Get the free INTERNAL ROTH CONVERSION FORM - horizontrustcom

Show details

INTERNAL ROTH CONVERSION FORM MAILING ADDRESS FOR OVERNIGHT NIGHT MAIL ONLY: Horizon Trust Company P.O. Box 30007 Albuquerque, New Mexico 87190 Horizon Trust Company 10600 Metal Blvd. N.E. Albuquerque,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal roth conversion form

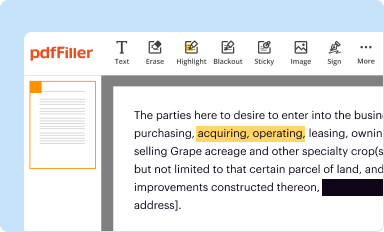

Edit your internal roth conversion form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

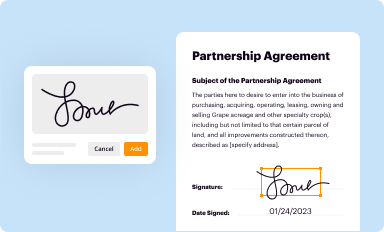

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

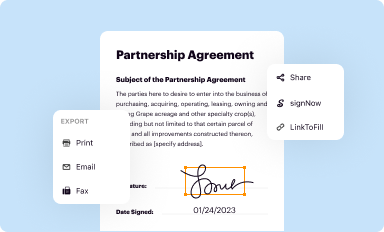

Share your form instantly

Email, fax, or share your internal roth conversion form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

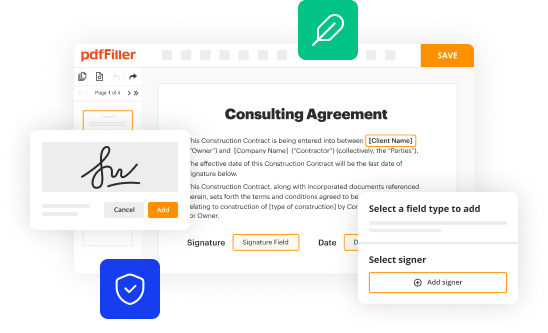

Editing internal roth conversion form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit internal roth conversion form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal roth conversion form

01

To fill out an internal Roth conversion form, gather all necessary information such as your account details, income information, and any tax-related documents. It is important to have accurate and up-to-date information before starting the process.

02

Verify if your financial institution supports internal Roth conversions and if they have a specific form for this purpose. You may need to contact your financial institution directly or check their website for the form.

03

Begin by filling out the personal information section of the internal Roth conversion form. This typically includes your full name, address, social security number, and contact information. Ensure that all information is accurate and up-to-date.

04

Provide your account information in the designated section of the form. This will include the account numbers or identifiers for both the traditional IRA or retirement account being converted and the Roth IRA account where you want the funds to be transferred.

05

Indicate the amount you wish to convert from the traditional IRA to the Roth IRA. This should be the amount you want to transfer or convert, typically stated in dollars. Be mindful of any contribution limits or tax implications that may apply.

06

If applicable, include any special instructions or considerations in the designated section of the form. For example, if you want to specify which investments within your traditional IRA should be converted or if you have any specific tax preferences or requirements.

07

Before submitting the form, double-check all the information you have provided and make sure it is accurate. This will help prevent delays or errors in the conversion process.

Who needs an internal Roth conversion form?

01

Individuals who have a traditional IRA or eligible retirement account and want to convert funds into a Roth IRA may need to complete an internal Roth conversion form. This is particularly relevant for those who are looking to take advantage of the potential tax benefits associated with Roth IRAs.

02

Those who wish to convert their traditional IRA funds into a Roth IRA should consider this form. By converting to a Roth IRA, individuals can potentially enjoy tax-free withdrawals in retirement, as well as potential tax advantages on investment earnings.

03

It is important to note that not all financial institutions support internal Roth conversions or may have specific requirements and procedures for the process. Therefore, individuals who are interested in converting should check with their financial institution to determine if they need to complete an internal Roth conversion form and to understand their specific guidelines and instructions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the internal roth conversion form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your internal roth conversion form in seconds.

How do I fill out internal roth conversion form using my mobile device?

Use the pdfFiller mobile app to fill out and sign internal roth conversion form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out internal roth conversion form on an Android device?

On Android, use the pdfFiller mobile app to finish your internal roth conversion form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is internal roth conversion form?

The internal Roth conversion form is a document used to convert funds from a traditional IRA to a Roth IRA within the same financial institution.

Who is required to file internal roth conversion form?

Individuals who have completed a Roth conversion within the same financial institution are required to file the internal Roth conversion form.

How to fill out internal roth conversion form?

The internal Roth conversion form typically requires the account holder to provide personal information, details about the conversion, and may require a signature.

What is the purpose of internal roth conversion form?

The purpose of the internal Roth conversion form is to officially document the conversion of funds from a traditional IRA to a Roth IRA.

What information must be reported on internal roth conversion form?

The internal Roth conversion form may require the reporting of account holder information, details about the conversion, and any tax implications.

Fill out your internal roth conversion form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Roth Conversion Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.