Get the free INSURANCE FILING

Show details

NOTICE OF PRIVACY PRACTICES HIPAA

INSURANCE FILING

PATIENT ACKNOWLEDGEMENT FORM

Our Notice of Privacy Practices Notice provides information about:

1 The privacy rights of our patients; and

2 how we

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance filing

Edit your insurance filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

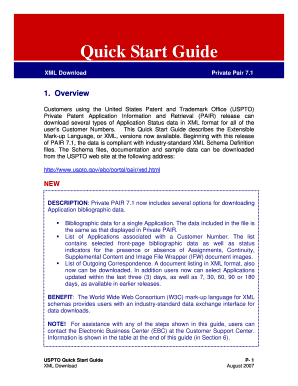

How to edit insurance filing online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance filing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance filing

How to fill out insurance filing?

01

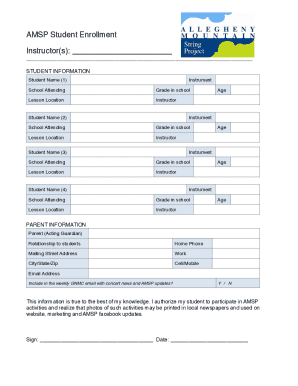

Gather all necessary information: Start by gathering all the essential information required for filling out the insurance filing form. This may include personal details, policy information, details of the incident or claim, and any supporting documents.

02

Read and understand the form: Carefully read and understand the insurance filing form to ensure you provide accurate and complete information. Familiarize yourself with the sections and questions on the form.

03

Provide accurate information: Fill in the form with accurate and truthful information. Avoid guessing or making assumptions. If you are unsure about any details, contact your insurance company or agent for guidance.

04

Follow the instructions: Each insurance filing form may have specific instructions to follow. Pay close attention to these instructions and provide information as requested. This helps ensure that your filing is processed smoothly.

05

Attach supporting documents: Depending on the nature of the claim or incident, there may be supporting documents required. This may include police reports, medical bills, receipts, or any other relevant documentation. Make sure to attach these documents along with the filing form, if needed.

06

Double-check for completeness: Before submitting the insurance filing, review all the information provided. Ensure that you have filled out all the required fields, attached any necessary documents, and that everything is accurate and complete.

07

Submit the filing: Once you are confident that the insurance filing form is correctly filled, submit it to your insurance company. Follow the preferred submission method, such as mailing it, submitting online, or delivering it in person, as instructed by your insurer.

Who needs insurance filing?

01

Individuals with insurance policies: Anyone who has an insurance policy, whether it's auto insurance, health insurance, homeowners insurance, or any other type, may need to file an insurance claim at some point. Insurance filing is necessary to report incidents, accidents, damage, or claims for reimbursement.

02

Business owners: Business owners who have insurance coverage for their commercial properties, assets, liability, or employee benefits may need to file insurance claims or documentation related to their policies. Insurance filing ensures that they can receive suitable compensation or coverage as per their policy terms.

03

Those involved in accidents or incidents: If you have been involved in an accident, such as a car accident or a slip and fall incident, you may need to file an insurance claim. Insurance filing is essential for documenting the incident and seeking coverage for damages, injuries, or medical expenses.

04

Policyholders with changes in circumstances: Sometimes, policyholders need to update their insurance policies due to changes in circumstances. This may include modifications to coverage, adding or removing beneficiaries, or updating personal information. In such cases, insurance filing is necessary to ensure these changes are properly recorded and implemented.

05

Individuals seeking reimbursement: In certain situations, individuals may need to file for reimbursement from their insurance provider. This could be due to qualifying medical expenses, travel expenses, or other eligible costs covered by their policy. Insurance filing enables them to claim the reimbursement they are entitled to.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance filing directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your insurance filing and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit insurance filing on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing insurance filing.

How can I fill out insurance filing on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your insurance filing. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is insurance filing?

Insurance filing is the process of submitting necessary paperwork or documentation to an insurance provider in order to request coverage or benefits.

Who is required to file insurance filing?

Insurance filing is typically required by individuals or businesses who have an insurance policy and need to make a claim or request reimbursement for covered services or expenses.

How to fill out insurance filing?

To fill out insurance filing, you will need to gather all relevant documentation, such as receipts, medical records, or invoices, and complete the necessary forms provided by your insurance provider.

What is the purpose of insurance filing?

The purpose of insurance filing is to request reimbursement from an insurance provider for covered services or expenses, or to make a claim for benefits under an insurance policy.

What information must be reported on insurance filing?

Information that must be reported on insurance filing typically includes policyholder details, description of services or expenses, date of service, and any supporting documentation required by the insurance provider.

Fill out your insurance filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.