Get the free Request for Refund of Defined Benefit Plan Contributions

Show details

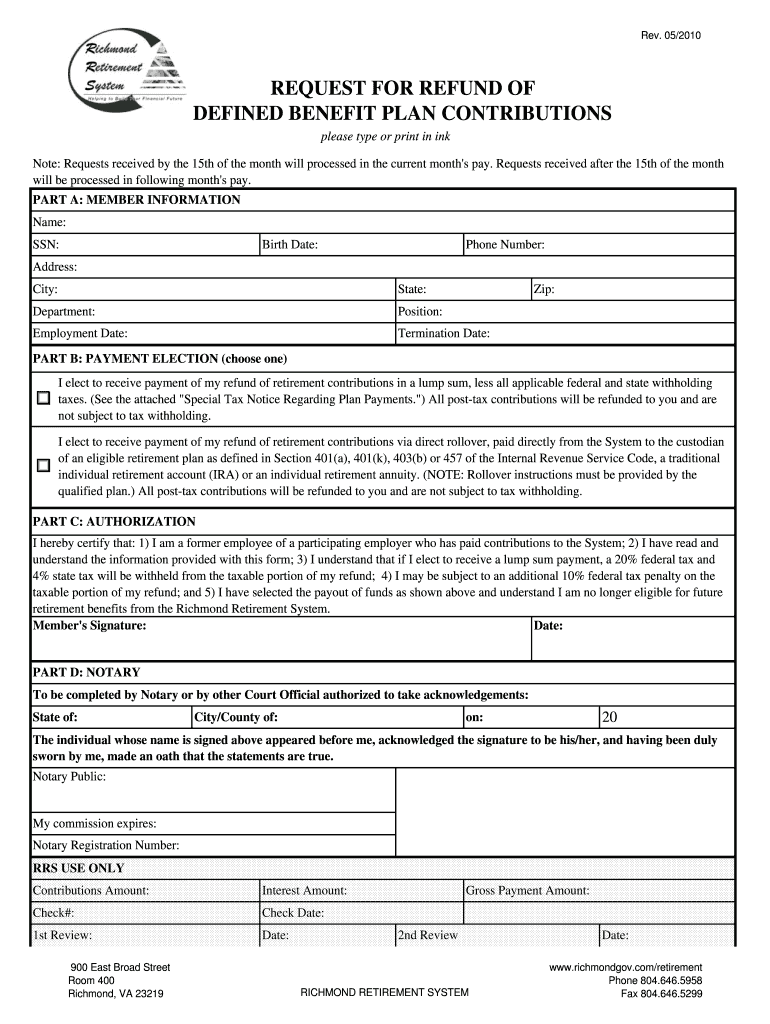

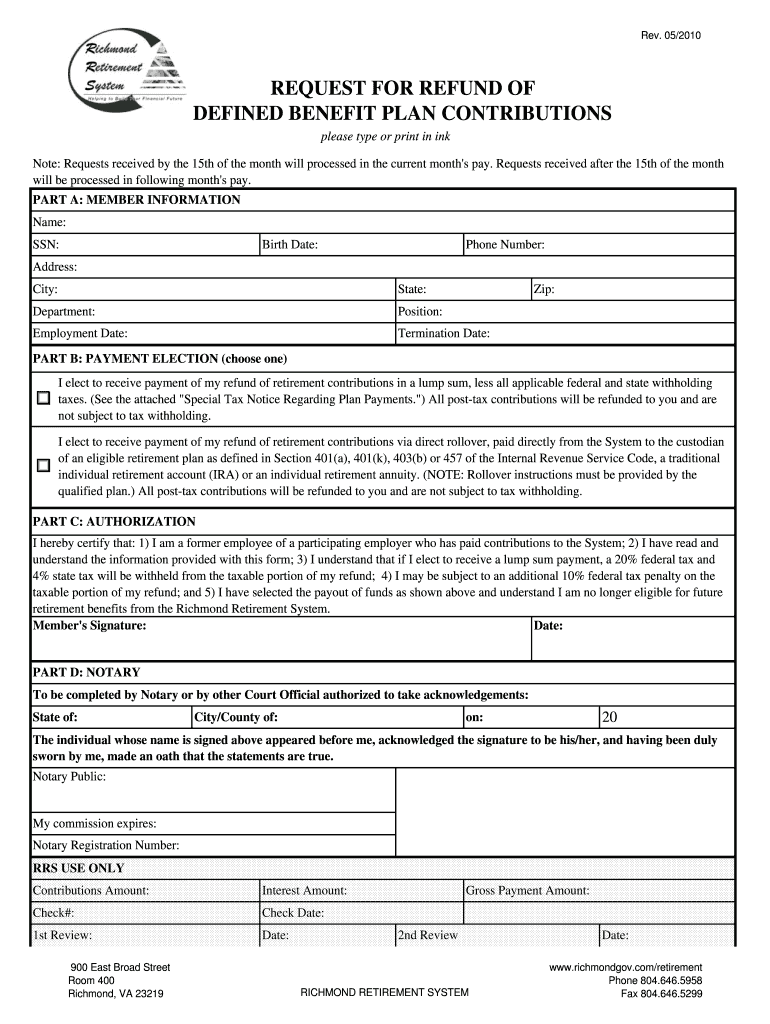

This document is used to request a refund of contributions made to a defined benefit retirement plan. It includes sections for member information, payment election, authorization, and a notary section.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for refund of

Edit your request for refund of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for refund of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request for refund of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit request for refund of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for refund of

How to fill out Request for Refund of Defined Benefit Plan Contributions

01

Obtain the Request for Refund of Defined Benefit Plan Contributions form from the relevant authority or website.

02

Enter your personal information such as name, address, and contact details in the designated fields.

03

Provide your identification details, including your member ID number associated with the defined benefit plan.

04

Specify the amount you are requesting to be refunded from your contributions.

05

Sign and date the form to verify the accuracy of the information provided.

06

Attach any required documentation that supports your request, such as proof of eligibility or prior contributions.

07

Submit the completed form and supporting documents to the appropriate office as indicated on the form.

Who needs Request for Refund of Defined Benefit Plan Contributions?

01

Individuals who have previously contributed to a Defined Benefit Plan and are eligible for a refund.

02

Former employees who have left their employer and wish to withdraw their contributions.

03

Beneficiaries of deceased members who are entitled to refunds of contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is a defined benefit contribution?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

Can you cash in a defined contribution pension?

You can leave your money in your pension pot and take lump sums from it when you need to. You can do this until your money runs out or you choose another option. This option is also known as Uncrystallised Funds Pension Lump Sum (UFPLS). Each time you take a lump sum of money, 25% is usually tax-free.

At what age can you withdraw from a defined benefit plan?

In-service withdrawals Generally, a defined benefit plan may not make in-service distributions to a participant before age 59 1/2.

Can I withdraw from a defined contribution plan?

With both types of plans, annual income accrued within the plans is tax-exempt. Early withdrawals (before age 59½) from defined-contribution plans incur penalties (in addition to the regular tax on withdrawals), except in limited circumstances such as disability or very large medical expenses.

How do you refund your pension?

If you'd like your pension contributions refunded, ask your pension provider what information they need. This often means completing a form. Your provider will check you're eligible and arrange for any payment to be made. If you run into any problems, you can complain.

When can I withdraw from a defined contribution plan?

You can't withdraw the money in a DCPP before you retire. The earliest retirement age depends on the plan and is typically 10 years before the normal retirement age. So, if the normal retirement age is 65, the earliest you can retire and withdraw money from the plan is age 55.

Can you withdraw from a defined benefit pension plan?

Defined benefit pensions usually let you take a 25% tax-free cash lump sum in exchange for getting a lower income, and the conversion rate of pension to cash is dependent on the scheme's rules.

Can you withdraw from a defined contribution plan?

Early withdrawals (before age 59½) from defined-contribution plans incur penalties (in addition to the regular tax on withdrawals), except in limited circumstances such as disability or very large medical expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Refund of Defined Benefit Plan Contributions?

A Request for Refund of Defined Benefit Plan Contributions is a formal application made by an employee or a member of a retirement plan seeking the return of contributions made to a defined benefit pension plan.

Who is required to file Request for Refund of Defined Benefit Plan Contributions?

Employees or former employees who have contributed to a defined benefit plan and wish to withdraw those contributions after leaving their employment or under specific circumstances are required to file this request.

How to fill out Request for Refund of Defined Benefit Plan Contributions?

To fill out the Request for Refund of Defined Benefit Plan Contributions, you typically need to provide personal information, details about your employment, the amount of contributions to be refunded, and any other required documentation as specified by the pension plan administrator.

What is the purpose of Request for Refund of Defined Benefit Plan Contributions?

The purpose of the Request for Refund of Defined Benefit Plan Contributions is to initiate the process of returning the contributions made by the employee to the pension plan, often when they are no longer eligible for benefits or have left employment.

What information must be reported on Request for Refund of Defined Benefit Plan Contributions?

The information that must be reported typically includes your personal details (such as name and address), employment history, the total amount contributed, the reason for the request, and any other pertinent information required by the pension plan.

Fill out your request for refund of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Refund Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.