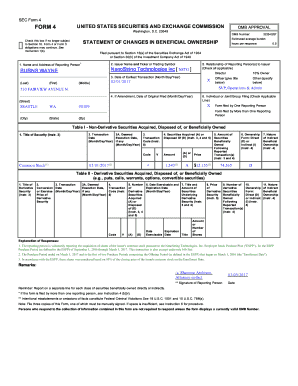

Get the free Form 1099-Q

Show details

This form is used to report distributions from qualified tuition programs and Coverdell Education Savings Accounts (ESA). It provides information on gross distributions, earnings, basis, and other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1099-q

Edit your form 1099-q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1099-q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1099-q online

Follow the steps below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 1099-q. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1099-q

How to fill out Form 1099-Q

01

Start by obtaining Form 1099-Q from the IRS website or your tax preparation software.

02

In Box 1, enter the total amount of distributions you made from the qualified education program.

03

In Box 2, provide the earnings portion of the distribution for the year.

04

In Box 3, list the basis (the amount that was contributed) of the distributions.

05

In Box 4, indicate whether any federal income tax was withheld.

06

Enter the recipient's name, address, and taxpayer identification number (TIN) in the appropriate boxes.

07

Complete the payer information section, including your name, address, and TIN.

08

Ensure all entered information is accurate, then submit the form to the IRS and provide a copy to the recipient.

Who needs Form 1099-Q?

01

Individuals who have taken distributions from a Qualified Tuition Program (QTP) or Coverdell Education Savings Account (ESA).

02

Payers who are responsible for reporting distributions made from these educational accounts.

Fill

form

: Try Risk Free

People Also Ask about

What are qualified expenses for 1099-Q distributions?

Qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment at an eligible school; expenses for room and board if the student is enrolled at least half-time; expenses for special needs services; and qualified elementary and secondary expenses (for ESA distributions only).

What is the penalty for a 1099-Q?

Form 1099-Q penalty Days latePenalty per return Up to 30 days $60 31 days late through August 1 $130 After August 1 or not filed $330 Intentional disregard $660

Is the 1099-Q the parent or student?

The person who reports the form depends on who received the distribution. If the funds were sent directly to the beneficiary, school, or student loan provider for the student's benefit, the student reports it. If the distribution was made to the parent (i.e., the account owner), then the parent reports it.

Who claims 1099Q, parent or student?

The person who reports the form depends on who received the distribution. If the funds were sent directly to the beneficiary, school, or student loan provider for the student's benefit, the student reports it. If the distribution was made to the parent (i.e., the account owner), then the parent reports it.

Do I have to report a 1099-Q on my tax return?

IRS Form 1099-Q is issued when you withdraw funds from a 529 plan or Coverdell ESA, detailing your total withdrawals, including earnings and basis. When you receive IRS Form 1099-Q, you'll need to report this information on your tax return if the distribution is used for non-qualifying expenses.

What is the penalty for not paying quarterly taxes?

If you don't pay your estimated taxes on time (or if you don't pay enough), the IRS can charge you a penalty. The amount you owe increases the longer you go without payment. The failure to pay penalty is 0.5% of the unpaid taxes for each month or part of a month you don't pay, up to 25% of your unpaid taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1099-Q?

Form 1099-Q is a tax form used to report distributions from Qualified Education Programs, such as 529 plans and Coverdell Education Savings Accounts.

Who is required to file Form 1099-Q?

Form 1099-Q must be filed by the financial institution or entity that manages the Qualified Education Program when a distribution is made to the account holder or beneficiary.

How to fill out Form 1099-Q?

To fill out Form 1099-Q, provide information such as the payer's details, recipient's details, the amount of distribution, and the earnings portion of the distribution. Ensure proper identification numbers are included and that the form is submitted both to the recipient and the IRS.

What is the purpose of Form 1099-Q?

The purpose of Form 1099-Q is to report any distributions made from Qualified Education Programs, allowing recipients to inform the IRS about the funds received for educational expenses.

What information must be reported on Form 1099-Q?

Form 1099-Q must report the total amount of the distribution, the amount of earnings, the name of the beneficiary, and the taxpayer identification number of both the payer and the recipient.

Fill out your form 1099-q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1099-Q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.