Get the free Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on...

Show details

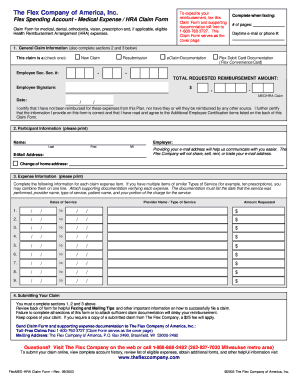

This document is intended for active duty service members to apply for tax exempt status for their motor vehicle owned or leased, to avoid taxation under specific conditions outlined by Connecticut

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for exempt status

Edit your application for exempt status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for exempt status form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for exempt status online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for exempt status. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for exempt status

How to fill out Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date

01

Obtain the Application for Exempt Status form from the Connecticut Department of Motor Vehicles website or local office.

02

Review the eligibility requirements to ensure you qualify as a Connecticut resident on active military duty.

03

Fill out the form, providing all necessary personal information, including name, address, and military status.

04

Indicate the details of the motor vehicle for which you are seeking exempt status, including make, model, and VIN.

05

Attach any required supporting documentation, such as a copy of your military orders or identification.

06

Review the completed application to ensure all information is accurate and complete.

07

Submit the application either online, by mail, or in person at your local Department of Motor Vehicles office.

Who needs Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

01

Connecticut residents who are active military members on the assessment date and own a motor vehicle.

Fill

form

: Try Risk Free

People Also Ask about

What vehicles are exempt from sales tax in CT?

Tax exempt vehicles Gifts. Farm vehicles. Ambulance vehicles. Driver training vehicles. Vehicles involved in interstate commerce. Commercial vehicles.

Does Connecticut tax Active Duty military?

Taxability of Military Pay for Residents: If you are a Connecticut resident, your military pay or your military pension is subject to Connecticut income tax to the same extent that it is taxable for federal income tax purposes.

What happens if I can't pay my car taxes in CT?

If motor vehicle taxes remain unpaid, you will be unable to renew ANY vehicle, snowmobile, or vessel registrations with the Connecticut Department of Motor Vehicles (DMV), per Connecticut General Statute 14-33. Past due motor vehicle taxes must be paid in full in order to receive DMV tax clearance.

How to dispute car taxes in CT?

You may appeal your assessment to the Board of Assessment Appeals. Any October 1st assessment may be appealed in March. This would be on the current assessment applicable to the following July. A meeting with the Board of Assessment Appeals can be scheduled by calling the Assessor's office no later than February 20th.

Why is car tax so high in CT?

During the pandemic, frustrations over the car tax reached a high point. Volatility in the used car market caused the market value of many vehicles to spike. That spike was reflected in higher valuations, since towns calculated tax bills based on national averages of used car prices.

Is military exempt from vehicle tax in SC?

Application for exemption must be made annually. What is not exempt from taxes? Vehicle property taxes are not exempted if the Active Duty military personnel's primary residence (home state of record) is located in South Carolina. Vehicle fees are not exempted (including DMV registration fees and County road fees).

How to get car taxes waived in CT?

Out of state residents based in CT must file a Soldiers' and Sailors' Civil Relief Act form with the Assessor's office to be exempt from paying property taxes. Residents of CT must file an Active Duty form annually with the Assessor's Office to have one passenger motor vehicle exempt from taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

The Application for Exempt Status is a form that allows Connecticut residents who are on active military duty to request an exemption from vehicle property taxes on their motor vehicle as of the assessment date.

Who is required to file Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

Connecticut residents who are currently on active military duty and own a motor vehicle are required to file this application to obtain the tax exemption.

How to fill out Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

To fill out the application, residents must provide personal information, vehicle details, and proof of active military duty status. This includes completing the required sections of the application form and submitting it to the appropriate local tax authority.

What is the purpose of Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

The purpose of the application is to provide tax relief for Connecticut residents on active military duty, ensuring they are not financially burdened by vehicle property taxes while serving.

What information must be reported on Application for Exempt Status for a Motor Vehicle Owned by a Connecticut Resident on Active Military Duty on the Assessment Date?

The information required includes the applicant's name, address, military status, vehicle make and model, vehicle identification number (VIN), and any supporting documentation verifying active military service.

Fill out your application for exempt status online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Exempt Status is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.