Get the free Form 245

Show details

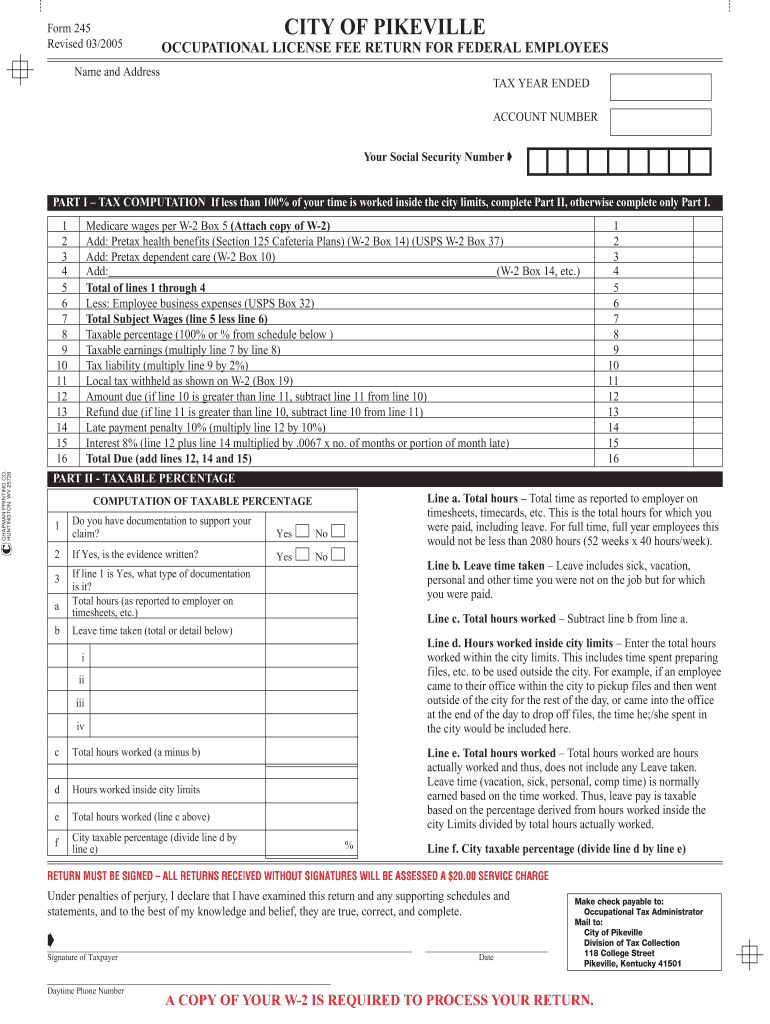

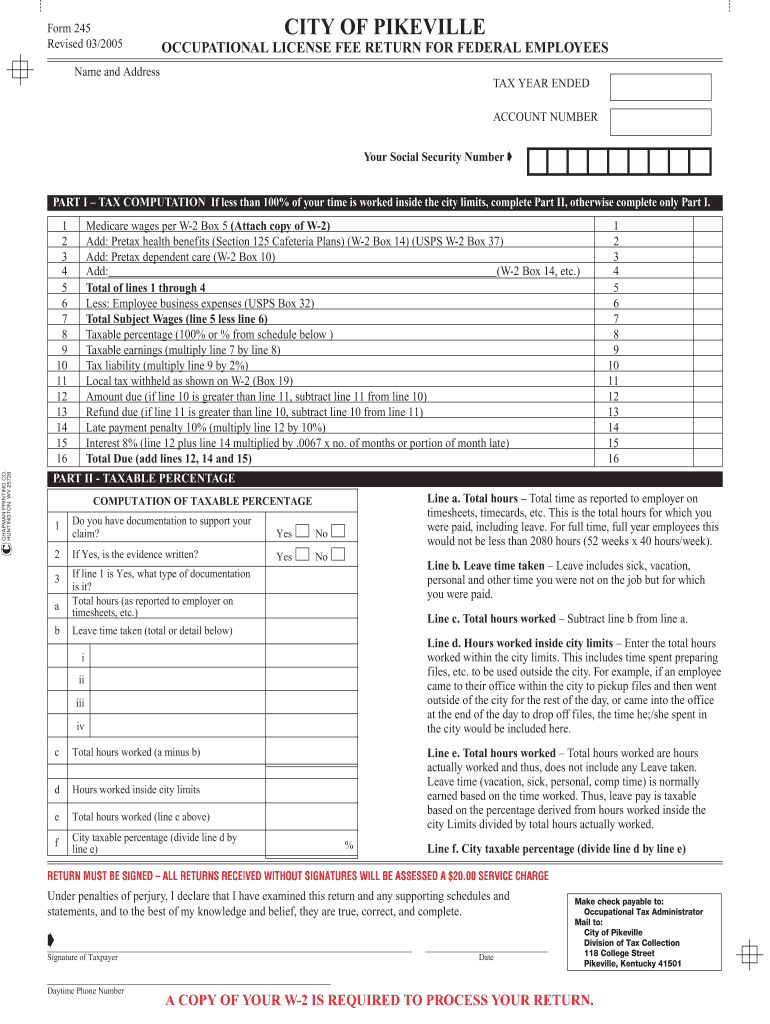

This document is a tax return for federal employees to calculate their occupational license fee based on wages earned within the city limits of Pikeville.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 245

Edit your form 245 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 245 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 245 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 245. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 245

How to fill out Form 245

01

Start by downloading Form 245 from the official website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal details in Section 1, including your name, address, and contact information.

04

Complete Section 2 by providing any required identification numbers.

05

In Section 3, describe the purpose of filling out the form in detail.

06

If applicable, fill out Section 4 with supporting information or documentation.

07

Review your completed form to ensure all information is accurate and legible.

08

Sign and date the form at the designated section.

09

Submit the form as directed, either electronically or by mail.

Who needs Form 245?

01

Individuals who are seeking a specific service or benefit related to the subject of Form 245.

02

Anyone required by law or regulation to fill out this form for compliance purposes.

03

Organizations that need to report information as stipulated in the guidelines related to Form 245.

Fill

form

: Try Risk Free

People Also Ask about

What is the 245a adjustment of status?

Under section 245(a) of the INA, a noncitizen is eligible for adjustment of status if they: • Have been inspected and admitted or paroled upon entry to the United States; • Have an immigrant visa immediately available to them at the time the adjustment application is filed and approved; • Are not otherwise barred under

What is section 245 A?

An alien must meet certain eligibility requirements to adjust status to that of a lawful permanent resident (LPR). INA 245(a) Adjustment of Status Eligibility Requirements. The applicant must have been: Inspected and admitted into the United States; or. Inspected and paroled into the United States.

What is the 245A code?

245A Deduction for foreign source-portion of dividends received by domestic corporations from specified 10-percent owned foreign corporations. 26 USC section 245A. Deduction for foreign source-portion of dividends received by domestic corporations from specified 10-percent owned foreign corporations.

What is the adjustment of status section 245A?

Under section 245(a) of the INA, a noncitizen is eligible for adjustment of status if they: • Have been inspected and admitted or paroled upon entry to the United States; • Have an immigrant visa immediately available to them at the time the adjustment application is filed and approved; • Are not otherwise barred under

Who is eligible for 245A?

Section 245A allows an exemption for certain foreign income of a domestic corporation that is a U.S. Shareholder (within the meaning of IRC Section 951(b)) by means of a 100 percent dividends received deduction (“DRD”) for the foreign source portion of dividends received from “Specified 10-percent owned Foreign

What is a 245 i form?

Under Section 245(i) of the Immigration and Nationality Act (INA), those undocumented immigrants who had an immigrant visa petition or labor certification application filed on their behalf on or before a specified date (filing deadline) are eligible to apply for LPR status without having to depart the United States,

Who passed 245i?

Congress first enacted Section 245(i) in 1994. Congress allowed 245 (i) to "sunset" but the Legal Immigration and Family Equity (LIFE) Act reinstated §245(i) until April 30, 2001.

What is Section 245 of the immigration and Naturalization Act?

Section 245(i) grandfathers individuals as well as the applications or petitions filed for them. The basis of a grandfathered individual's eventual adjustment, however, is not restricted to the application or petition filed to preserve adjustment eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 245?

Form 245 is a tax form used for reporting specific financial details to tax authorities.

Who is required to file Form 245?

Individuals or businesses that meet certain criteria set by tax authorities are required to file Form 245.

How to fill out Form 245?

Form 245 is filled out by providing personal and financial information as outlined in the form's instructions.

What is the purpose of Form 245?

The purpose of Form 245 is to ensure compliance with tax regulations and to report necessary financial information.

What information must be reported on Form 245?

Form 245 requires reporting of income, deductions, and any other relevant financial data as specified in the instructions.

Fill out your form 245 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 245 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.