Get the free Superannuation Safety Toolkit

Show details

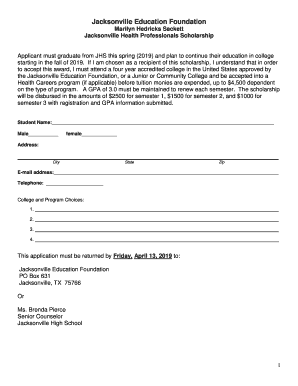

This document provides information and a form to order the Superannuation Safety Toolkit which assists trustees in preparing their RSE licence application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign superannuation safety toolkit

Edit your superannuation safety toolkit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your superannuation safety toolkit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit superannuation safety toolkit online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit superannuation safety toolkit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out superannuation safety toolkit

How to fill out Superannuation Safety Toolkit

01

Begin by gathering all necessary documentation related to your superannuation fund.

02

Review each section of the Superannuation Safety Toolkit to understand the requirements.

03

Fill in your personal details such as name, contact information, and superannuation fund name.

04

Complete the risk assessment section by evaluating your current superannuation strategy.

05

Provide details of any previous assessments or audits related to your superannuation.

06

Identify any gaps or issues found in your current superannuation setup.

07

Outline steps you’ll take to improve the safety and performance of your superannuation.

08

Save and archive your completed Toolkit for future reference and compliance.

Who needs Superannuation Safety Toolkit?

01

Individuals planning for retirement who want to ensure their superannuation is secure.

02

Financial advisors assisting clients with superannuation management.

03

Employers looking to assess and improve their employee superannuation offerings.

04

Anyone reviewing their financial strategy to optimize retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a superannuation fund?

Suppose your basic + DA is ₹40,000/month. Your employer contributes 15%, i.e., ₹6,000/month, to your superannuation fund. Over 20 years, that adds up to ₹14.4 lakh just in contributions.

What types of super funds are there?

To understand the differences between all of those funds, it helps to know what the different types of super funds are. Basically, there are five main types of funds: retail funds, public sector funds, corporate funds, self-managed funds and, our favourite, industry super funds.

How many superannuation funds are there?

Types of superannuation funds. There are 93 APRA regulated superannuation funds which are classified as corporate, industry, public sector or retail. These 93 funds manage $2.9 trillion (or 70%) of the $4.2 trillion funds within superannuation.

What are the 5 basic types of superannuation funds?

Super fund categories. To start with, let's take a look at the different super fund categories. Almost all funds will fall into one of these five – retail, industry, corporate, public sector or self managed. A retail super fund is available for anyone to join.

What are the rules for superannuation?

Superannuation guarantee Under the super guarantee, employers have to pay super contributions of 12% of an employee's ordinary time earnings when an employee is: over 18 years, or. under 18 years and works over 30 hours a week.

How to check superannuation details?

Use ATO online services through myGov Sign in to myGov and select Australian Taxation Office. Select Super. Select from the Information and manage options. You can check your super balances, find lost super, compare super products, choose a new super fund and transfer your super.

What is a superannuation fund?

Superannuation (super for short) is a long-term investment that grows over time. The more you contribute during your working life, the more you'll have for your retirement. For most people, super begins when you start work and your employer starts paying a percentage of your salary or wages into your super fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Superannuation Safety Toolkit?

The Superannuation Safety Toolkit is a set of guidelines and resources designed to help organizations ensure the security and compliance of their superannuation processes.

Who is required to file Superannuation Safety Toolkit?

Organizations that manage superannuation funds or require superannuation contributions from employees are required to file the Superannuation Safety Toolkit.

How to fill out Superannuation Safety Toolkit?

To fill out the Superannuation Safety Toolkit, organizations need to follow the specific instructions provided in the toolkit documentation, addressing all required sections fully and accurately.

What is the purpose of Superannuation Safety Toolkit?

The purpose of the Superannuation Safety Toolkit is to provide a framework for evaluating and enhancing the security and integrity of superannuation funds and processes.

What information must be reported on Superannuation Safety Toolkit?

Information that must be reported on the Superannuation Safety Toolkit includes details about compliance procedures, risk assessments, and the management of superannuation funds.

Fill out your superannuation safety toolkit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Superannuation Safety Toolkit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.