Get the free CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION

Show details

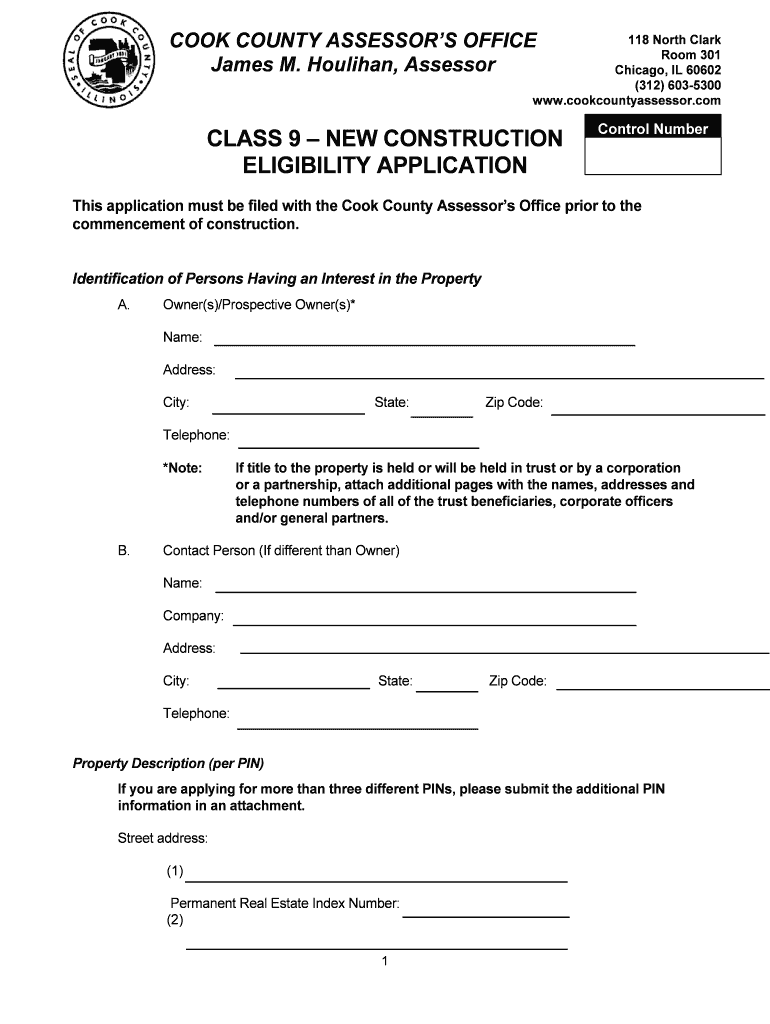

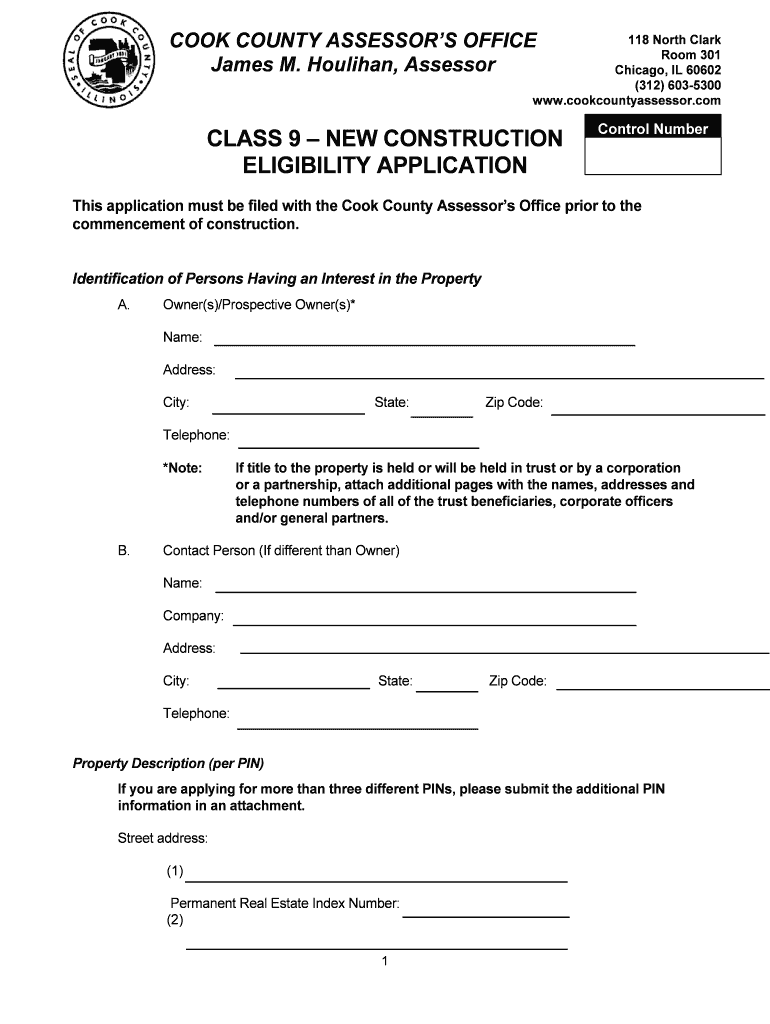

This document is an application form for property owners or prospective owners to apply for Class 9 tax incentives for new construction projects in Cook County. It requires detailed information about

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign class 9 new construction

Edit your class 9 new construction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your class 9 new construction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing class 9 new construction online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit class 9 new construction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out class 9 new construction

How to fill out CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION

01

Obtain the CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION form from the appropriate local government or online portal.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details about the new construction, including the address, type of construction, and intended use.

04

Attach any necessary documents, such as plans, blueprints, or permits related to the construction project.

05

Review the application for accuracy and completeness.

06

Sign and date the application form.

07

Submit the application to the local tax assessor's office or designated department before the deadline.

Who needs CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

01

Property owners or developers planning new construction projects who seek tax benefits or exemptions under Class 9 regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is Class L in Cook County?

Class L: Provides a reduced level of assessment for buildings in a multi-family rental residential, not-for-profit, commercial or industrial use (Class 3, 4 or 5a/b) where the owner has invested at least 50% of the building's market value in rehabilitation.

How is Cook County divided?

Cook County is divided into three areas, the northern suburbs, southern suburbs, and the City of Chicago. Each of these areas is valued once every three years. Furthermore, Cook County is divided into 36 townships for assessment purposes.

What is the Cook County Class 9 program?

Cook County Class 9 Program offers a 50% reduction in assessments and taxes to developers who complete major rehab on multifamily buildings and keep rent below certain levels.

What is the Cook County 6b program?

Class 6b. Designed to encourage industrial development throughout Cook County by offering a real estate tax incentive for the development of new industrial facilities, the rehabilitation of existing industrial structures, and the industrial reutilization of abandoned buildings.

What is the Cook County Class 7 incentive?

Class 7(a) and 7(b) Property Tax Incentive Qualifying properties can receive a 12-year reduction in real estate assessments from the standard Cook County commercial rate of 25 percent. Qualifying properties are assessed at 10 percent for the first 10 years, 15 percent for the 11th year and 20 percent for the 12th year.

What is Class 9 in Cook County?

Cook County Class 9 Program offers a 50% reduction in assessments and taxes to developers who complete major rehab on multifamily buildings and keep rent below certain levels.

What is a Class 2 03 in Cook County?

A common classification code is a 2-03, which the Cook County Assessor's Office (CCAO) defines as a one-story residence that is 1,000 to 1,800 square feet. For the purposes of property assessment, every Property Index Number (PIN) is assigned a classification code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

The CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION is a form used by property owners or developers to apply for eligibility under a specific classification that recognizes new construction for property tax purposes.

Who is required to file CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

Property owners or developers who have recently completed new construction on their property and wish to qualify for tax benefits associated with new construction are required to file this application.

How to fill out CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

To fill out the CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION, applicants should provide required information such as property details, descriptions of the new construction, and any relevant documentation that supports the application.

What is the purpose of CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

The purpose of the CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION is to determine whether a property qualifies for a classification that offers reduced property tax rates for newly constructed buildings.

What information must be reported on CLASS 9 – NEW CONSTRUCTION ELIGIBILITY APPLICATION?

The information that must be reported includes property identification details, a description of the new construction, completion dates, and any other relevant data necessary to assess eligibility for the tax classification.

Fill out your class 9 new construction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Class 9 New Construction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.