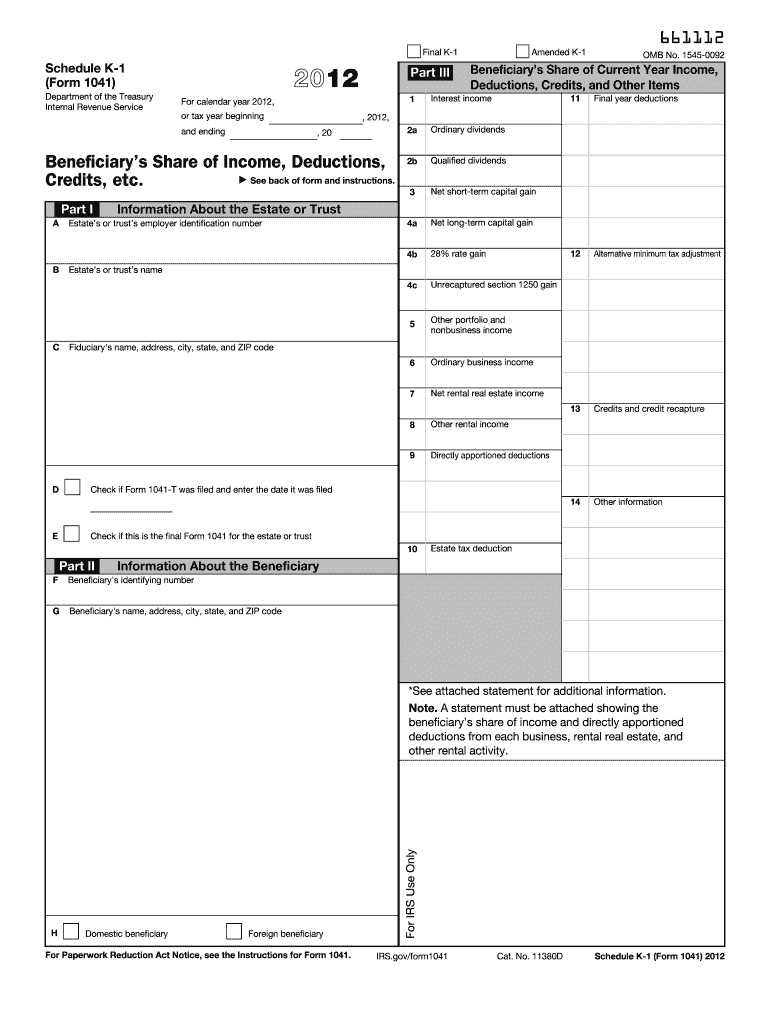

IRS 1041 - Schedule K-1 2012 free printable template

Show details

Internal Revenue Service. 2012. For calendar year 2012, or tax year beginning. , 2012, and ending. , 20. Beneficiary×39’s Share of Income, Deductions, Credits, etc.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

To edit IRS 1041 - Schedule K-1, you can utilize the tools available in pdfFiller. Start by uploading your Schedule K-1 to the platform. Once uploaded, you can make necessary changes directly on the form. After completing your edits, you can save, print, or share the updated version as needed.

How to fill out IRS 1041 - Schedule K-1

Filling out IRS 1041 - Schedule K-1 requires careful attention to detail. Collect all necessary information from the relevant parties and follow these steps:

01

Obtain the correct version of the form.

02

Fill in the upper section with the trust's name, address, and identifying number.

03

List the beneficiary’s information including name, address, and taxpayer identification number.

04

Provide details of income, deductions, and credits applicable to the beneficiary.

05

Check for accuracy before finalizing the form.

About IRS 1041 - Schedule K-1 2012 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041 - Schedule K-1 2012 previous version

What is IRS 1041 - Schedule K-1?

IRS 1041 - Schedule K-1 is a tax document that reports income, deductions, and credits from an estate or trust. It is used for income allocated to beneficiaries, providing them with the necessary details to file their personal tax returns.

What is the purpose of this form?

The primary purpose of IRS 1041 - Schedule K-1 is to inform beneficiaries of their share of an estate's or trust's income, deductions, and tax credits. This ensures that beneficiaries accurately report this information when filing their individual tax returns.

Who needs the form?

Beneficiaries who receive income from a trust or estate need IRS 1041 - Schedule K-1. This includes individuals receiving distributions of income from the estate or trust and those who may be subject to tax on that income.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1041 - Schedule K-1 if you do not receive any distributions from the trust or estate during the tax year. Additionally, if the estate or trust does not earn income, the form may not be necessary.

Components of the form

IRS 1041 - Schedule K-1 consists of several key components, including the name and identification information of the trust or estate, beneficiary details, and a breakdown of income types, deductions, and credits. Each section must be filled out accurately to provide clear reporting information to the IRS and beneficiaries.

What are the penalties for not issuing the form?

Failing to issue IRS 1041 - Schedule K-1 can result in penalties for the estate or trust. The IRS may impose fines for late filing or failure to provide the proper information. It is essential to comply with all requirements to avoid additional costs.

What information do you need when you file the form?

When filing IRS 1041 - Schedule K-1, you need the following information:

01

The trust's or estate's name and Tax Identification Number (TIN).

02

The beneficiary’s name, address, and TIN.

03

Details about income types, deductions, and credits allocated to the beneficiary.

04

Any other relevant tax information applicable to the year of filing.

Is the form accompanied by other forms?

IRS 1041 - Schedule K-1 may need to be submitted along with Form 1041, the U.S. Income Tax Return for Estates and Trusts. This form provides the overall financial picture of the trust or estate and may be accompanied by other schedules or documentation depending on the complexity of the trust.

Where do I send the form?

IRS 1041 - Schedule K-1 should be sent to the IRS along with Form 1041. Additionally, a copy must also be provided to the beneficiary for their personal tax reporting. Ensure to double-check the mailing address based on whether you are filing electronically or via paper to ensure accurate submission.

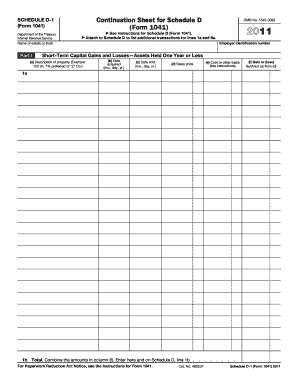

See what our users say