Get the free Check Acceptance - Business and Finance - The Ohio State University - busfin osu

Show details

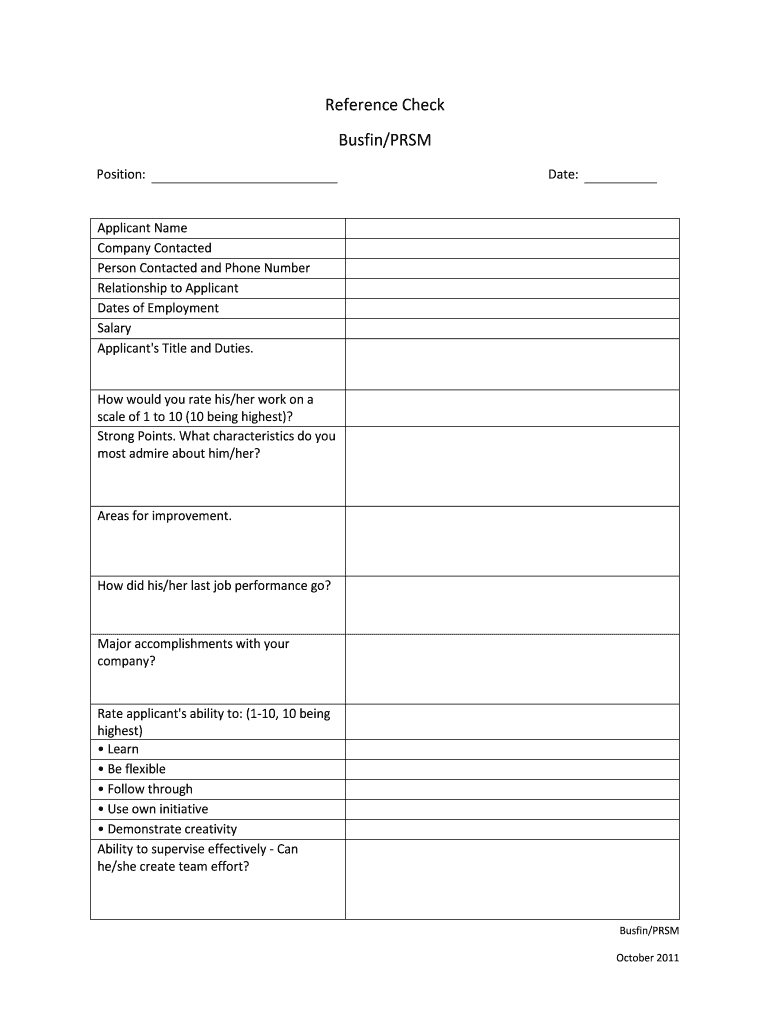

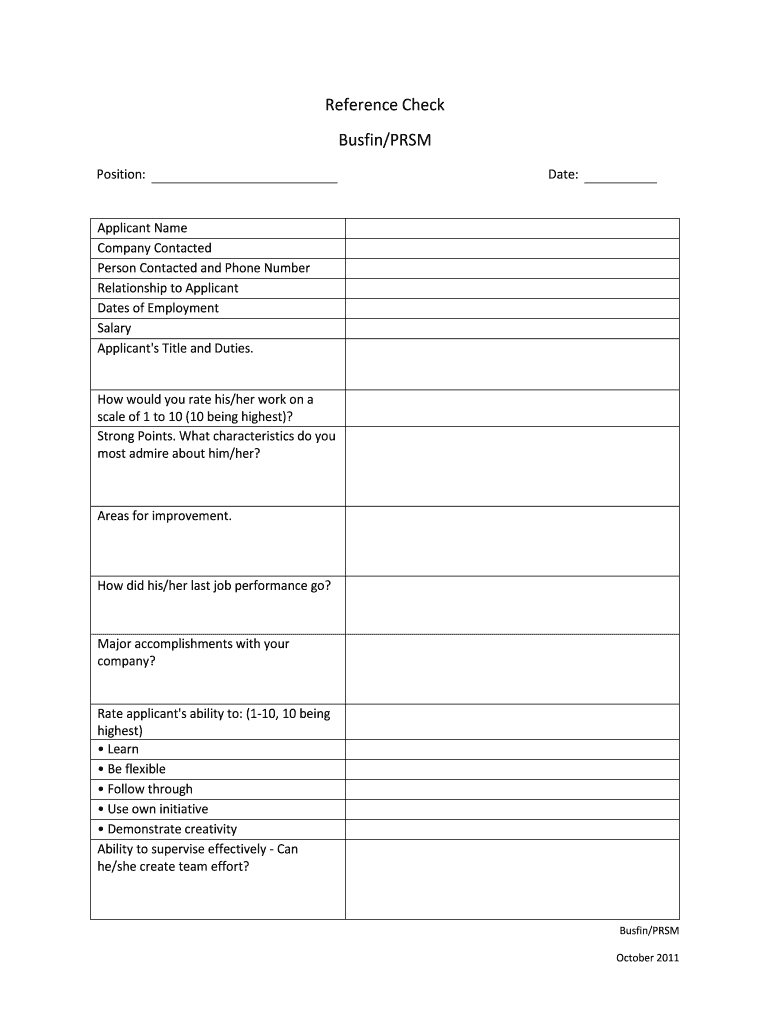

Reference Check Buskin×PRISM Position: Date: Applicant Name Company Contacted Person Contacted and Phone Number Relationship to Applicant Dates of Employment Salary Applicant's Title and Duties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check acceptance - business

Edit your check acceptance - business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check acceptance - business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check acceptance - business online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit check acceptance - business. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check acceptance - business

How to fill out check acceptance - business?

01

Write the date: Start by writing the current date on the line labeled "Date" in the top right corner of the check. Be sure to use the correct format, typically month, day, and year.

02

Enter the name of the payee: On the line labeled "Pay to the Order of," write the name of the individual or business that will receive the funds. Make sure to write legibly and accurately.

03

Write the amount in numbers: On the line to the right of the payee name, enter the amount of money you wish to pay in numerical format. Be precise, using both dollars and cents if necessary. Make sure to write the amount close to the left-hand side to prevent any alterations.

04

Spell out the amount in words: Underneath the payee line, write out the amount in words. Start by writing the whole dollar amount in words, followed by "and," and then the cents portion in words. Be sure to fill up the space provided to avoid any alterations.

05

Memo line (optional): If there is a specific purpose for the payment or any additional information you want to include, you can write it on the memo line. This is typically located in the bottom left corner. It can help maintain clarity regarding the purpose of the payment.

06

Sign the check: In the bottom right corner, you will find a line labeled "Signature." Sign your name using the same signature you have on file with your bank. Your signature confirms that you authorize the payment.

Who needs check acceptance - business?

01

Retail stores: Many retail businesses accept checks as a form of payment. By offering check acceptance, businesses can cater to a wider range of customers who prefer this payment method.

02

Service-based businesses: Professionals such as attorneys, accountants, consultants, and other service providers often accept checks from their clients. It provides a convenient way for clients to pay for ongoing services or make large payments.

03

B2B transactions: In business-to-business transactions, checks are commonly used to settle payments between companies. By accepting checks, businesses can maintain a traditional payment option that is familiar and convenient for many organizations.

Overall, businesses that want to offer customers various payment options or cater to specific customer preferences may choose to accept checks. Additionally, accepting checks can help businesses establish trust and credibility, as they offer customers a secure and widely accepted payment method.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check acceptance - business to be eSigned by others?

Once your check acceptance - business is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute check acceptance - business online?

pdfFiller has made filling out and eSigning check acceptance - business easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit check acceptance - business on an Android device?

You can make any changes to PDF files, like check acceptance - business, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is check acceptance - business?

Check acceptance - business is the process of a business accepting payment by check from customers.

Who is required to file check acceptance - business?

Any business that accepts payment by check from customers is required to file check acceptance - business.

How to fill out check acceptance - business?

To fill out check acceptance - business, businesses must report all checks received, including the check number, amount, and customer information.

What is the purpose of check acceptance - business?

The purpose of check acceptance - business is to track payments received by check and ensure accurate record-keeping for financial purposes.

What information must be reported on check acceptance - business?

Businesses must report the check number, amount, date received, customer name, and any other relevant details for each check accepted.

Fill out your check acceptance - business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Acceptance - Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.