Get the free MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES

Show details

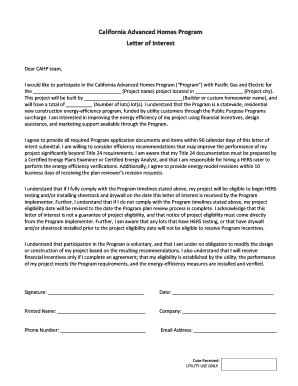

This document serves as a registration form for mortgage intermediaries to register and provide their details for the payment of procuration fees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage intermediary registrationpayment of

Edit your mortgage intermediary registrationpayment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage intermediary registrationpayment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage intermediary registrationpayment of online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage intermediary registrationpayment of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage intermediary registrationpayment of

How to fill out MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES

01

Obtain the MORTGAGE INTERMEDIARY REGISTRATION form from the relevant regulatory authority or website.

02

Fill in your personal details, including name, address, and contact information.

03

Provide details about your business, including the business name, registration number, and type of services offered.

04

Specify the type of mortgage products you will be intermediating.

05

Include information on any professional qualifications or licenses you possess.

06

Review the fee structure for procuration fees and include the relevant payment information.

07

Attach any required documentation, such as proof of identity and business registration.

08

Submit the completed form along with the required fees to the regulatory authority.

Who needs MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

01

Mortgage brokers and intermediaries who facilitate mortgage transactions.

02

Individuals or businesses intending to offer mortgage-related services.

03

Real estate professionals who assist clients in obtaining mortgage financing.

Fill

form

: Try Risk Free

People Also Ask about

What is the average mortgage procuration fee?

This is sometimes known as a procuration fee, and is around 0.35% of the mortgage value. Some brokers who work for commission might still charge you a fee on top. That might be an upfront flat fee for beginning their search. It might be a refundable fee, that they pay you back if they don't get you a mortgage.

How much is a mortgage product fee?

Effectively, a product fee is the price it costs to set up your mortgage. You can either add this to the loan or pay it up front. Some mortgages don't have product fees, but others may do. Typical fees are £495, £999, or even £1,500 or more.

What is the average proc fee?

Most mortgage lenders will pay brokers a commission, or procuration fee, of about 0.35% of the loan size.

What is the procuration fee for mortgage?

pays a procuration fee of 0.30% gross for Product Transfers - to recognise the work you do for your client to make sure they get the right deal to meet their needs.

What is the procuration fee for Santander?

The actual procuration fee percentage paid on residential purchases will remain unchanged. The change means that the procuration fee will now always directly relate to the value of the mortgage. On buy-to-let mortgages, Santander is reducing the procuration fee from 0.5% to 0.45%.

What is a procuration fee?

the total amount paid by a home finance provider to a home finance intermediary , whether directly or indirectly, in connection with providing applications from customers to enter into home finance transactions with that home finance provider .

How much is precise mortgages procuration fee?

For all new customer options completions, we'll pay a procuration fee of 0.25% if submitted direct or, if submitted via a club or network, we'll pay them 0.30% for distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

MORTGAGE INTERMEDIARY REGISTRATION refers to the process by which individuals or entities that facilitate mortgage transactions register with the appropriate authority. The PAYMENT OF PROCURATION FEES is a fee paid to mortgage intermediaries for their services in securing mortgage agreements between borrowers and lenders.

Who is required to file MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

Individuals or businesses acting as mortgage intermediaries, which may include brokers and agents who assist in arranging loans for clients, are required to file for MORTGAGE INTERMEDIARY REGISTRATION and pay the applicable procuration fees.

How to fill out MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

To fill out the MORTGAGE INTERMEDIARY REGISTRATION, one must complete a designated application form, provide required documentation such as proof of identity, business information, and any previous registration details, and submit payment for the procuration fees according to the guidelines set by the regulatory authority.

What is the purpose of MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

The purpose of MORTGAGE INTERMEDIARY REGISTRATION is to ensure that all mortgage intermediaries are properly vetted and compliant with regulations, thus promoting transparency and accountability in the mortgage industry. The PAYMENT OF PROCURATION FEES helps fund oversight and regulatory activities.

What information must be reported on MORTGAGE INTERMEDIARY REGISTRATION/PAYMENT OF PROCURATION FEES?

The information that must be reported typically includes the business name, address, contact information, details of ownership or partnership, license numbers, and records of past transactions. Additionally, any related financial information necessary for assessing compliance may also be required.

Fill out your mortgage intermediary registrationpayment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Intermediary Registrationpayment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.