Get the free DESCRIPTION OF CHARGES Fees Charges Description - cgcl co

Show details

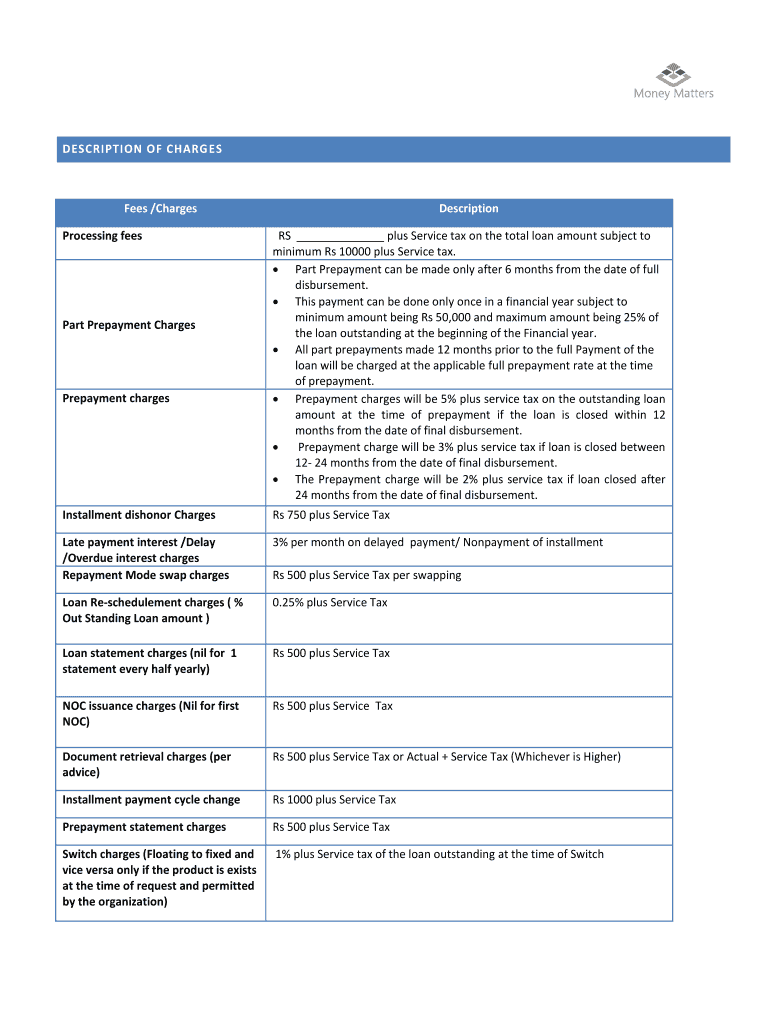

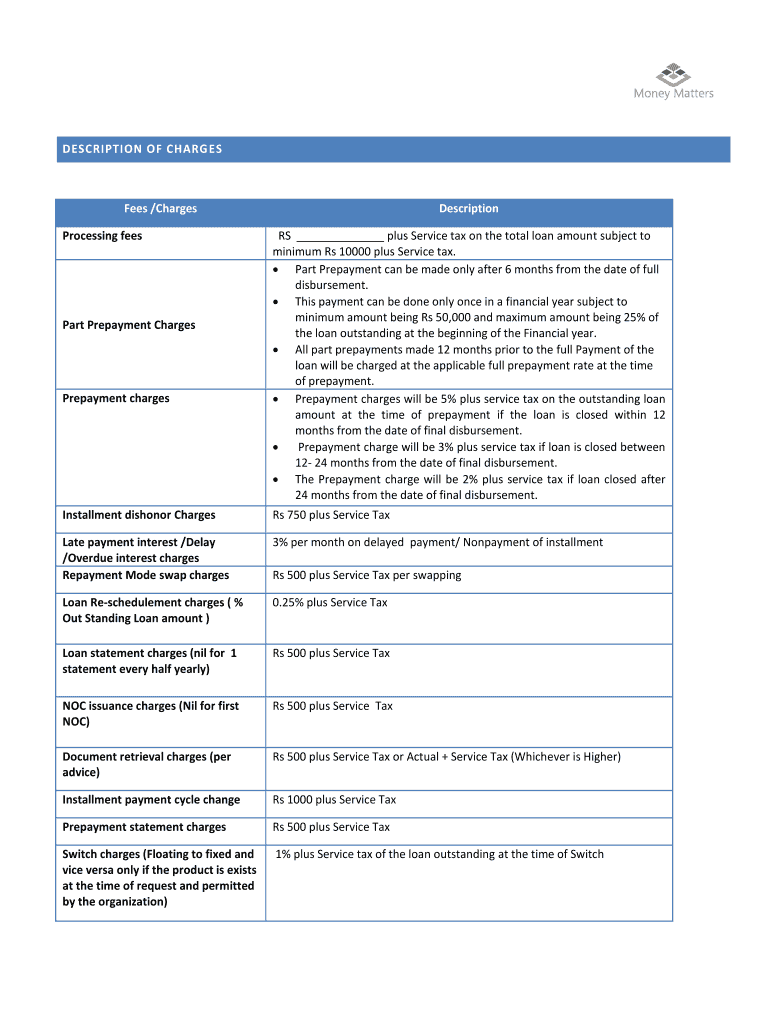

DESCRIPTION OF CHAR GES Fees /Charges Processing fees Part Prepayment Charges Description RS plus Service tax on the total loan amount subject to minimum Rs 10000 plus Service tax. Part Prepayment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign description of charges fees

Edit your description of charges fees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your description of charges fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing description of charges fees online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit description of charges fees. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out description of charges fees

To fill out the description of charges fees, follow these points:

01

Clearly state the purpose: Begin by clearly stating the purpose of the charges fees. Whether it is for a product, service, or any other transaction, provide a concise and accurate description.

02

Break down the charges: Break down the charges in a detailed manner. Specify each component of the fees, such as the base cost, taxes, additional services, or any other relevant charges. This breakdown will help the recipient understand the breakdown of the fees.

03

Use simple language: Ensure that the description is written in simple and easy-to-understand language. Avoid using complex jargon or technical terms that may confuse the recipient. Use plain language that comprehensively explains the charges.

04

Provide necessary details: Include all the necessary details about the charges, such as date of transaction, invoice number, and any applicable terms or conditions. This information will help the recipient to identify and reconcile the charges easily.

05

Be transparent: Maintain transparency while describing the charges fees. Clearly explain the reason behind each fee and provide any supporting documentation if required. Transparency builds trust and helps to avoid any potential misunderstandings.

06

Mention contact information: Include contact information in case the recipient has any questions or concerns regarding the charges. Provide an email address, phone number, or any other relevant communication channel. This will help in addressing any inquiries promptly.

Who needs description of charges fees?

Various individuals or entities may require a description of charges fees, including:

01

Customers: Customers need a clear understanding of the charges they are being billed for, ensuring they are aware of what they are paying for and giving them the opportunity to verify the charges.

02

Clients: Clients who are seeking professional services or engaging in business partnerships may require a description of charges fees. This allows them to understand and evaluate the cost of the services being provided.

03

Financial departments: Companies' financial departments require a detailed description of charges fees for accounting and record-keeping purposes. This helps in maintaining accurate financial documentation.

04

Auditors or regulators: Auditors or regulatory bodies may request a description of charges fees to ensure compliance with financial regulations or to conduct financial audits.

In summary, filling out the description of charges fees requires clear and simple language, a breakdown of charges, necessary details, transparency, and contact information. It is essential for customers, clients, financial departments, auditors, and regulators who require a comprehensive understanding of the charges fees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify description of charges fees without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including description of charges fees, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send description of charges fees to be eSigned by others?

To distribute your description of charges fees, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in description of charges fees?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your description of charges fees and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is description of charges fees?

Description of charges fees refer to the breakdown of costs or fees associated with a particular service or transaction.

Who is required to file description of charges fees?

Any individual or organization that provides services or conducts transactions which include charges or fees is required to file description of charges fees.

How to fill out description of charges fees?

Description of charges fees should be filled out by providing a detailed list of all charges or fees involved in a particular service or transaction.

What is the purpose of description of charges fees?

The purpose of description of charges fees is to increase transparency and provide clarity to consumers or clients regarding the costs associated with a service or transaction.

What information must be reported on description of charges fees?

The information that must be reported on description of charges fees includes the name of the charge or fee, the amount, and the reason for the charge or fee.

Fill out your description of charges fees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Description Of Charges Fees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.