Get the free Publication 559

Show details

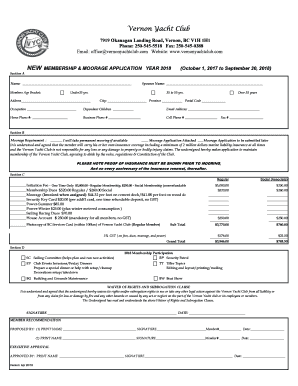

This publication is designed to help those in charge of the property of an individual who has died. It provides instructions on how to complete and file federal income tax returns and emphasizes the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 559

Edit your publication 559 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 559 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 559 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit publication 559. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 559

How to fill out Publication 559

01

Obtain a copy of Publication 559 from the IRS website or local tax office.

02

Review the table of contents to understand the sections that apply to you.

03

Complete the 'Who Must File' section to determine your eligibility.

04

Fill out the 'Filing Requirements' section with your personal information.

05

Provide details regarding your income and any allowable deductions.

06

Follow the instructions in the section relevant to your specific situation (e.g., disaster relief).

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form before submission.

Who needs Publication 559?

01

Individuals and businesses affected by disasters who need guidance on tax relief options.

02

Taxpayers seeking to claim losses incurred as a result of federally declared disasters.

Fill

form

: Try Risk Free

People Also Ask about

What is publication 538?

This publication explains some of the rules for accounting periods and accounting methods. It is not intended as a guide to general business and tax accounting rules.

Can the IRS come after an estate?

While some debts disappear after the debtor dies, that's not true of tax debts. That debt is now owed to the IRS by the deceased's estate, and the IRS will attach a lien to it for the amount owed. If the estate includes property, like a home, the lien may include that property.

What is IRS publication 559?

Publication 559 is designed to help those in charge (personal representatives) of the property (estate) of an individual who has died (decedent). It shows them how to complete and file federal income tax returns and explains their responsibility to pay any taxes due on behalf of the decedent.

Can IRS go after executor of estate?

ing to IRS regulations, executors and administrators must file proper tax returns for deceased persons. If they fail to do so, the IRS can hold them personally liable for the unpaid taxes.

Is an executor personally liable for taxes?

Pursuant to Code § 6901(a) and 31 U.S.C. § 3713(b), an executor is personally liable for a decedent's unpaid income and gift taxes if the executor: (1) knew the debt existed, and (2) distributed the estate without first paying the taxes.

What are the IRS rules for surviving spouse after death?

Qualifying widow or widower Surviving spouses with dependent children may be able to file as a Qualifying Surviving Spouse for two years after their spouse's death. This filing status allows them to use joint return tax rates and the highest standard deduction amount if they don't itemize deductions.

How far back can the IRS audit a deceased person?

§ 6501(e) gives the IRS up to six years to audit it.

Is family responsible for deceased IRS debt?

Debts are not directly passed on to heirs in the United States, but if there is any money in your parent's estate, the IRS is the first one getting paid. So, while beneficiaries don't inherit unpaid tax bills, those bills, must be settled before any money is disbursed to beneficiaries from the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publication 559?

Publication 559 is a tax publication released by the IRS that provides guidance on the tax responsibilities of individuals who have experienced a disaster, including information related to casualty and theft losses.

Who is required to file Publication 559?

Individuals who have suffered a casualty or theft loss related to a disaster and wish to take deductions or claim certain tax benefits due to the loss are required to file Publication 559.

How to fill out Publication 559?

To fill out Publication 559, taxpayers should gather relevant financial and property loss information, follow the instructions provided in the publication, and ensure that they report accurate loss amounts, dates, and any related insurance reimbursements.

What is the purpose of Publication 559?

The purpose of Publication 559 is to inform taxpayers about how to claim tax benefits related to property loss due to disasters, including the process for reporting casualty and theft losses, and to provide guidance on the necessary documentation.

What information must be reported on Publication 559?

Information that must be reported on Publication 559 includes the details of the loss, including the type of loss, date of the event, amount of loss, any insurance coverage, and how the loss affects tax filings.

Fill out your publication 559 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 559 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.