Get the free YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA

Show details

This handbook provides information on understanding and using your health reimbursement account (HRA) along with details about high deductible health plans (HDHPs) and eligible medical expenses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your hra handbook for

Edit your your hra handbook for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your hra handbook for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your hra handbook for online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit your hra handbook for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

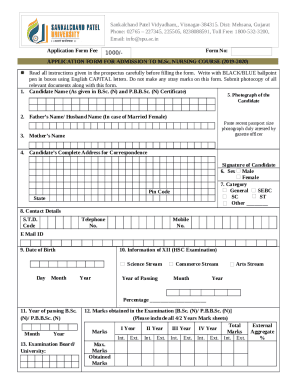

How to fill out your hra handbook for

How to fill out YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA

01

Gather your personal and dependent information.

02

Ensure you have your Blue Options HRA details on hand.

03

Carefully read the introductory section of the handbook.

04

Fill out the section for employee information with accurate data.

05

Complete each section regarding your healthcare expenses and reimbursements.

06

Make sure to include any necessary supporting documentation.

07

Review the filled-out handbook for accuracy.

08

Submit the handbook to the designated department or online platform as instructed.

Who needs YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

01

Employees enrolled in the Blue Options HRA plan.

02

Individuals looking to understand their healthcare reimbursement options.

03

HR personnel who assist employees with HRA guidelines.

04

Financial professionals managing healthcare spending accounts.

Fill

form

: Try Risk Free

People Also Ask about

How do I use my HRA?

Your HRA may come with a special debit card. This is the easiest way to use your HRA – just present the debit card at your provider's office when paying for services, or use it to pay for eligible items at a store or online. The card takes the money directly from the account.

Can you buy toothpaste with HRA?

Toothpaste is not eligible for reimbursement with a flexible spending account (FSA), health savings account (HSA), health reimbursement arrangement (HRA), limited-purpose flexible spending account (LPFSA) or a dependent care flexible spending account (DCFSA).

How do I check if I have an HRA?

How will I know if I have an individual coverage HRA offer? Most of the time, your employer will send you a letter at least 90 days before the start of the HRA's 12-month plan year.

What is the meaning of HRA?

Health Reimbursement Arrangements (HRAs) are account-based health plans that employers can offer to their employees. They reimburse employees for their medical expenses. Your employer may offer you either an. individual coverage HRA.

Is an HRA the same as an HSA?

While you and your employer can contribute to your HSA, up to the HSA contribution limits, only your employer can put money into an HRA. Check with your employer to see how much your HRA may have each year. There is no limit on the amount of money your employer can contribute to the accounts.

What is the difference between HSA and HRA?

HSA: You can only use what you've saved. HRA: Because the employer owns these accounts, you can't directly withdraw funds to pay for qualified medical expenses or health coverage. You must incur the charge first and then file your claim for reimbursement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA is a guide that provides detailed information on how to navigate and utilize the Health Reimbursement Arrangement (HRA) associated with Blue Options health plans.

Who is required to file YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

Participants enrolled in a Blue Options health plan that includes a Health Reimbursement Arrangement (HRA) are required to file the handbook to ensure compliance and receive the benefits.

How to fill out YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

To fill out the YOUR HRA HANDBOOK, follow the guidelines provided in the document, which typically include sections to report personal information, medical expenses, and any other required documentation.

What is the purpose of YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

The purpose of the YOUR HRA HANDBOOK is to inform participants about their rights, responsibilities, and the process for claiming reimbursements from their HRA, ensuring they make the most of their healthcare benefits.

What information must be reported on YOUR HRA HANDBOOK FOR BLUE OPTIONS HRA?

Important information that must be reported includes personal identification details, expense claims, supporting documentation for healthcare services, and any relevant policy numbers.

Fill out your your hra handbook for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Hra Handbook For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.