CA Metrolink Payroll Reporting Form 2001-2025 free printable template

Show details

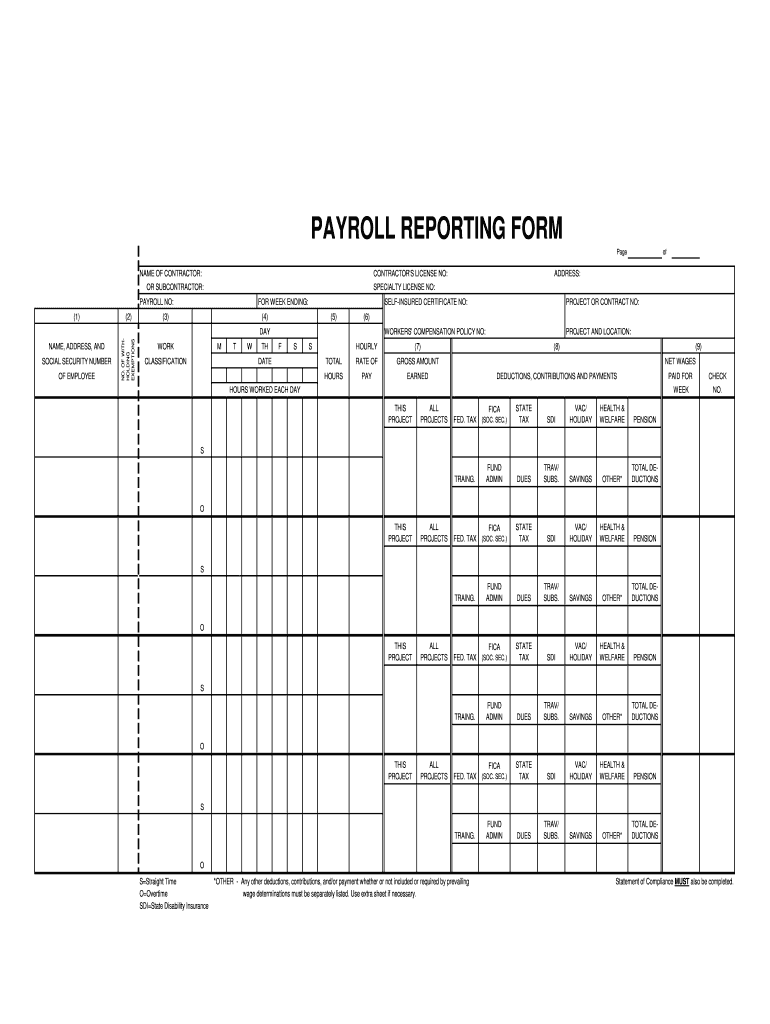

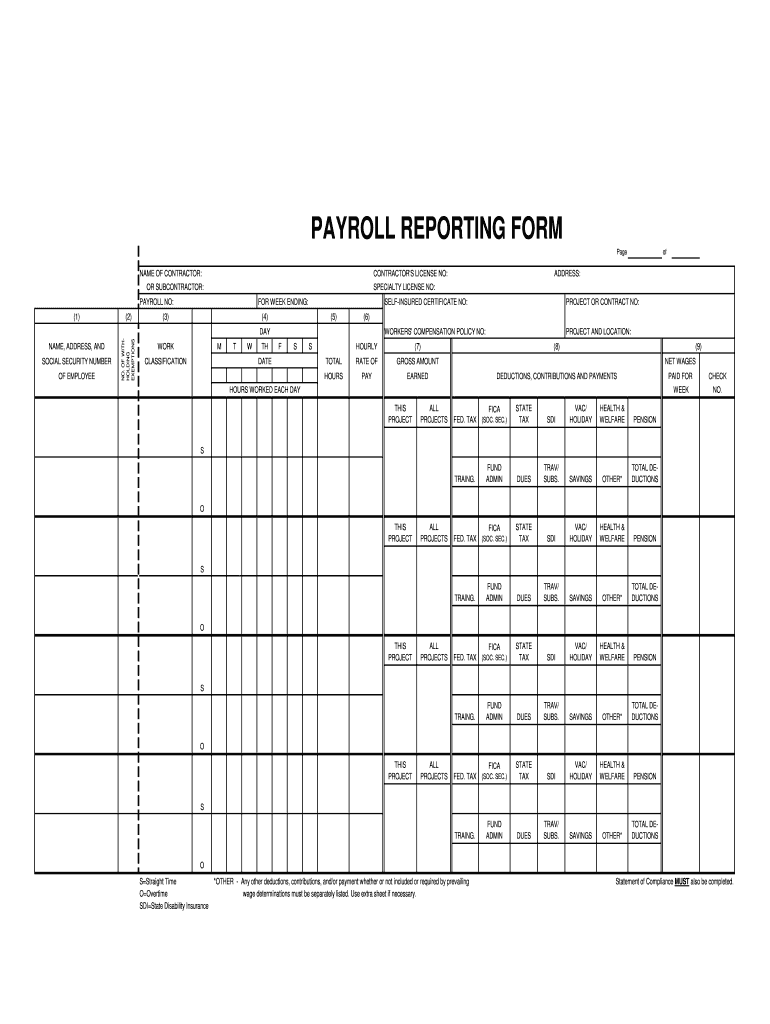

PAYROLL REPORTING FORM Page CONTRACTOR'S LICENSE NO: NAME OF CONTRACTOR: SPECIALTY LICENSE NO: OR SUBCONTRACTOR: PAYROLL NO: (1) (2) SELF-INSURED CERTIFICATE NO: FOR WEEK ENDING: (4) (3) (5) OF EMPLOYEE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Metrolink Payroll Reporting Form

Edit your CA Metrolink Payroll Reporting Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Metrolink Payroll Reporting Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Metrolink Payroll Reporting Form online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Metrolink Payroll Reporting Form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA Metrolink Payroll Reporting Form

How to fill out CA Metrolink Payroll Reporting Form

01

Obtain the CA Metrolink Payroll Reporting Form from the official Metrolink website or related authority.

02

Enter the employer's business name and contact information in the designated fields.

03

Provide the employee's personal information, including name, Social Security number, and job title.

04

Fill in the pay period dates and total hours worked during that period.

05

Calculate the total wages earned by the employee during the pay period and enter it in the form.

06

Include any applicable deductions or withholdings for taxes and benefits.

07

Review all information for accuracy before submitting.

08

Sign and date the form where required.

09

Submit the completed form to the designated Metrolink office by the due date.

Who needs CA Metrolink Payroll Reporting Form?

01

Employers in California who have employees working on projects funded by Metrolink.

02

Payroll departments responsible for reporting employee earnings and hours worked.

03

Businesses seeking reimbursement for transit costs related to employee commuting.

Fill

form

: Try Risk Free

People Also Ask about

What is certified payroll California?

Certified payroll is a special weekly payroll report used by contractors who are working on federally funded projects. To meet your certified payroll requirements, you'll need to submit Form WH-347 to the Department of Labor every week.

What is a statement of non performance?

In the event there has been no work performed during a given week on the project, the Statement of Non-Performance (“SNP”) can be filled out for that week. A subcontractor must submit a SNP or Certified Payroll Report for each week on the job until their scope of work is complete.

How do I correct certified payroll errors?

You cannot change or delete records that have already been submitted. However, you may correct errors by submitting a new record for the same pay period. The new or "amended" record for an employee will take precedence over the original record submitted.

How do I fill out a payroll report?

How To Create a Payroll Report Choose the Time Period for the Report. Payroll reports always summarize information over a period of time, such as a week, month, or year. Outline the Information You Need to Collect. Enter Data in Your Spreadsheet or Generate a Report with Software. Analyze Your Report.

What is the difference between payroll and certified payroll?

Certified Payroll is a company's accounting of everything paid out under a contract performed for a government client, while Wrap-Up Payroll is what a company has to report to their Workers Compensation Carrier for the state in which they are doing the work.

What should be included in a payroll report?

A payroll report is a document that employers use to verify their tax liabilities or cross-check financial data. It may include such information as pay rates, hours worked, overtime accrued, taxes withheld from wages, employer tax contributions, vacation balances and more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit CA Metrolink Payroll Reporting Form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign CA Metrolink Payroll Reporting Form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out CA Metrolink Payroll Reporting Form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CA Metrolink Payroll Reporting Form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out CA Metrolink Payroll Reporting Form on an Android device?

Use the pdfFiller mobile app and complete your CA Metrolink Payroll Reporting Form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA Metrolink Payroll Reporting Form?

The CA Metrolink Payroll Reporting Form is a document used by employers to report payroll information to the California Metrolink agency for the purpose of calculating contributions and compliance with state regulations.

Who is required to file CA Metrolink Payroll Reporting Form?

Employers who have employees working on Metrolink projects or in areas served by Metrolink are required to file the CA Metrolink Payroll Reporting Form.

How to fill out CA Metrolink Payroll Reporting Form?

To fill out the CA Metrolink Payroll Reporting Form, employers must provide accurate details of employee wages, hours worked, and any deductions. This typically includes sections for employee information, total earnings, classifications, and signature of the authorized representative.

What is the purpose of CA Metrolink Payroll Reporting Form?

The purpose of the CA Metrolink Payroll Reporting Form is to ensure compliance with labor laws and to gather data necessary for the proper funding and operation of Metrolink services, as well as to monitor wage and benefit practices.

What information must be reported on CA Metrolink Payroll Reporting Form?

The CA Metrolink Payroll Reporting Form must include information such as employee names, identification numbers, work classifications, hours worked, wage rates, total wages earned, and any applicable deductions or contributions.

Fill out your CA Metrolink Payroll Reporting Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Metrolink Payroll Reporting Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.