Get the free REQUEST FOR “LANDS AVAILABLE FOR TAXES” INFORMATION

Show details

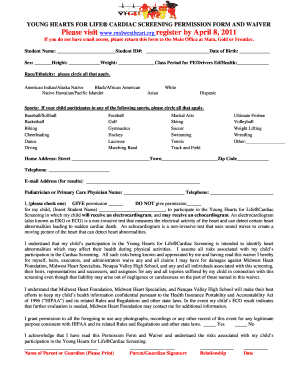

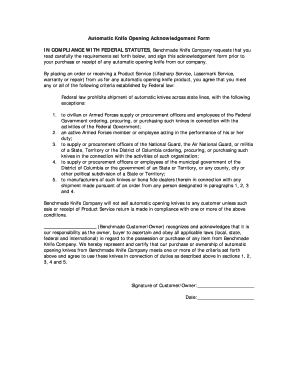

This document is a request form for information regarding lands available for taxes, requiring specific property details to be filled in by the customer.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for lands available

Edit your request for lands available form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for lands available form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for lands available online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit request for lands available. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for lands available

How to fill out REQUEST FOR “LANDS AVAILABLE FOR TAXES” INFORMATION

01

Obtain a copy of the REQUEST FOR 'LANDS AVAILABLE FOR TAXES' form from the local tax office or official website.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide the reason for your request clearly in the designated section.

04

Include any identifying information about the property, such as the parcel number or address.

05

Sign and date the completed form.

06

Submit the form to the relevant tax office by mail, email, or in person, as instructed.

Who needs REQUEST FOR “LANDS AVAILABLE FOR TAXES” INFORMATION?

01

Property developers looking for tax-foreclosed land opportunities.

02

Investors interested in acquiring tax-delinquent properties.

03

Real estate agents assisting clients in locating available land.

04

Individuals conducting research on land ownership for personal or business purposes.

Fill

form

: Try Risk Free

People Also Ask about

How long can property taxes go unpaid in Washington?

If you owe unpaid property tax for more than 3 years, the county may start a foreclosure process. For example, even if you've paid all the property taxes you owe in the last 3 years, but you still owe taxes from 4 years ago, the county may still start the foreclosure process.

How do I buy a tax lien in CA?

Tax lien auctions are typically held online, making it accessible for investors across the state and beyond. Counties will announce these auctions, providing details about the properties and the unpaid taxes. Investors must register in advance, often providing a refundable deposit to participate.

Is tax lien investing a good idea in California?

While tax lien investing can offer high returns, it also comes with risks: Redemption: The original property owner has the right to redeem the property by paying off the back taxes plus the agreed-upon interest rate within a specified period, typically one to five years.

How do I get a copy of my Volusia County tax bill?

If you do not receive a tax bill you can print a tax bill online or call the Volusia County tax office at 386-736-5938.

What is a tax deed application in Florida?

The Tax Deed Application is a legal document that begins the process wherein the Clerk of the Circuit Court sells the property to the highest bidder at public auction.

Are tax liens legal in California?

When you owe tax debt, we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to. If you don't respond to our letters, pay in full, or set a payment plan, we may record and/or file a Notice of State Tax Lien against you.

Does paying property taxes give you ownership in California?

No. Legal title to a tax-defaulted property subject to the Tax Collector's power to sell can only be obtained by becoming the successful bidder at the county tax sale. Paying the outstanding property taxes on such property will only benefit the current owner.

How long does a tax lien last in California?

The state tax lien attaches to all property and rights to property, belonging to the taxpayer and located in the State of California (Gov. Code section 7170(a)). A state tax lien continues in effect for ten years from the date of its creation unless it is released or discharged.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION?

REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION is a formal inquiry submitted to local government or tax authorities to obtain details about properties that are available for purchase due to unpaid taxes.

Who is required to file REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION?

Individuals or entities interested in purchasing tax-delinquent properties are typically required to file this request, including potential investors and real estate developers.

How to fill out REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION?

To fill out the request, one must complete the necessary form provided by the local tax authority, ensuring that all required fields are filled in accurately, and then submit it through the prescribed method, which may include mail or online submission.

What is the purpose of REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION?

The purpose of this request is to facilitate access to information regarding properties that can be acquired through tax lien or tax deed sales, thereby promoting the responsible acquisition and development of such lands.

What information must be reported on REQUEST FOR 'LANDS AVAILABLE FOR TAXES' INFORMATION?

The request typically requires information such as the requester's contact details, the specific properties or parcels of interest, and any pertinent identifying information about the lands available for taxes.

Fill out your request for lands available online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Lands Available is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.