Get the free INTERNATIONAL PORTFOLIO BOND

Show details

This document serves as the formal appointment of a Platform Provider and Financial Adviser by the policyholder for the management of investments within the International Portfolio Bond, outlining

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international portfolio bond

Edit your international portfolio bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international portfolio bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international portfolio bond online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit international portfolio bond. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

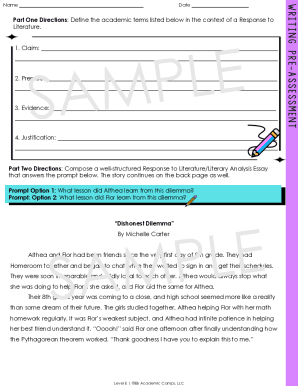

How to fill out international portfolio bond

How to fill out INTERNATIONAL PORTFOLIO BOND

01

Gather all necessary personal identification documents.

02

Obtain the International Portfolio Bond application form from the provider.

03

Fill in your personal details including name, address, and date of birth.

04

Choose the currency for your bond investment.

05

Specify the premium payment frequency (monthly, quarterly, annually).

06

Indicate the total amount you wish to invest in the bond.

07

Select any additional riders or benefits you want included in the bond.

08

Review the terms and conditions of the bond carefully.

09

Sign and date the application form.

10

Submit the completed form along with the required documents to the bond provider.

Who needs INTERNATIONAL PORTFOLIO BOND?

01

Individuals seeking long-term investment growth.

02

People looking for tax-efficient investment options.

03

Those who want to diversify their investment portfolio internationally.

04

Investors interested in life insurance benefits alongside investment growth.

05

Wealthy individuals planning for estate and succession planning.

Fill

form

: Try Risk Free

People Also Ask about

Are international bonds a good investment?

International bonds are much riskier than US bonds because of less regulation and higher risk of default. The point of holding bonds is to lower volatility.

What is an international portfolio?

What Is an International Portfolio? An international portfolio is a selection of stocks and other assets that focuses on foreign markets rather than domestic ones. If well designed, an international portfolio gives the investor exposure to emerging and developed markets and provides diversification.

What is an international investment bond?

An offshore bond, or international investment bond, is simply a tax-efficient wrapper that is issued outside of UK jurisdiction. [2] The word 'offshore' can cause people to make the incorrect assumption that these are highly complex tax-evasion vehicles.

What are international investment bonds?

An offshore bond, or international investment bond, is simply a tax-efficient wrapper that is issued outside of UK jurisdiction. [2] The word 'offshore' can cause people to make the incorrect assumption that these are highly complex tax-evasion vehicles.

How much of your bond portfolio should be international?

However, to get the full diversification benefits, consider investing about 40% of your stock allocation in international stocks and about 30% of your bond allocation in international bonds.

What are the two types of international bonds?

Eurobonds: Underwritten by an international company using domestic currency and then traded outside of the country's domestic market. Foreign bonds: Issued in a domestic country by a foreign company, using the regulations and currency of the domestic country.

What happens after 20 years with an offshore bond?

So, you can have 5% of the initial investment amount for 20 years, or 4% for 25 years etc. A taxable income is created when the bond is cashed in or surrendered either in full or in part. This will happen when a withdrawal exceeds the cumulative 5% p.a. annual allowance.

What is the international portfolio bond for wrap?

The International Portfolio Bond for Wrap is an offshore investment linked life insurance product made up of a number of individual policies. The Bond is provided by Standard Life International dac, a part of the Phoenix group and is administered in Ireland.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INTERNATIONAL PORTFOLIO BOND?

An International Portfolio Bond is a type of investment product that allows individuals to hold a variety of financial assets and investments, typically from different countries, under a single insurance or investment wrapper. This can include stocks, bonds, or mutual funds and often provides tax advantages or other financial benefits.

Who is required to file INTERNATIONAL PORTFOLIO BOND?

Individuals or entities that invest in International Portfolio Bonds and wish to report their financial assets for tax purposes are typically required to file this bond. This can include expatriates, foreign investors, or residents with substantial foreign investments.

How to fill out INTERNATIONAL PORTFOLIO BOND?

Filling out an International Portfolio Bond involves providing personal and financial information, including details of the investments held, the value of the portfolio, and any relevant income or gains. It is advisable to consult with a financial advisor or tax professional to ensure accurate completion.

What is the purpose of INTERNATIONAL PORTFOLIO BOND?

The purpose of an International Portfolio Bond is to provide investors with a flexible and efficient means of managing and holding international investments, while also potentially benefiting from tax efficiencies and estate planning advantages.

What information must be reported on INTERNATIONAL PORTFOLIO BOND?

Information that must be reported includes the identity of the investor, details about all financial assets included in the bond, their current market value, income generated from these assets, and any gains or losses realized during the reporting period.

Fill out your international portfolio bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Portfolio Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.