Get the free Credit Unions - Monthly Financial and Statistical Report - Schedule 6 - Alberta Fina...

Show details

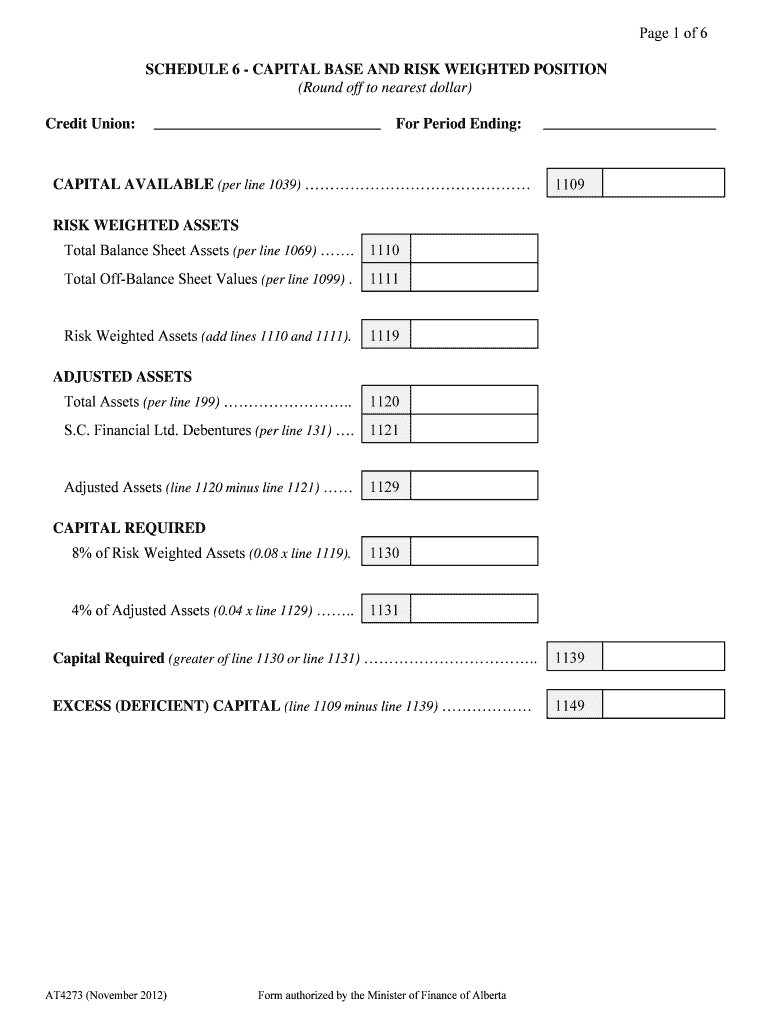

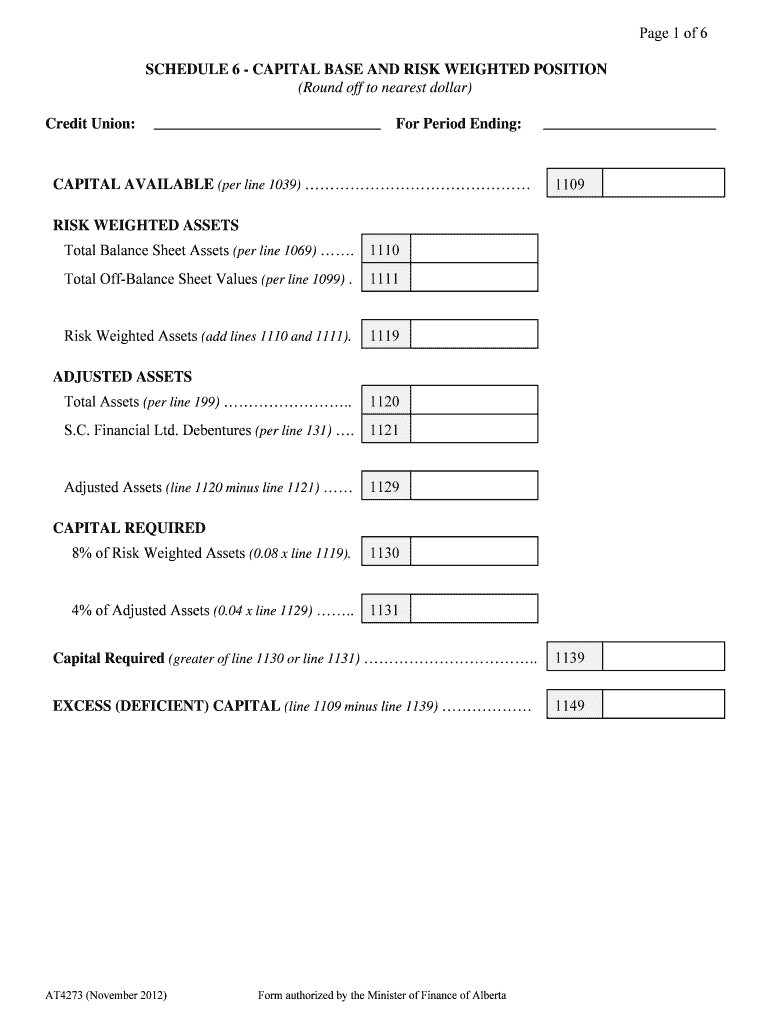

Page 1 of 6 SCHEDULE 6 CAPITAL BASE AND RISK WEIGHTED POSITION (Round off to the nearest dollar) Credit Union: For Period Ending: CAPITAL AVAILABLE (per line 1039× 1109 RISK WEIGHTED ASSETS Total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit unions - monthly

Edit your credit unions - monthly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit unions - monthly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit unions - monthly online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit unions - monthly. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit unions - monthly

How to fill out credit unions - monthly?

01

Research different credit unions: Start by researching different credit unions in your area. Look for ones that offer monthly repayment options and have favorable interest rates. Compare their benefits, fees, and customer reviews to choose the best one for your needs.

02

Gather necessary documents: Before filling out the credit union application, gather all the required documents. These might include proof of income, identification, proof of address, and any other information the credit union may require.

03

Complete the application: Fill out the credit union application form accurately and thoroughly. Make sure to provide all the necessary information and double-check for any errors before submitting it.

04

Provide supporting documents: Along with the application, attach all the supporting documents the credit union requires. This could include pay stubs, bank statements, and any other relevant financial information to verify your income and financial stability.

05

Review and understand the terms: Carefully review the terms and conditions of the credit union agreement. Make sure you understand the monthly payment amount, interest rate, repayment period, and any other terms mentioned. Seek clarification if anything is unclear.

06

Submit the application: Once you have completed the application and attached all the required documents, submit it to the credit union. Ensure that you follow the submission instructions provided by the credit union to avoid any delays in processing.

Who needs credit unions - monthly?

01

Individuals with irregular incomes: Credit unions that offer monthly repayment options can be beneficial for individuals with irregular or fluctuating incomes. The flexibility of monthly payments allows for better budgeting and easier loan repayments.

02

People seeking lower interest rates: Credit unions often offer lower interest rates compared to traditional banks. If you are looking for more affordable borrowing options, credit unions with monthly repayment plans can be a suitable choice.

03

Individuals looking for local banking options: Credit unions are community-based financial institutions that focus on serving their members. If you prefer localized banking services and want to support local economies, credit unions offering monthly repayment plans can be a great fit.

04

Those in need of financial guidance: Many credit unions provide financial counseling services to their members. If you require guidance on managing your finances or improving your credit score, credit unions with monthly repayment options can offer the support you need.

In conclusion, filling out credit unions - monthly involves researching, completing an application, providing supporting documents, reviewing terms, and submitting the application. Credit unions with monthly repayment options are suitable for individuals with irregular incomes, those seeking lower interest rates, people looking for local banking options, and those in need of financial guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit unions - monthly for eSignature?

Once your credit unions - monthly is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get credit unions - monthly?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific credit unions - monthly and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in credit unions - monthly without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your credit unions - monthly, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is credit unions - monthly?

Credit unions - monthly refers to the financial reports that credit unions must file on a monthly basis to provide an overview of their financial activities.

Who is required to file credit unions - monthly?

Credit unions are required to file monthly financial reports as mandated by regulatory authorities.

How to fill out credit unions - monthly?

Credit unions can fill out their monthly reports by compiling financial data, reconciling accounts, and submitting the necessary information to the appropriate regulatory bodies.

What is the purpose of credit unions - monthly?

The purpose of credit unions - monthly reports is to ensure transparency and accountability in the financial operations of credit unions.

What information must be reported on credit unions - monthly?

Credit unions must report financial data such as income, expenses, assets, liabilities, and other key financial metrics.

Fill out your credit unions - monthly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Unions - Monthly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.