Get the free Long Term Disability policy booklet - SW BOCES Teachers ... - bocesta

Show details

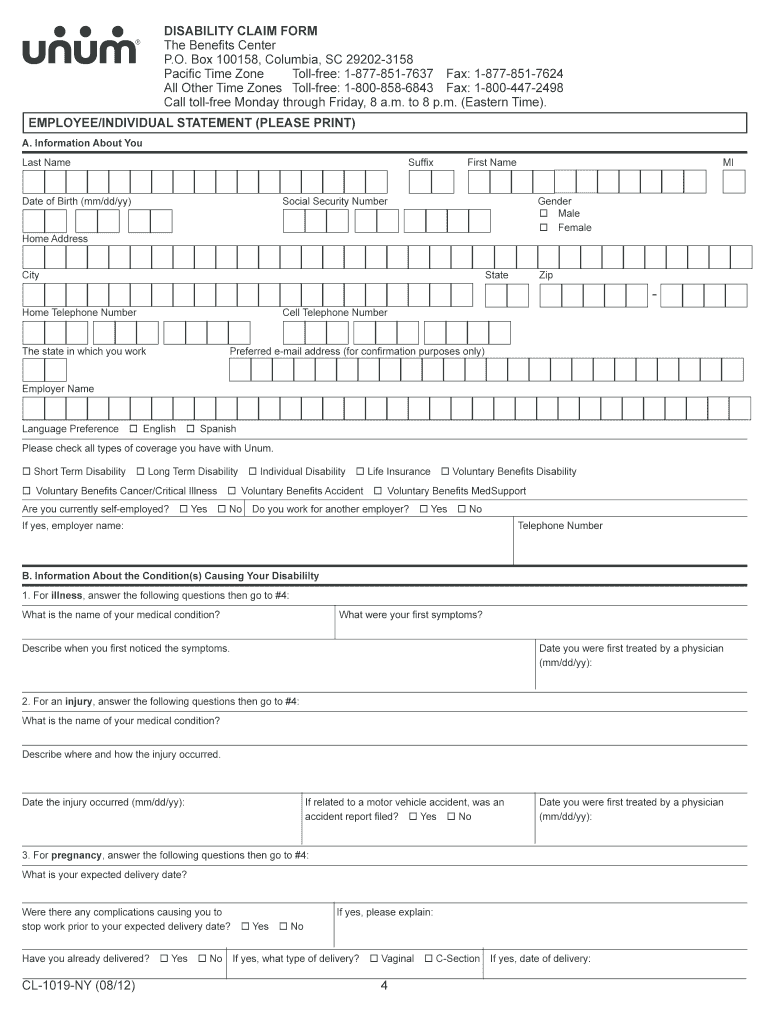

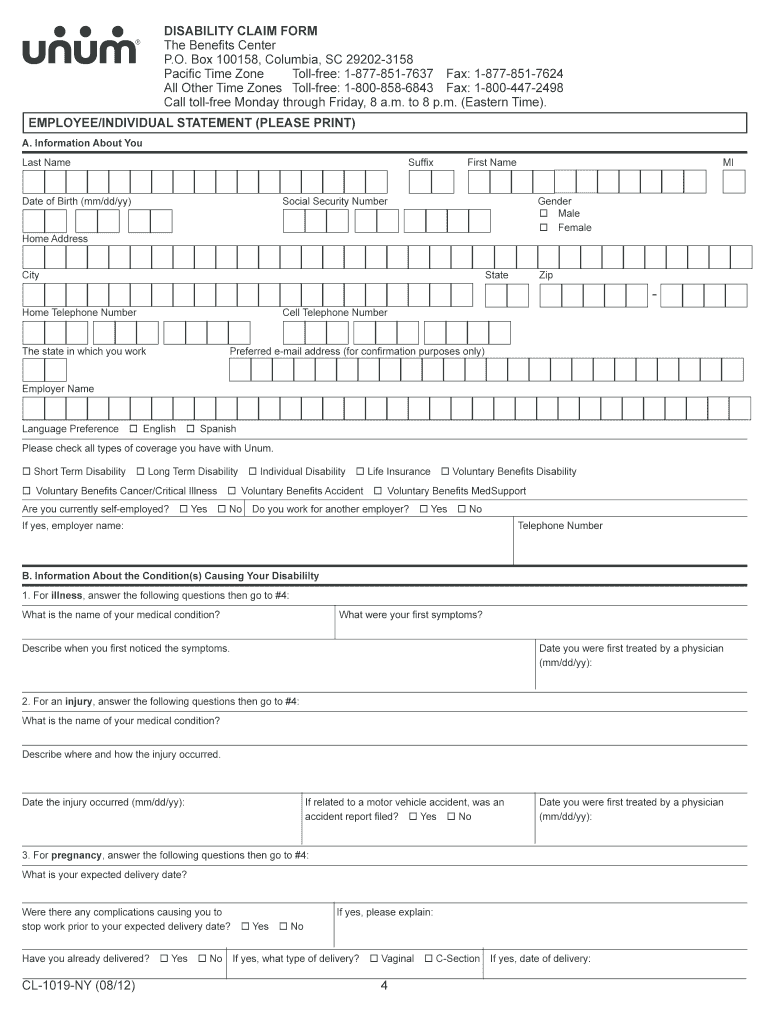

DISABILITY CLAIM FORM For use with policies issued by the following UNM Group UNM subsidiaries: First UNM Life Insurance Company Provident Life and Casualty Insurance Company The Paul Revere Life

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term disability policy

Edit your long term disability policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term disability policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long term disability policy online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit long term disability policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term disability policy

How to fill out long term disability policy:

01

Gather necessary information: Start by gathering all the necessary information you will need to fill out the long term disability policy. This may include personal details such as your name, contact information, and social security number, as well as information about your current employment, job title, and salary.

02

Understand the policy guidelines: Take the time to carefully read and understand the guidelines of the long term disability policy. Familiarize yourself with the coverage period, benefits, exclusions, and any other terms and conditions outlined in the policy. This will help you accurately complete the necessary sections.

03

Provide accurate employment details: When filling out the policy, make sure to accurately provide your current employment details. This may include your job title, employer's name and address, and any other relevant information. Providing precise information will help avoid any potential issues when filing for a claim.

04

Disclose medical history: Be transparent and disclose your accurate medical history when filling out the long term disability policy. This may include any pre-existing medical conditions, previous illnesses or injuries, and current medications or treatments. It is important to provide this information truthfully as it may impact the approval of your claim in the future.

05

Nominate a beneficiary: Consider nominating a beneficiary who would receive the disability benefits in case of your inability to do so. This can be a family member, a trusted friend, or anyone you deem appropriate. Provide their contact information and relevant details to ensure a smooth process in case of a claim.

06

Seek assistance if needed: If you are unsure about any aspects of filling out the long term disability policy, don't hesitate to seek guidance from a professional, such as an insurance agent or legal advisor. They can provide clarification and ensure that you complete the policy accurately.

Who needs long term disability policy:

01

Individuals with dependents: Long term disability policies are particularly beneficial for individuals with dependents, such as spouses, children, or other family members who rely on their income. It provides financial protection in case the policyholder becomes disabled and unable to work for an extended period.

02

Self-employed individuals: Self-employed individuals may not have access to employer-sponsored disability benefits. Therefore, obtaining a long term disability policy can be crucial in providing income replacement in case of a disability that prevents them from working.

03

Individuals with physically demanding jobs: People working in physically demanding occupations, such as construction, manual labor, or sports, may have a higher risk of sustaining injuries that could lead to disabilities. Having a long term disability policy can provide financial security by covering their income during the disability period.

04

Professionals in high-risk industries: Certain industries, such as aviation, mining, or law enforcement, can present higher risks and higher chances of accidents or injuries. Professionals working in such industries might find it essential to have a long term disability policy to safeguard their financial well-being if they become disabled.

05

Those without significant savings: Individuals without substantial savings or emergency funds may find a long term disability policy necessary. It ensures they have a source of income if they are unable to work due to a disability, helping to cover ongoing expenses and maintain financial stability.

Remember, it's important to consult with an insurance advisor or professional to determine your specific needs and the appropriate coverage for your long term disability policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit long term disability policy straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing long term disability policy.

Can I edit long term disability policy on an Android device?

With the pdfFiller Android app, you can edit, sign, and share long term disability policy on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out long term disability policy on an Android device?

On an Android device, use the pdfFiller mobile app to finish your long term disability policy. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is long term disability policy?

Long term disability policy is a type of insurance that provides income replacement for individuals who are unable to work for an extended period of time due to a disability.

Who is required to file long term disability policy?

Employers are typically required to provide long term disability insurance for their employees.

How to fill out long term disability policy?

To fill out a long term disability policy, you will need to provide information about your medical history, employment status, and any documentation related to your disability.

What is the purpose of long term disability policy?

The purpose of long term disability policy is to provide financial protection for individuals who are unable to work due to a long term disability.

What information must be reported on long term disability policy?

Information that must be reported on a long term disability policy includes the nature of the disability, medical documentation, and any relevant employment information.

Fill out your long term disability policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Disability Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.