bankruptcies?

In the majority of cases the cost is approximately $200 a month for each of the 9 months. If you have 'surplus' income, according to Low Income Cut-Offs, you may be required to pay a portion of your income into the bankruptcy, for the benefit of your creditors. How long will I be in bankruptcy?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nebraska Rules of Bankruptcy Procedure?

The Nebraska Rules of Bankruptcy Procedure are a set of legal guidelines and standards that govern the process of bankruptcy cases in the state of Nebraska, establishing the procedures for filing, handling, and resolving bankruptcy cases in accordance with federal law.

Who is required to file Nebraska Rules of Bankruptcy Procedure?

Individuals or entities that are seeking bankruptcy relief in Nebraska, including businesses and consumers who meet the eligibility criteria for bankruptcy under federal law, are required to adhere to the Nebraska Rules of Bankruptcy Procedure.

How to fill out Nebraska Rules of Bankruptcy Procedure?

To fill out the Nebraska Rules of Bankruptcy Procedure, individuals must complete the required forms provided by the court, ensuring that all necessary information regarding their financial situation, debts, assets, and other relevant details are accurately reported.

What is the purpose of Nebraska Rules of Bankruptcy Procedure?

The purpose of the Nebraska Rules of Bankruptcy Procedure is to provide a structured framework for the bankruptcy process, ensuring fairness, consistency, and transparency in the handling of bankruptcy cases, and to facilitate an orderly resolution of financial distress.

What information must be reported on Nebraska Rules of Bankruptcy Procedure?

The information that must be reported includes personal identification details, a list of creditors, a statement of financial affairs, schedules of assets and liabilities, income and expenses, and any ongoing legal actions related to the debtor.

Fill out your nebraska rules of bankruptcy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Rules Of Bankruptcy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.