Get the free Junior ISA Terms and Conditions

Show details

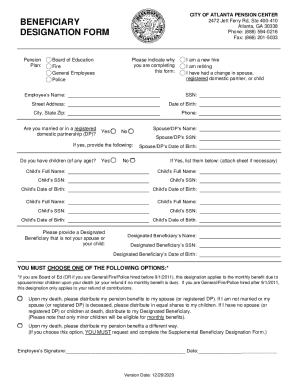

This document outlines the terms and conditions for the Legal & General Junior ISA, including definitions, acceptance criteria, cancellation rights, payment administration, and investment practices.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign junior isa terms and

Edit your junior isa terms and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your junior isa terms and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit junior isa terms and online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit junior isa terms and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out junior isa terms and

How to fill out Junior ISA Terms and Conditions

01

Begin by downloading the Junior ISA Terms and Conditions document from the issuer's website.

02

Read through the entire document carefully to understand the terms.

03

Fill in your personal information, including your name, address, and date of birth.

04

Provide the child's details for whom the Junior ISA is being opened.

05

Select the type of Junior ISA you wish to open (cash or stocks & shares).

06

Read and confirm your agreement to the terms by signing where indicated.

07

Submit the completed form along with any required identification documents.

Who needs Junior ISA Terms and Conditions?

01

Parents or guardians looking to save for their child's future.

02

Individuals wanting to invest in a Junior ISA on behalf of a child.

03

Anyone seeking to understand the legal requirements and regulations surrounding Junior ISAs.

Fill

form

: Try Risk Free

People Also Ask about

What is the loophole for the junior ISA?

The loophole exists because, at present, 16 and 17-year-olds are able to have two ISA allowances in their names. One allowance is the junior ISA of £9,000, and the other is the £20,000 allowance for a cash adult ISA.

Do you have to tell your child about a junior ISA?

Regardless of how old your child is now, you may want to make them aware of their Child Trust Fund or Junior ISA, especially in the lead up to their 18th birthday. This is because they will be able to access their fund and decide whether they wish to make an encashment, continue investing or a mixture of the two.

What are the rules for junior ISAs?

How does a Junior ISA work? A child's parent or legal guardian must open the Junior ISA account on their behalf. Money in the account belongs to the child, but they can't withdraw it until they turn 18, apart from in exceptional circumstances.

What are the disadvantages of a junior ISA?

Your money is locked in As we've mentioned, the money you put into a junior ISA is locked-in until your child turns 18. While this removes temptation, it could be seen as a problem if you or your child need the money before their 18th birthday or if you decide you'd rather use it for something else.

Can parents withdraw from junior ISA?

Withdrawals from a Junior ISA can only be made by the child once they 18.

What are the Junior ISA rules?

How does a Junior ISA work? A child's parent or legal guardian must open the Junior ISA account on their behalf. Money in the account belongs to the child, but they can't withdraw it until they turn 18, apart from in exceptional circumstances. The Junior ISA limit is £9,000 for the tax year 2025/26.

What are the negatives of a junior ISA?

Stocks and shares junior ISAs can fall in value The money invested in a stocks and shares JISA is affected by changes in the stock market. This means the value of your investments could go down as well as up, so your child may get back less than has been put in.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Junior ISA Terms and Conditions?

Junior ISA Terms and Conditions refer to the specific rules and guidelines that govern the operation of a Junior Individual Savings Account (ISA), including eligibility, contributions, withdrawals, and tax implications.

Who is required to file Junior ISA Terms and Conditions?

The account holders of Junior ISAs, typically the parents or guardians of the minor for whom the account is opened, are required to adhere to and file under the Junior ISA Terms and Conditions.

How to fill out Junior ISA Terms and Conditions?

To fill out Junior ISA Terms and Conditions, you must provide personal information about the child and the account holder, including identification, contact details, and confirmation of terms acceptance; this can usually be completed via an online application or paper form provided by the financial institution.

What is the purpose of Junior ISA Terms and Conditions?

The purpose of Junior ISA Terms and Conditions is to outline the rights and responsibilities of both the account holder and the financial institution, ensuring compliance with regulations and protecting the interests of the minor beneficiary.

What information must be reported on Junior ISA Terms and Conditions?

Information that must be reported includes details of the account holder, the minor's personal information, contribution limits, the account's current balance, transaction history, and any relevant legal or financial disclosures as required by law.

Fill out your junior isa terms and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Junior Isa Terms And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.