Get the free Mortgage Pre-?Qualification Request - NBDC Bank

Show details

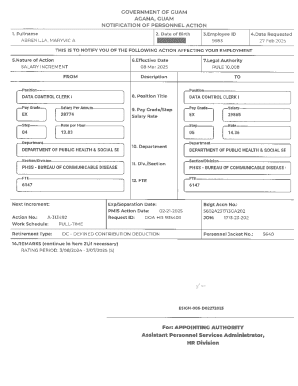

Mortgage Prepublication Request Steven R. Turner Vice President, Loan Department Manager 131133 Delaware St. Walton, NY 13856 ×607× 8653202 (Direct) Turner nbdcbank.com MAO # 500677 This application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage pre-qualification request

Edit your mortgage pre-qualification request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage pre-qualification request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage pre-qualification request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage pre-qualification request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage pre-qualification request

Question: How to fill out a mortgage pre-qualification request and who needs it?

How to fill out a mortgage pre-qualification request:

01

Start by gathering all the necessary documents. These typically include proof of income, such as pay stubs or tax returns, bank statements, and identification documents.

02

Research and choose a reputable lender or mortgage broker to work with. They will provide you with the pre-qualification request form.

03

Fill out your personal information accurately and completely. This includes your full name, contact information, social security number, and employment details.

04

Provide detailed information about your income and assets. This may include your current employment status, salary, bonuses, and any other sources of income. Additionally, disclose the value of your assets, such as savings, investments, or real estate holdings.

05

Provide information on your monthly debts and expenses. This includes details about any outstanding loans, credit card balances, student loans, and monthly bills.

06

Include details about the property you are interested in purchasing. This may include the property address, estimated purchase price, and any down payment amount you are considering.

07

Sign and date the form, ensuring that all the information provided is accurate and up-to-date.

Who needs a mortgage pre-qualification request:

01

First-time homebuyers: If you are a first-time homebuyer, getting pre-qualified for a mortgage is crucial. It gives you a better understanding of how much you can afford to borrow and helps you set a realistic budget.

02

Homeowners looking to refinance: If you currently own a home and are considering refinancing your mortgage, a pre-qualification request can help you determine your eligibility for a new loan and provide an estimate of your potential loan terms.

03

Real estate investors: Investors who are looking to purchase properties for rental income or fix and flip projects can benefit from a mortgage pre-qualification. It helps them understand their borrowing capacity and enables them to make informed decisions when evaluating potential investment opportunities.

04

Those looking to upgrade or downsize: If you are thinking about selling your current home and purchasing a new one, a mortgage pre-qualification request can help you determine how much you can afford for your next home. This ensures that you are realistic about your budget and helps streamline the homebuying process.

05

Individuals with unique financial situations: If you have a complex financial situation, such as being self-employed or having a less-than-ideal credit score, a pre-qualification request can help you understand what mortgage options may be available to you.

In conclusion, filling out a mortgage pre-qualification request requires gathering necessary documents, providing accurate information about your finances and assets, and choosing a reputable lender. It is beneficial for various individuals, including first-time homebuyers, homeowners looking to refinance, real estate investors, individuals looking to upgrade or downsize, and those with unique financial situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage pre-qualification request to be eSigned by others?

When your mortgage pre-qualification request is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit mortgage pre-qualification request in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing mortgage pre-qualification request and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out mortgage pre-qualification request using my mobile device?

Use the pdfFiller mobile app to fill out and sign mortgage pre-qualification request. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is mortgage pre-qualification request?

A mortgage pre-qualification request is a process where a potential borrower provides basic financial information to a lender to determine how much they may be eligible to borrow.

Who is required to file mortgage pre-qualification request?

Anyone looking to apply for a mortgage loan is typically required to file a mortgage pre-qualification request.

How to fill out mortgage pre-qualification request?

To fill out a mortgage pre-qualification request, the borrower needs to provide information such as income, assets, and debts to the lender.

What is the purpose of mortgage pre-qualification request?

The purpose of a mortgage pre-qualification request is to help borrowers understand how much they may be able to borrow and what type of loan options are available to them.

What information must be reported on mortgage pre-qualification request?

Information such as income, assets, debts, and credit history must be reported on a mortgage pre-qualification request.

Fill out your mortgage pre-qualification request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Pre-Qualification Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.