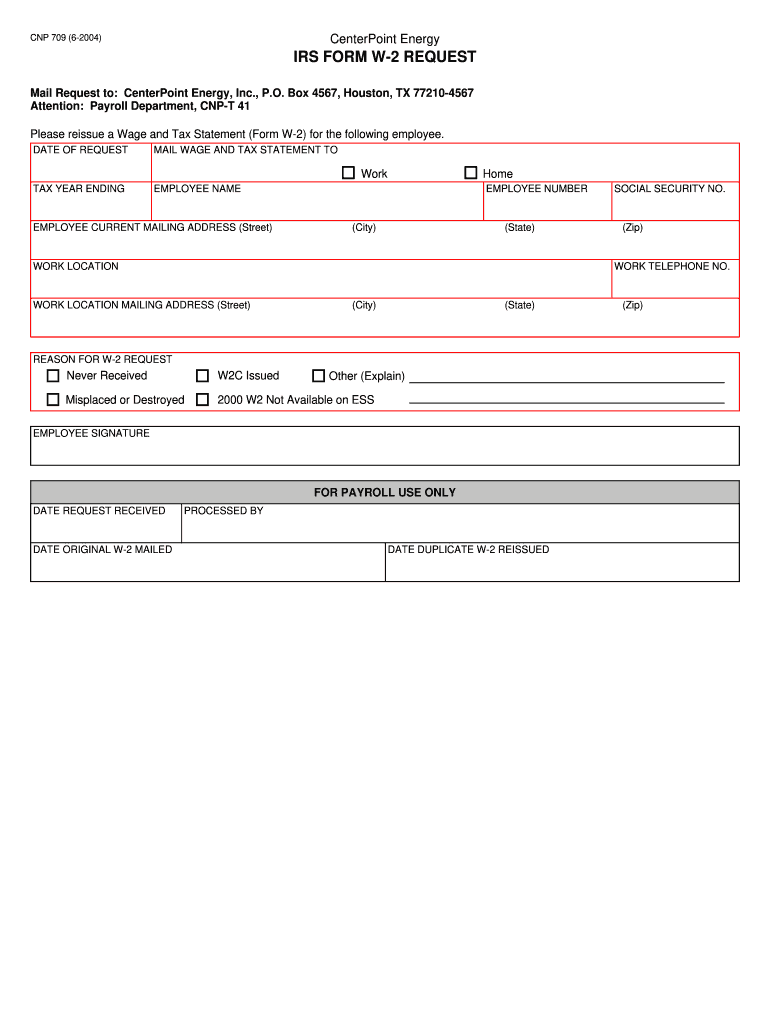

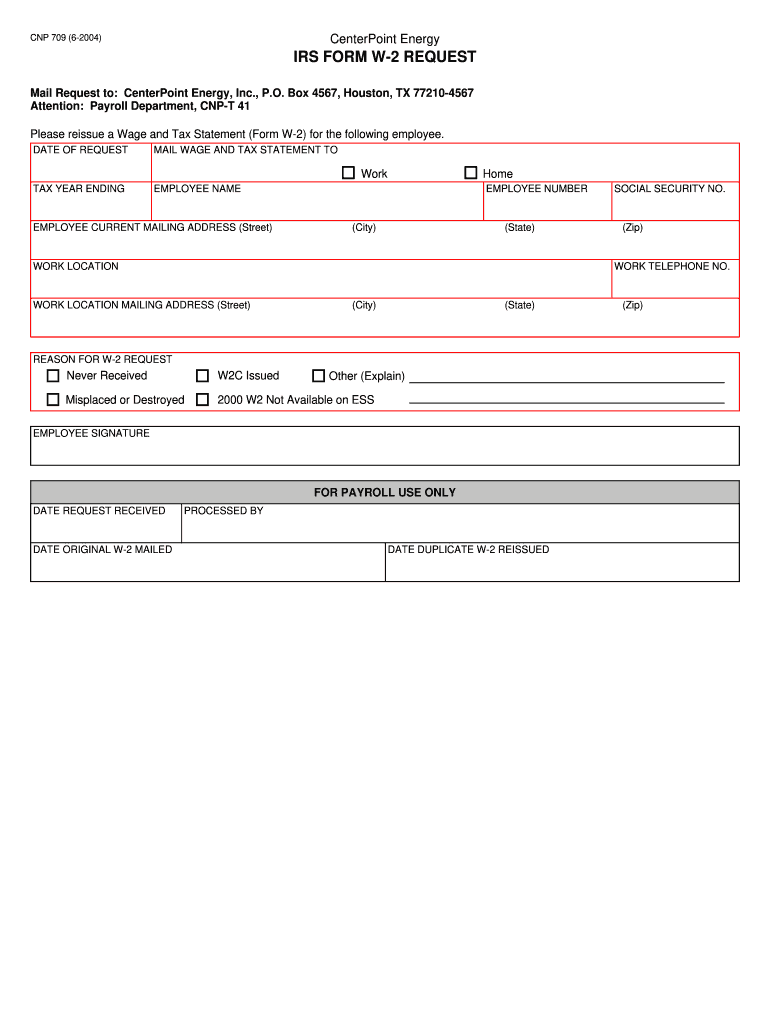

CenterPoint Energy CNP 709 2004-2025 free printable template

Show details

Counterpoint Energy CNP 709 (6-2004) IRS FORM W-2 REQUEST Mail Request to: Counterpoint Energy, Inc., P.O. Box 4567, Houston, TX 77210-4567 Attention: Payroll Department, CNP-T 41 Please reissue a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cnp709 irs

Edit your cnp709 irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cnp709 irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cnp709 irs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cnp709 irs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cnp709 irs

How to fill out CenterPoint Energy CNP 709

01

Gather all required personal information, including your full name, address, and contact details.

02

Locate your account number, which can be found on your CenterPoint Energy bill.

03

Review the sections of the form to understand what information is required in each part.

04

Fill out the form carefully, ensuring all fields are completed accurately.

05

If applicable, include any necessary documentation or additional information as specified on the form.

06

Review your completed form for errors or omissions.

07

Submit your form through the designated method as indicated (online, mail, etc.).

Who needs CenterPoint Energy CNP 709?

01

Residential and commercial customers looking to apply for or modify their service with CenterPoint Energy.

02

Individuals who need assistance with billing or service issues that require submission of this specific form.

03

Anyone relocating or changing their service provider within the CenterPoint Energy coverage area.

Fill

form

: Try Risk Free

People Also Ask about

Is Form 709 filed with Form 1040?

Form 709 Deadlines If an extension is needed, an automatic Form 709 extension will result from an extension of time granted for filing the federal income tax return Form 1040.

What is IRS form 709 used for?

Form 709 is used to report transfers subject to the Federal gift and certain generation-skipping transfer (GST) taxes, and to figure the tax, if any, due on those transfers. Form 709 InstructionsPDF. This item contains helpful information to be used by the taxpayer in preparation of Form 709, U.S. Gift Tax Return.

Do you report gift tax on 1040?

Essentially, gifts are neither taxable nor deductible on your tax return. Also, a monetary gift has to be substantial for IRS purposes — In order for the giver of the sum to be subject to tax ramifications, the gift must be greater than the annual gift tax exclusion amount.

Does form 709 get filed with Form 1040?

Form 709 is an annual return that is due by April 15 of the year after the gift was made. While this is the same deadline as the individual income tax return (Form 1040), the gift tax return must be filed separately.

Who needs to file IRS form 709?

Each individual is responsible to file a Form 709.If you meet all of the following requirements, you are not required to file Form 709. You made no gifts during the year to your spouse. You did not give more than $16,000 to any one donee. All the gifts you made were of present interests.

What happens if I don't fill out form 709?

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cnp709 irs?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific cnp709 irs and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the cnp709 irs electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your cnp709 irs in seconds.

Can I create an electronic signature for signing my cnp709 irs in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your cnp709 irs right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is CenterPoint Energy CNP 709?

CenterPoint Energy CNP 709 is a regulatory form used by CenterPoint Energy to report specific operational or financial information as required by regulatory authorities.

Who is required to file CenterPoint Energy CNP 709?

Entities that are regulated by CenterPoint Energy and that meet certain criteria set by regulatory bodies are required to file CenterPoint Energy CNP 709.

How to fill out CenterPoint Energy CNP 709?

To fill out CenterPoint Energy CNP 709, follow the provided instructions which typically include entering required data accurately, reviewing the form for completeness, and submitting it by the specified deadline.

What is the purpose of CenterPoint Energy CNP 709?

The purpose of CenterPoint Energy CNP 709 is to collect data that helps regulatory agencies monitor compliance and assess the operational performance of regulated entities.

What information must be reported on CenterPoint Energy CNP 709?

The information that must be reported on CenterPoint Energy CNP 709 includes financial data, operational metrics, compliance details, and any other information specified by regulatory authorities.

Fill out your cnp709 irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

cnp709 Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.