Get the free Property valuation of Garces Avenue, San Jose, CA: 5984 ...

Show details

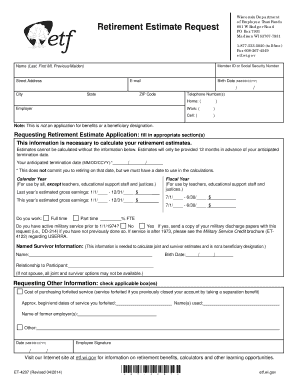

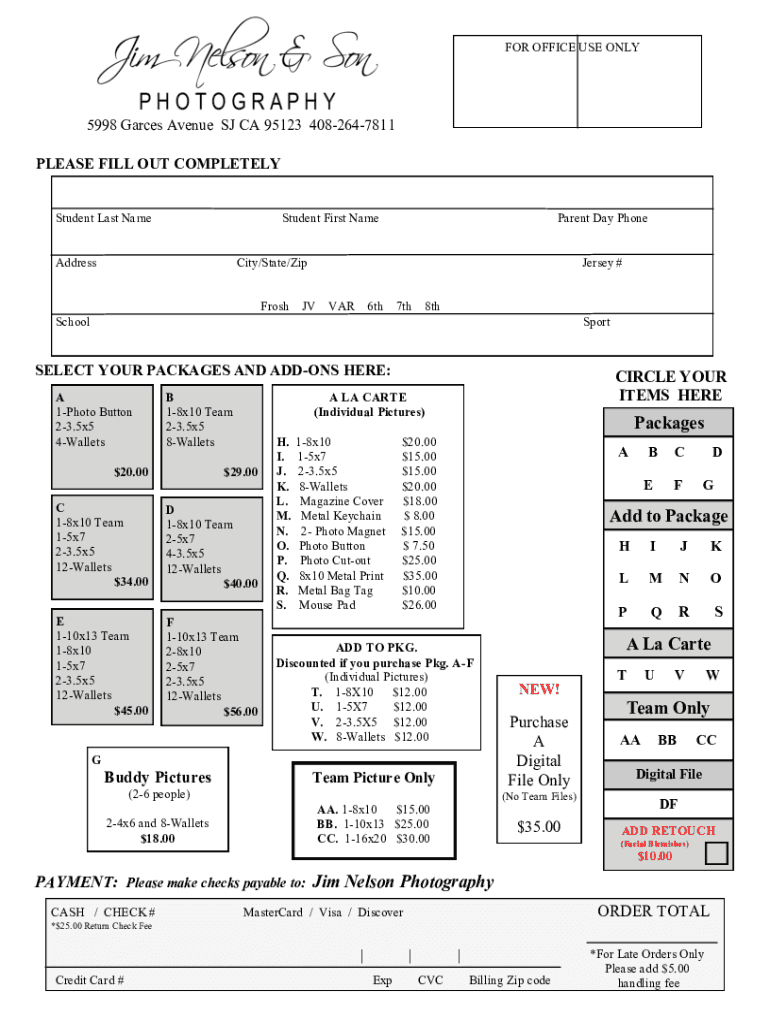

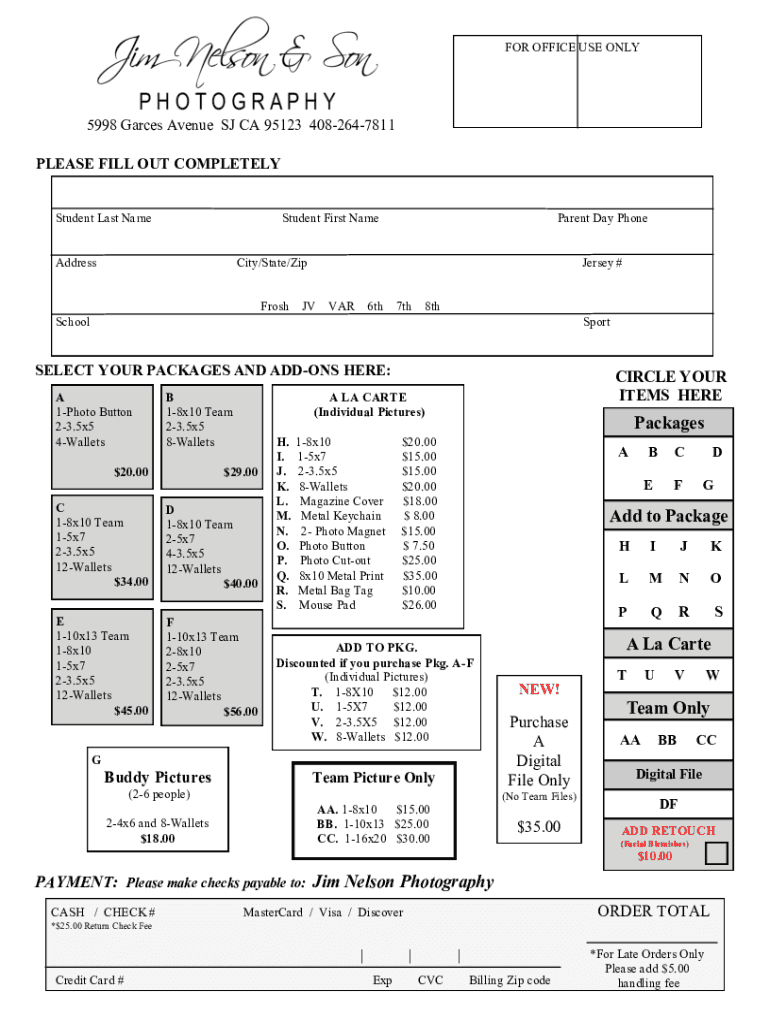

FOR OFFICE USE ONLY5998 Graces Avenue SJ CA 95123 4082647811

PLEASE FILL OUT COMPLETELY

Student Last NameStudent First NameAddressParent Day Phonetic×State×Zip

Frosh Jersey #JVVAR6th7th8thSchoolSportSELECT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property valuation of garces

Edit your property valuation of garces form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property valuation of garces form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property valuation of garces online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property valuation of garces. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property valuation of garces

How to fill out property valuation of garces:

01

Start by gathering all relevant information about the property, such as its address, size, and any recent renovations or improvements.

02

Determine the purpose of the valuation. Is it for insurance purposes, selling or buying the property, or for tax assessments? This will help in selecting the appropriate valuation method.

03

Choose the valuation method that best suits your needs. Common methods include the sales comparison approach, income approach, and cost approach. Research each method and decide which one will provide the most accurate value for the property.

04

Conduct a market analysis to compare similar properties in the area that have recently sold or are currently on the market. This will help in determining the property's value based on current market trends.

05

If necessary, enlist the help of a licensed appraiser who specializes in property valuations. They can provide an objective and unbiased valuation based on their expertise and knowledge of the local market.

06

Gather all the necessary documents, such as property documents, recent tax assessments, and any appraisals or inspections done in the past. These will provide valuable information to support the valuation process.

07

Carefully fill out all the required fields and provide accurate information when completing the property valuation form. Double-check all the details to ensure accuracy.

08

If unsure about any aspect of the valuation process, consult with a real estate professional or seek advice from a property valuation specialist.

Who needs property valuation of garces?

01

Property owners who want to sell their property can benefit from a property valuation of garces to determine the appropriate selling price and attract potential buyers.

02

Buyers interested in purchasing the property can utilize a property valuation to negotiate a fair purchase price and ensure they are making a sound investment.

03

Lenders may require a property valuation before approving a mortgage or loan application to assess the value of the property and determine the loan-to-value ratio.

04

Insurance companies may request a property valuation to determine the replacement cost of the property for insurance purposes.

05

Executors of an estate may require a property valuation of garces to assess the value of the property for estate planning and distribution purposes.

06

Government agencies, such as tax assessment offices, may need property valuations to determine property taxes or assess the value of properties for public planning purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get property valuation of garces?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific property valuation of garces and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete property valuation of garces online?

With pdfFiller, you may easily complete and sign property valuation of garces online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the property valuation of garces in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your property valuation of garces in seconds.

What is property valuation of garces?

Property valuation of Garces refers to determining the monetary value of the Garces property.

Who is required to file property valuation of garces?

The property owner or designated representative is required to file the property valuation of Garces.

How to fill out property valuation of garces?

To fill out the property valuation of Garces, the property owner or designated representative must provide accurate information regarding the property's value.

What is the purpose of property valuation of garces?

The purpose of property valuation of Garces is to assess the property's worth for taxation or investment purposes.

What information must be reported on property valuation of garces?

The property valuation of Garces must include details such as property location, size, condition, and recent sales data.

Fill out your property valuation of garces online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Valuation Of Garces is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.