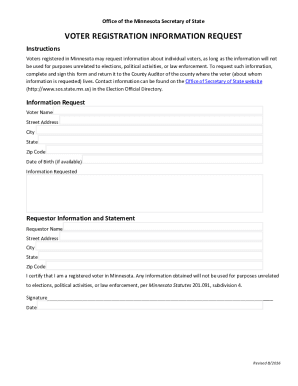

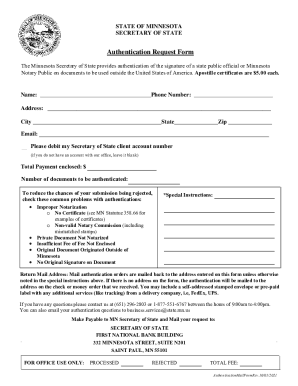

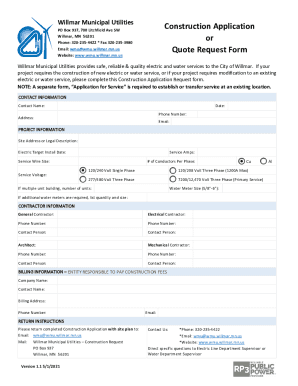

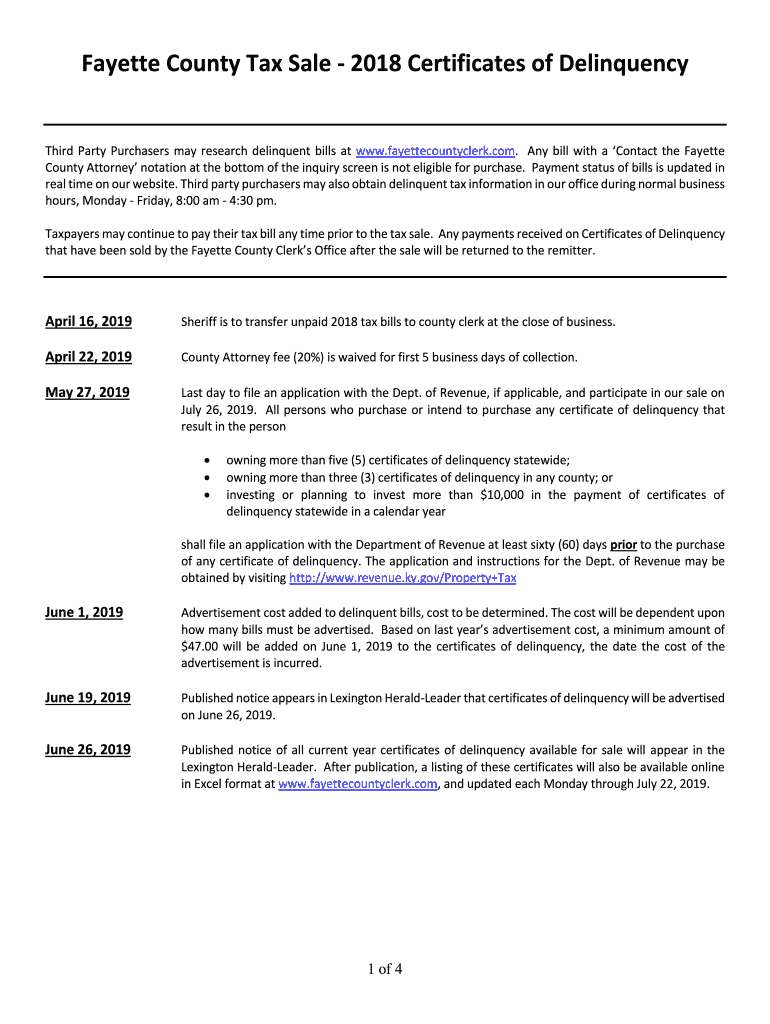

Get the free Fayette County Tax Sale - 2018 Certificates of Delinquency

Show details

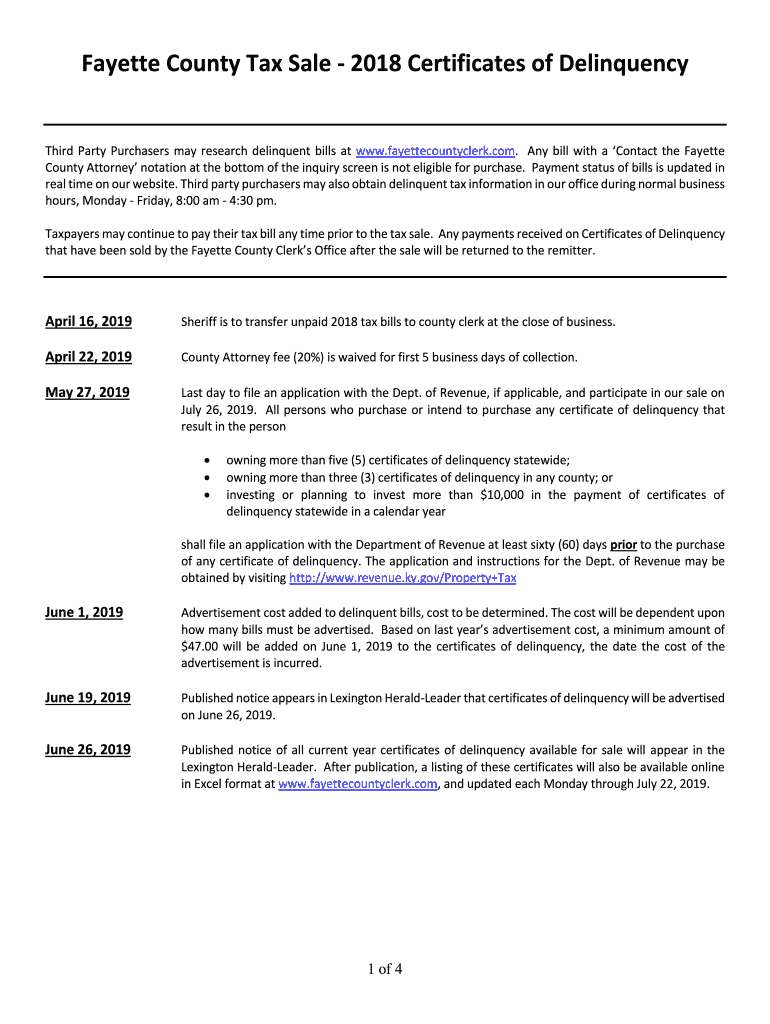

This document provides detailed information on the Fayette County 2018 tax sale, including dates, registration requirements, payment processes, and related regulations for third party purchasers of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fayette county tax sale

Edit your fayette county tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fayette county tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fayette county tax sale online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fayette county tax sale. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fayette county tax sale

How to fill out Fayette County Tax Sale - 2018 Certificates of Delinquency

01

Obtain the Fayette County Tax Sale - 2018 Certificates of Delinquency from the official county website or office.

02

Review the documents for any specific requirements or instructions related to the tax sale.

03

Gather all necessary personal and financial information needed for the application.

04

Complete the application form carefully, ensuring all fields are filled out accurately.

05

Attach any required documents, such as proof of identity or payment confirmations.

06

Submit the completed application and required materials to the appropriate county office by the specified deadline.

07

Keep a copy of your submission for your personal records.

Who needs Fayette County Tax Sale - 2018 Certificates of Delinquency?

01

Individuals or entities that have outstanding property taxes in Fayette County.

02

Real estate investors looking to purchase delinquent tax certificates.

03

Property owners seeking to resolve their delinquent tax status.

04

Financial institutions or entities involved in property financing.

Fill

form

: Try Risk Free

People Also Ask about

How long can property taxes go unpaid in KY?

How long do I have to pay the buyer? The buyer may institute a foreclosure action in court against you for the unpaid debt one (1) year after the bill becomes delinquent.

How do I look up a tax lien in Kentucky?

Copies of tax liens can be obtained from the county court clerk in the county where the lien is filed.

How do I find a lien on a property in Kentucky?

To find liens on a property in Kentucky, an individual may: Visit the County Recorder's Office, which maintains public property records, including property, liens, and deeds. They are accessible online through the county's official website or in person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fayette County Tax Sale - 2018 Certificates of Delinquency?

The Fayette County Tax Sale - 2018 Certificates of Delinquency refers to the process by which the county sells certificates for taxes that have not been paid for the year 2018. These certificates represent a claim by the county on properties for unpaid taxes.

Who is required to file Fayette County Tax Sale - 2018 Certificates of Delinquency?

Property owners who have delinquent taxes from the year 2018 are required to file Fayette County Tax Sale - 2018 Certificates of Delinquency.

How to fill out Fayette County Tax Sale - 2018 Certificates of Delinquency?

To fill out the Fayette County Tax Sale - 2018 Certificates of Delinquency, individuals should provide information including their name, property address, the amount of delinquent taxes, and other relevant details as required on the official form.

What is the purpose of Fayette County Tax Sale - 2018 Certificates of Delinquency?

The purpose of Fayette County Tax Sale - 2018 Certificates of Delinquency is to recover unpaid property taxes owed to the county, thereby funding local services and infrastructure.

What information must be reported on Fayette County Tax Sale - 2018 Certificates of Delinquency?

The information that must be reported on Fayette County Tax Sale - 2018 Certificates of Delinquency includes the property owner's name, property description, total amount of delinquent taxes, and any applicable interest or penalties.

Fill out your fayette county tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fayette County Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.