Get the free BUSINESS EXPENSES OF ATHLETES - Grimes Tax

Show details

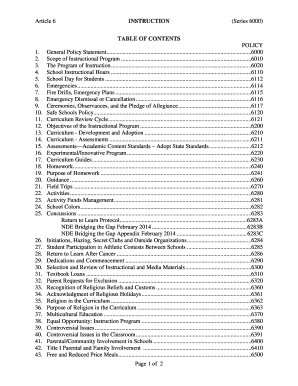

BUSINESS EXPENSES OF ATHLETES YEAR: NAME: SUPPLIES Stationery $ Sport Accessories Sport Equipment Printing Training supplies Video, tapes & DVD (s) Other: TOTAL: LEGAL & PROFESSIONAL SERVICES Agent's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business expenses of athletes

Edit your business expenses of athletes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business expenses of athletes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business expenses of athletes online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business expenses of athletes. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business expenses of athletes

How to fill out business expenses of athletes?

01

Obtain a copy of the business expenses form provided by the organization or athletic association. This form is typically used to track and report all the expenses incurred by athletes during their professional activities.

02

Keep a detailed record of all expenses made for the purpose of the sport or athletic profession. This includes travel expenses, equipment purchases, training fees, sports-related medical expenses, and any other costs directly related to the athlete's professional activities.

03

Ensure that all expenses are legitimate and necessary for the athlete's career. Only include expenses that are directly related to the athlete's professional development or performance in the sport.

04

Organize the expenses into different categories such as travel, equipment, training, and medical expenses. This will make it easier to fill out the form and provide a clear breakdown of the athlete's expenditures.

05

Attach all relevant receipts and documentation to support each expense claim. This is essential for verification purposes and to comply with any auditing or reporting requirements.

06

Review the form and double-check all the information provided before submitting it. Make sure that all expenses are accurately recorded, and that the total amount reflects the athlete's actual expenditures during the specified period.

07

Submit the completed business expenses form to the appropriate authority within the organization or athletic association. This may be the team manager, financial department, or an accountant responsible for handling athletes' expenses.

Who needs business expenses of athletes?

01

Athletes themselves: Keeping track of business expenses is crucial for athletes as it helps them to manage their finances effectively and ensure they are maximizing any potential tax deductions.

02

Sports organizations or athletic associations: These entities require athletes to submit their business expenses to monitor and review the financial activities related to their sport. This information can be used for budgeting purposes, financial reporting, or to ensure compliance with any governing regulations.

03

Tax authorities and auditors: In some cases, athletes may be required to report their business expenses for taxation purposes. The tax authorities or auditors may request these records to verify the legitimacy of the expenses claimed and ensure compliance with tax regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business expenses of athletes from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your business expenses of athletes into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out the business expenses of athletes form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign business expenses of athletes and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out business expenses of athletes on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your business expenses of athletes. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is business expenses of athletes?

Business expenses of athletes refer to the costs incurred by athletes in the course of their professional activities, such as training, travel, equipment, and competition fees.

Who is required to file business expenses of athletes?

Athletes who receive income from their athletic endeavors and incur related expenses are required to file business expenses of athletes.

How to fill out business expenses of athletes?

To fill out business expenses of athletes, athletes need to keep track of all their expenses related to their sports activities and report them accurately on appropriate tax forms.

What is the purpose of business expenses of athletes?

The purpose of business expenses of athletes is to allow athletes to deduct legitimate expenses related to their athletic endeavors from their taxable income, reducing their overall tax liability.

What information must be reported on business expenses of athletes?

Athletes must report detailed information on all their business expenses, including the nature of the expense, the date it was incurred, the amount spent, and any supporting documentation.

Fill out your business expenses of athletes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Expenses Of Athletes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.