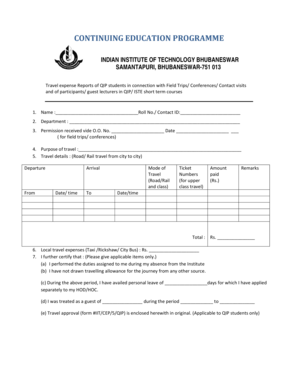

What is the Expense Reporting Form?

The Expense Reporting Form must be completed by the employer who need to declare all expenses of the company. This form perfectly fits big companies with many employees.

What is the Expense Reporting Form for?

As far as all institutions and businesses need to record and track all their expenses, it is important to fill out the Expense Reporting Form. It will help keep all expenses in an organizes way. The form may be used for claiming reimbursements for guests and students, faculty and staff.

When is the Expense Reporting Form Due?

Some employers complete this form for every month or even week, some of them decide to report the expenses for the whole year. It depends on the amount of expenses and the type of business.

Is the Expense Reporting Form Accompanied by Other Forms?

No, this report does not require any additional documents. It must be filed separately without any attachments.

What Information do I Include in the Expense Reporting Form?

First, it is necessary to indicate your name, system, manager, employee, subcontractor and the week ending date. The form includes the chart that you need to fill out with the following information about the expense: date, description, lodging, meal, flight, transportation, entertainment, repairs, other expenses and the total amount for this date. In the end write who must approve this report and the date. There is a special block for additional comments.

Where do I Send the Expense Reporting Form?

The employer must save this report for own records.