Get the free Notice N(30)(15)580-1

Show details

This document outlines the procedures and requirements for submitting reports to Congress and the GAO under the Small Business Regulatory Enforcement Fairness Act of 1996, detailing what constitutes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice n3015580-1

Edit your notice n3015580-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice n3015580-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice n3015580-1 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice n3015580-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice n3015580-1

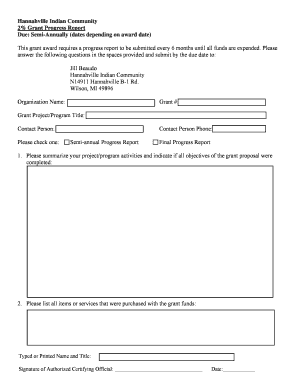

How to fill out Notice N(30)(15)580-1

01

Obtain the Notice N(30)(15)580-1 form from the appropriate agency or online.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal information in the designated fields, including your name, address, and contact information.

04

Enter the relevant dates, including the date of the notice and any applicable deadlines.

05

Provide any necessary supporting documentation as required by the form.

06

Review the completed form to ensure all information is accurate and complete.

07

Submit the form according to the instructions provided, either by mail or electronically.

Who needs Notice N(30)(15)580-1?

01

Individuals or entities involved in legal proceedings that require a formal notice.

02

Parties seeking to inform others of specific legal obligations or deadlines.

03

Professionals managing compliance or regulatory issues within their organization.

Fill

form

: Try Risk Free

People Also Ask about

How to write an appeal letter to the IRS?

The following should be provided in the protest: Taxpayer's name and address, and a daytime telephone number. A statement that taxpayer wants to appeal the IRS findings to the Appeals Office. A copy of the letter proposed tax adjustment. The tax periods or years involved.

How to write a professional letter to the IRS?

6 Essential Tips for Writing a Letter to the IRS Follow the business letter format. Explain why you qualify for a penalty abatement. Include a copy of the IRS notice you received. Identify additional enclosures. Close the letter on a friendly note. Send your letter as soon as possible.

How to write an effective letter of appeal?

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. Be Factual. Include factual detail but avoid dramatizing the situation. Be Specific. Documentation. Stick to the Point. Do Not Try to Manipulate the Reader. How to Talk About Feelings. Be Brief.

What is a 30 day letter?

An IRS 30 Day letter known as a Notice for Acceptance or Appeal. A document outlining the auditor's demands or proposed changes. An agreement form or waiver. A copy of IRS Publication 5, which explains how to pay taxes, including withholding and estimated taxes.

What is IRS notice CP118?

Identified as “IRS Notice CP118,” the Second Notice states that the “Government's analysis of the material received from [Littlejohn] indicates that the recipient's information that was disclosed was narrow in scope and limited to information returns (e.g., Forms 1099, Schedule K-1, etc.)

What is a Notice 1462 from the IRS?

IRS Notice 1462 This notice is sent when the IRS makes a correction to your tax return. It might involve changes due to errors found in your calculations or discrepancies in reported income.

How do I write an appeal letter for income tax?

Dear Sir or Madam, I hereby appeal the income tax assessment for the year [TAX YEAR] dated [DATE]. Thank you in advance. ? You can include your mailing address either under your name or in your email signature to ensure the tax office can contact you by post.

How do I write an appeal letter to the IRS?

In your formal protest, include a statement that you want to appeal the changes proposed by the IRS and include all of the following: ∎ Your name, address, and a daytime telephone number. ∎ List of all disputed issues, tax periods or years involved, proposed changes, and reasons you disagree with each issue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

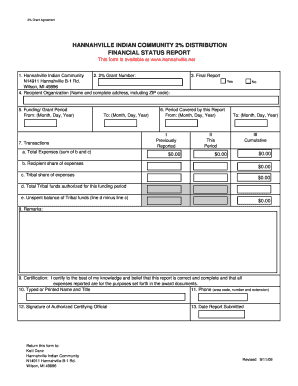

What is Notice N(30)(15)580-1?

Notice N(30)(15)580-1 is a regulatory document used for reporting specific financial or operational details to a governing body.

Who is required to file Notice N(30)(15)580-1?

Entities or individuals who meet the criteria set by the governing regulations applicable to Notice N(30)(15)580-1 are required to file this notice.

How to fill out Notice N(30)(15)580-1?

To fill out Notice N(30)(15)580-1, complete the designated fields with the required information as outlined in the accompanying instructions, and ensure to adhere to any specific formatting or submission guidelines.

What is the purpose of Notice N(30)(15)580-1?

The primary purpose of Notice N(30)(15)580-1 is to ensure compliance with regulatory requirements by collecting necessary information that supports transparency and accountability within the relevant sector.

What information must be reported on Notice N(30)(15)580-1?

The information required on Notice N(30)(15)580-1 typically includes details about financial performance, operational metrics, and any other specific data required by the governing body for assessment.

Fill out your notice n3015580-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice n3015580-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.