Get the free Deposit Slip

Show details

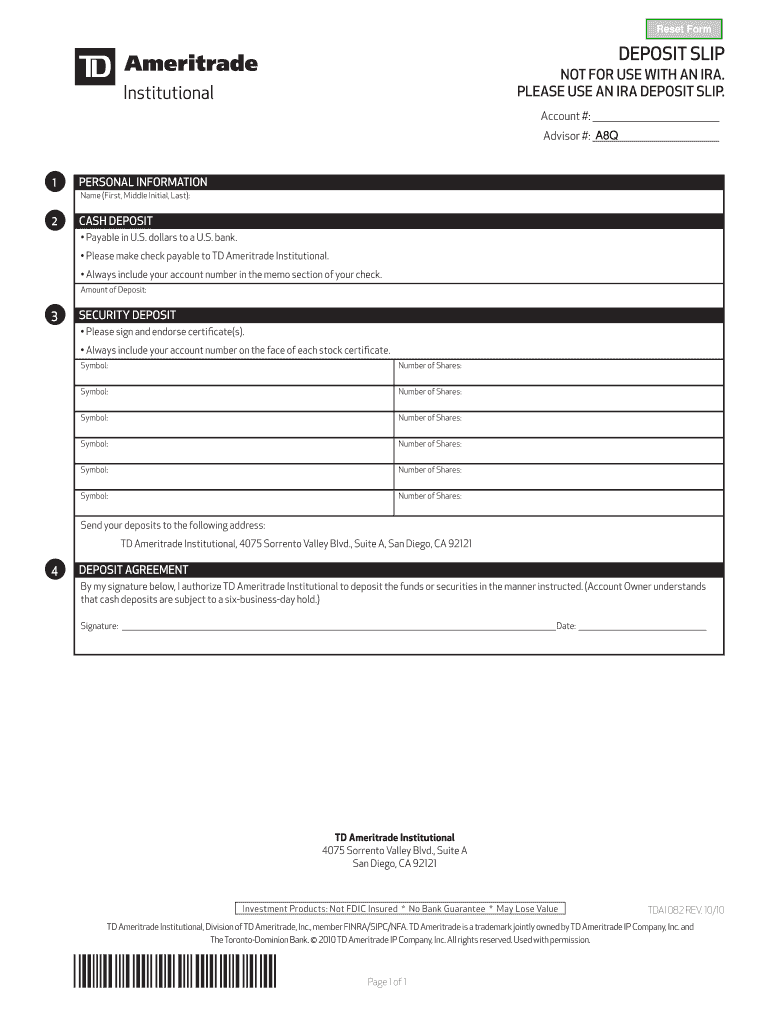

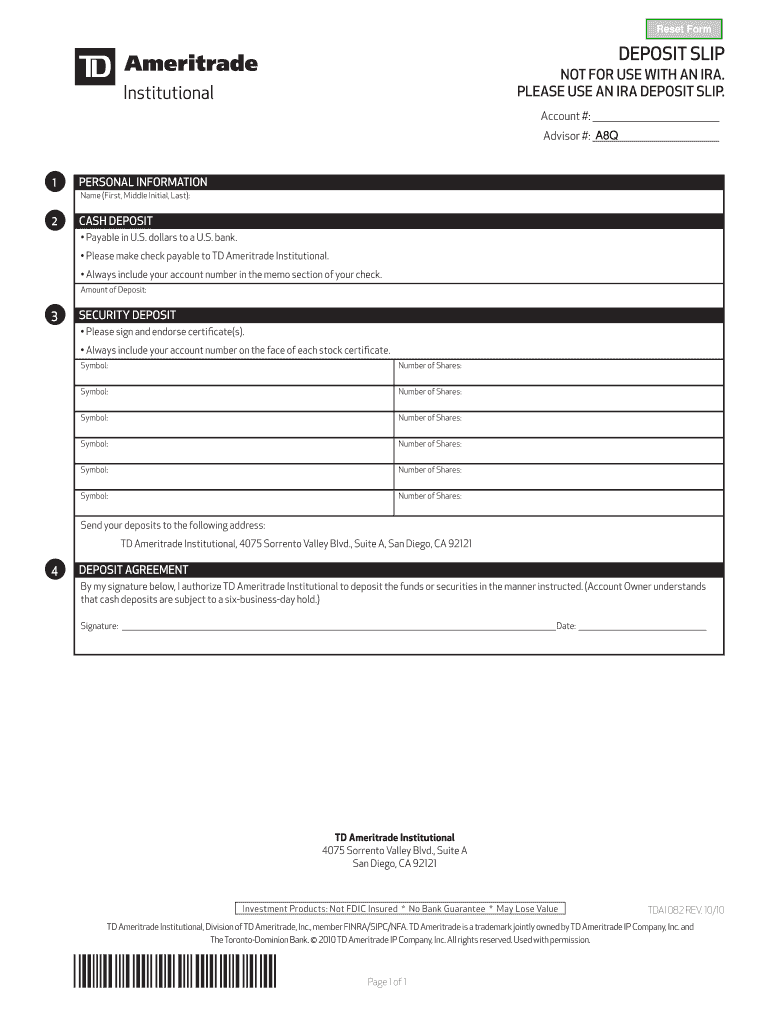

This document is a deposit slip for TD Ameritrade Institutional, outlining the details required for depositing cash and securities into a designated account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit slip

Edit your deposit slip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit slip form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deposit slip online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deposit slip. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit slip

How to fill out Deposit Slip

01

Obtain a deposit slip from your bank or print one from the bank's website.

02

Fill in the date at the top of the deposit slip.

03

Write your account number where indicated.

04

List the cash amount in the designated area.

05

List checks being deposited, including the amounts, in the specified areas.

06

Calculate the total deposit amount and write it in the 'Total' field.

07

Sign the deposit slip if required by your bank.

Who needs Deposit Slip?

01

Individuals making deposits into their bank accounts.

02

Businesses depositing cash and checks into their business accounts.

03

Anyone who wants to keep a record of their deposits.

Fill

form

: Try Risk Free

People Also Ask about

What is term deposit in English?

Term Deposits are one of the best investment options for people who are looking for a stable and safe return on their investments. In Term Deposits, the sum of money is kept for a fixed maturity and the depositor is not allowed to withdraw this sum till the end of the maturity period.

What is cash deposit slip in English?

A deposit slip is a small physical form that a bank customer includes when depositing money into a bank account. A deposit slip contains the date of deposit, the name of the depositor, the depositor's account number, and the amount being deposited.

What is a bank slip in English?

A deposit slip is a small paper form that a bank customer includes when depositing funds into a bank account. A deposit slip states the date, the name of the depositor, the depositor's account number, and the amounts being deposited.

How to fill deposit slip in english?

How to fill out a deposit slip for cash. Make sure you provide your name as it appears on your account. Include the account number. If you are requesting cash back, you may be required to sign the deposit slip in the appropriate space. Include a subtotal for the cash and checks, along with any amount you want back.

What is a cash deposit in English?

A cash deposit refers to the act of placing physical currency into a bank account.

What is deposit in British English?

A deposit is a sum of money which is part of the full price of something, and which you pay when you agree to buy it. A £50 deposit is required when ordering, and the balance is due upon delivery. A deposit is a sum of money which you pay when you start renting something.

What is a deposit UK?

A mortgage deposit is the money you pay upfront when buying a house. If you've got your eye on a new home or property, you'll need a deposit to buy it.

How do British people say deposit?

ˈpɒzɪt. 3 syllables: "di" + "POZ" + "it"

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deposit Slip?

A deposit slip is a printed form that a bank provides to customers for the purpose of depositing money into their bank account.

Who is required to file Deposit Slip?

Anyone who wishes to deposit cash or checks into their bank account is required to fill out a deposit slip.

How to fill out Deposit Slip?

To fill out a deposit slip, a person needs to write their account number, date, the amount of cash and/or checks being deposited, and sign the slip if required.

What is the purpose of Deposit Slip?

The purpose of a deposit slip is to provide the bank with information about the deposit being made, ensuring accurate processing and recording of the transaction.

What information must be reported on Deposit Slip?

The information that must be reported on a deposit slip includes the account holder's name, account number, date of deposit, and the total amount of the deposit (cash and checks).

Fill out your deposit slip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Slip is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.