Get the free Fixed Deposit Application Form - Transpek Industries Ltd.

Show details

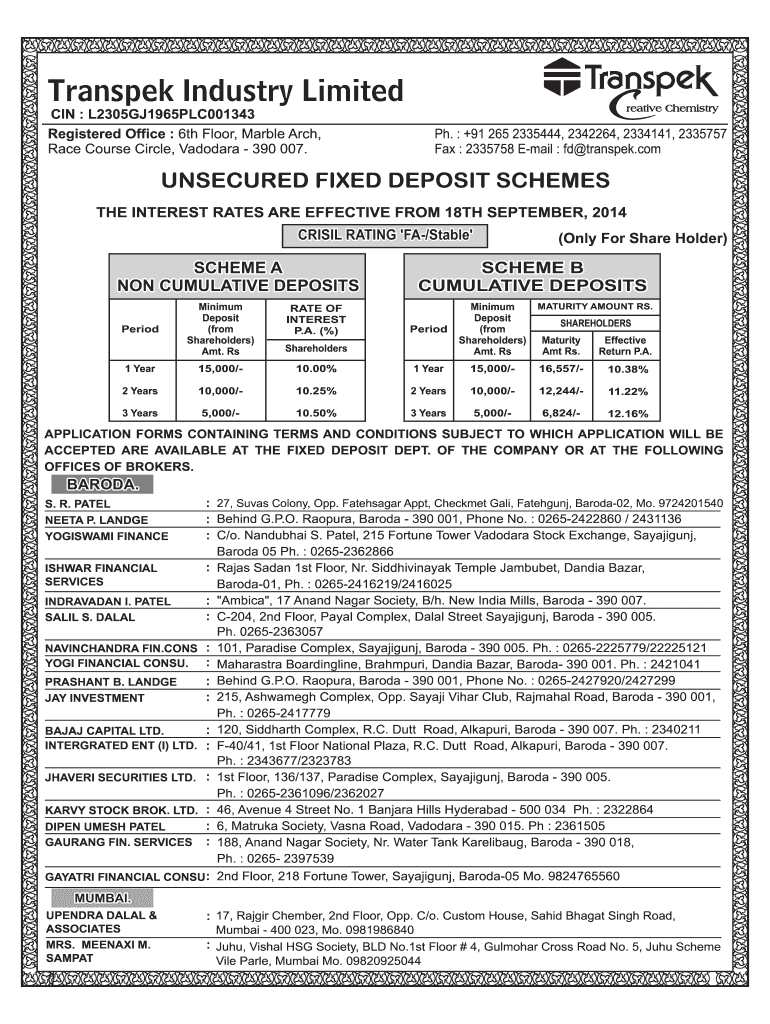

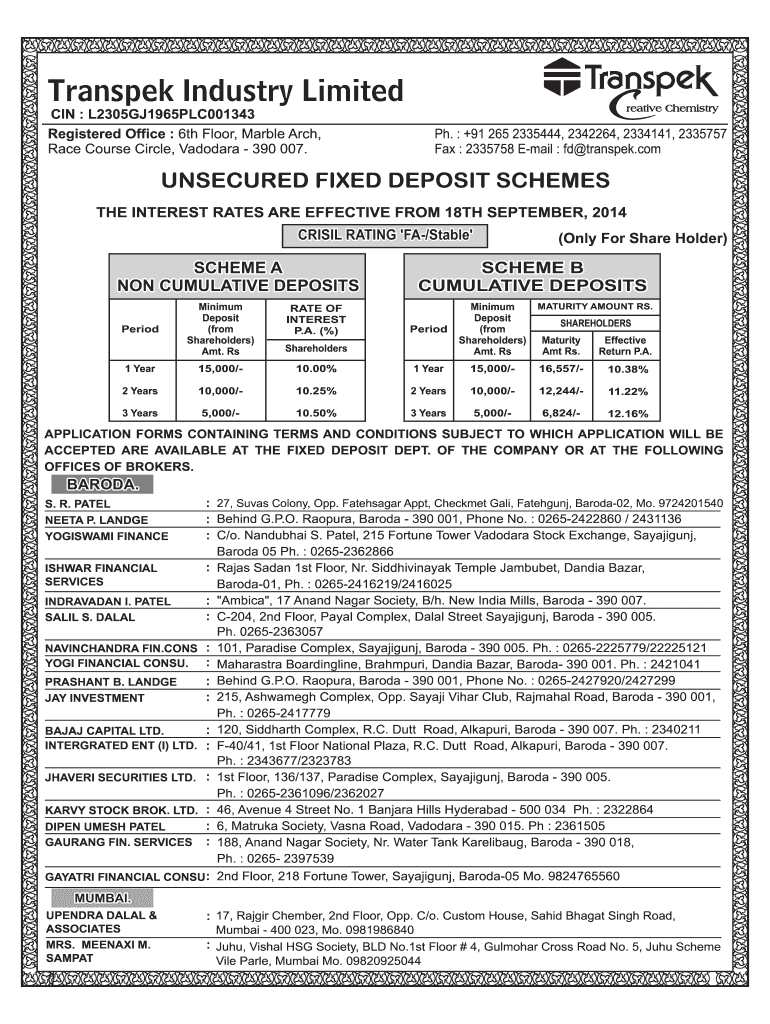

Transfer Industry Limited IN : L2305GJ1965PLC001343 Registered Office : 6th Floor, Marble Arch, Race Course Circle, Vadodara 390 007. PH. +91 265 2335444, 2342264, 2334141, 2335757 Fax : 2335758

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed deposit application form

Edit your fixed deposit application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed deposit application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed deposit application form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fixed deposit application form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed deposit application form

How to fill out a fixed deposit application form:

01

Gather necessary documents: Before filling out the form, make sure you have all the required documents, such as your identification proof, address proof, and PAN card.

02

Fill in personal details: Start by providing your personal information, such as your full name, date of birth, gender, and contact details. Make sure to write legibly and double-check for any errors.

03

Choose account type: Select the type of fixed deposit account you wish to open. This could include a regular fixed deposit, tax-saving fixed deposit, or senior citizen fixed deposit, among others.

04

Mention deposit amount and tenure: Specify the amount you wish to deposit and the duration for which you want to keep the money locked in a fixed deposit. Ensure this aligns with the bank's requirements and your financial goals.

05

Nomination details: If you want to nominate someone to receive the deposit amount in case of your demise, provide their details, including their name, address, and relationship to you.

06

Select interest payout frequency: Decide whether you want the interest earned on your fixed deposit to be paid out monthly, quarterly, annually, or on maturity. Choose the option that suits your financial needs.

07

Tax deduction details: If you are eligible for any tax deductions on your fixed deposit, provide the necessary details and submit the required documents as per the bank's guidelines.

08

Read and sign: Carefully read through the terms and conditions of the fixed deposit application form. Ensure you understand the rules, penalties, and policies associated with the account. Once you are satisfied, sign the form and date it.

09

Submit the form: Take the completed form along with the necessary documents to the bank branch where you wish to open the fixed deposit account. Hand it over to the designated officer or follow the prescribed procedure to submit it electronically.

Who needs a fixed deposit application form?

Individuals looking to save money in a secure and systematic manner can benefit from a fixed deposit account. Fixed deposit application forms are typically required by:

01

Individuals who want to earn a higher rate of interest than regular savings accounts offer.

02

Individuals who have a lump sum of money that they do not require immediate access to.

03

Individuals who want to diversify their investment portfolio and reduce their exposure to risks.

04

People who want to achieve specific financial goals, such as accumulating funds for a child's education or marriage, buying a house, or planning for retirement.

It is important to note that the eligibility criteria for opening a fixed deposit account can vary across banks, so it is advisable to check with the specific financial institution for their requirements and procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed deposit application form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your fixed deposit application form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out fixed deposit application form using my mobile device?

Use the pdfFiller mobile app to fill out and sign fixed deposit application form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete fixed deposit application form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fixed deposit application form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is fixed deposit application form?

Fixed deposit application form is a document used to apply for a fixed deposit account with a bank or financial institution.

Who is required to file fixed deposit application form?

Any individual or entity wishing to open a fixed deposit account is required to file a fixed deposit application form.

How to fill out fixed deposit application form?

To fill out a fixed deposit application form, one must provide personal information, deposit amount, preferred term, and sign the form.

What is the purpose of fixed deposit application form?

The purpose of a fixed deposit application form is to formally request the opening of a fixed deposit account and provide necessary information to the bank.

What information must be reported on fixed deposit application form?

Information such as name, address, contact details, deposit amount, term of deposit, and beneficiary details must be reported on a fixed deposit application form.

Fill out your fixed deposit application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Deposit Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.