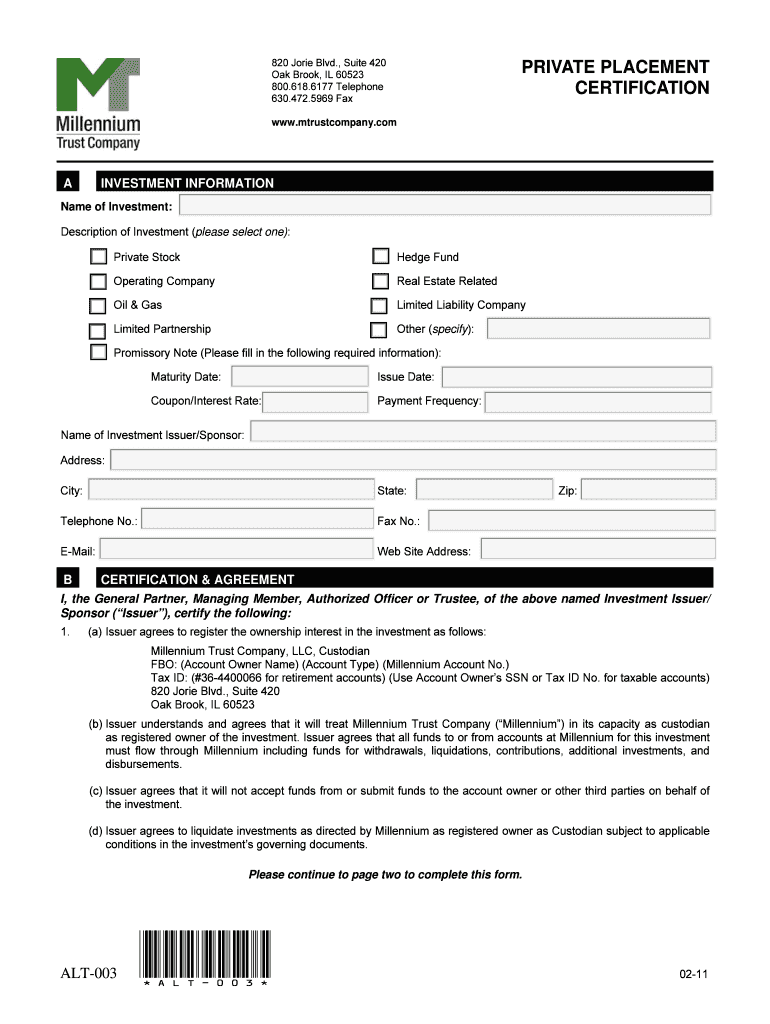

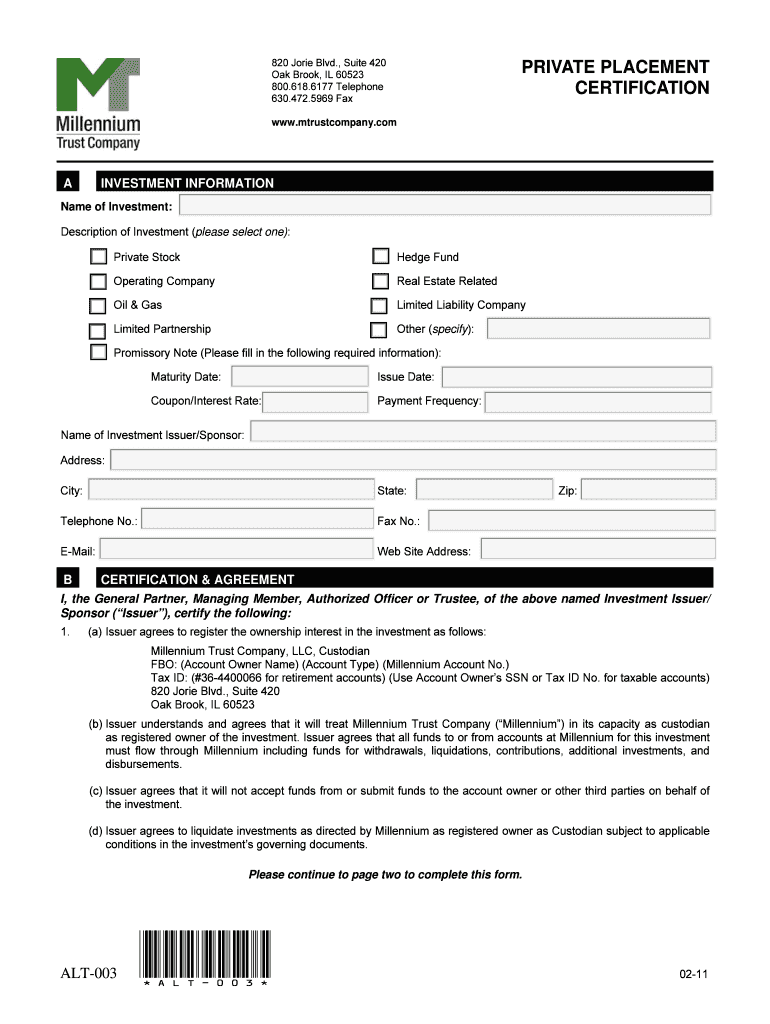

Get the free PRIVATE PLACEMENT CERTIFICATION

Show details

This document is used to certify and agree upon the terms and conditions regarding private investments, including information about the issuer and the specific investment details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private placement certification

Edit your private placement certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private placement certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private placement certification online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private placement certification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

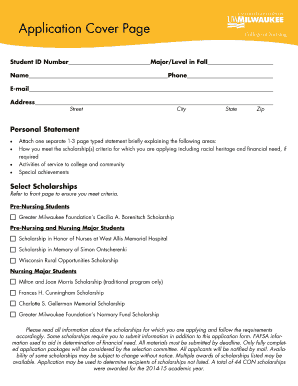

How to fill out private placement certification

How to fill out PRIVATE PLACEMENT CERTIFICATION

01

Obtain the PRIVATE PLACEMENT CERTIFICATION form from the relevant regulatory body or organization.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill in your personal information accurately in the designated fields, including name, address, and contact details.

04

Provide information regarding the entity or investment involved in the private placement.

05

Disclose the nature of the investment, including risks and benefits associated with it.

06

Attach any required documentation that supports your application, such as financial statements or investment memoranda.

07

Review the completed form for accuracy and completeness before submission.

08

Submit the PRIVATE PLACEMENT CERTIFICATION to the appropriate authority or organization as instructed.

Who needs PRIVATE PLACEMENT CERTIFICATION?

01

Investors participating in private placements to verify their eligibility.

02

Companies seeking to raise capital through private offerings.

03

Regulatory bodies that require documentation for compliance purposes.

04

Financial advisors and legal professionals assisting clients in private placements.

Fill

form

: Try Risk Free

People Also Ask about

Do I need CFA for private equity?

For the Private Equity Certificate, we recommend having a basic understanding of private markets, which can be gained through completing the Private Markets and Alternative Investments Certificate, CFA Level I, or relevant work experience. However, this is not a mandatory requirement.

Is private placement legal?

Private placement is governed by: Companies Act, 2013 (Sections 42 and 62): Outlines the legal requirements and procedures for issuing shares on a private placement basis. Companies (Prospectus and Allotment of Securities) Rules, 2014: Specifies rules regarding offer letters, filing requirements, and timelines.

What are the two types of private placement?

By opting for private placements, companies can maintain closer relations with investors, negotiate flexible terms, and potentially retain greater control over the company's direction and growth strategies. There are two kinds of private placement: preferential allotment and qualified institutional placement.

Is private placement risky?

Any investment in the Issuers is, by definition, a high-risk investment. Prospective investors should understand that they may lose their entire investment. Changes in Capital Markets and the Economy. Each Issuer is materially affected by conditions in the global capital markets and the economy generally.

What is the 80 20 rule in private equity?

The typical split in profits between LPs and GP is 80 / 20. That means, the LP gets distributed 80% of the profits on an exit (after returning their initial capital) and the GP keeps 20% of the profits.

What is the best certification for private equity?

What Are the Best Certifications for Getting Into Private Equity? Certified Financial Planner (CFP) Financial Risk Manager (FRM) Chartered Financial Analyst (CFA) Chartered Alternative Investment Analyst (CAIA) Chartered Private Equity Professional (CPEP) Chartered Private Equity Analyst (CPEA)

What is the best program for private equity?

Harvard Business School is widely regarded as one of the best MBA programs for consulting and private equity. HBS has strong ties with leading firms like KKR, and its prestigious brand, extensive alumni network, and emphasis on case studies provide MBA graduates with an ideal foundation for private equity careers.

Which degree is best for private equity?

Private equity firms usually look for entry-level associates with at least two years of experience within the banking industry. Investment bankers usually follow the PE firm career path as their next job and typically have a bachelor's degree in finance, accounting, economics, and other related fields.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PRIVATE PLACEMENT CERTIFICATION?

Private Placement Certification is a document that verifies compliance with regulations concerning private securities offerings, often used to confirm that the issuance meets necessary legal and financial standards.

Who is required to file PRIVATE PLACEMENT CERTIFICATION?

Companies or issuers that are raising funds through private placements must file a Private Placement Certification to ensure adherence to applicable securities laws.

How to fill out PRIVATE PLACEMENT CERTIFICATION?

To fill out a Private Placement Certification, the issuer should provide essential details about the offering, including the structure, amount being raised, investor qualifications, and affirmation of compliance with regulatory requirements.

What is the purpose of PRIVATE PLACEMENT CERTIFICATION?

The purpose of Private Placement Certification is to provide assurance to regulatory authorities and investors that the private placement complies with all relevant securities laws and regulations.

What information must be reported on PRIVATE PLACEMENT CERTIFICATION?

The information typically reported on Private Placement Certification includes the details of the issuer, type of security being offered, total amount raised, investor qualifications, and any relevant financial disclosures.

Fill out your private placement certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Placement Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.