Get the free Schedule J

Show details

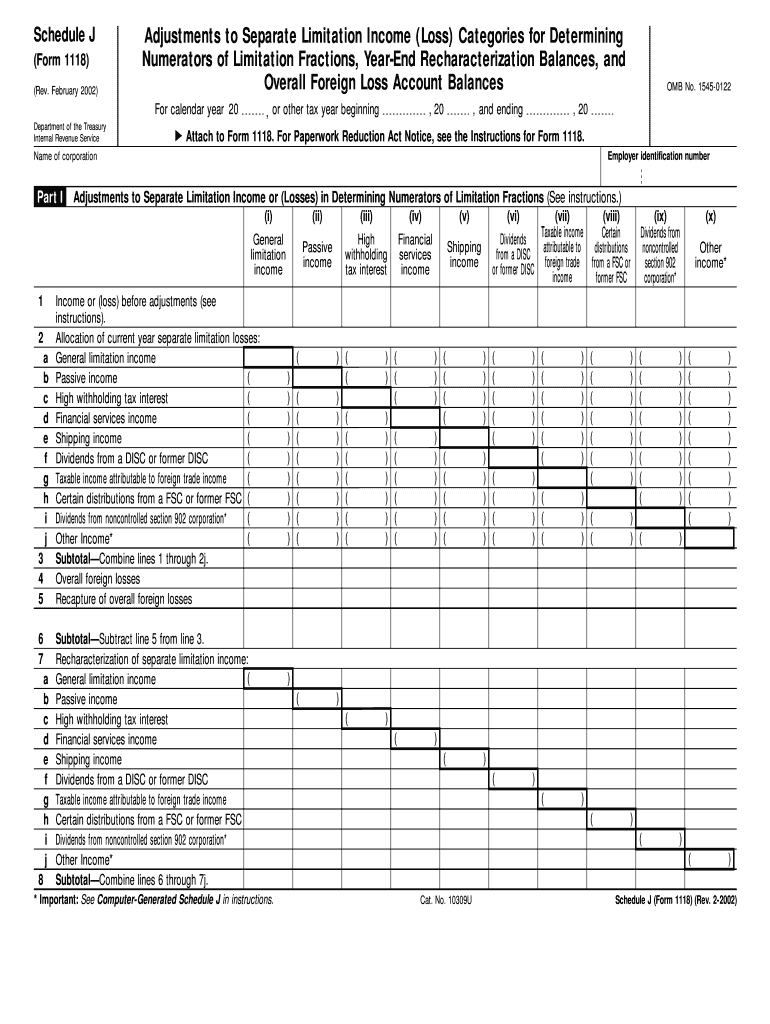

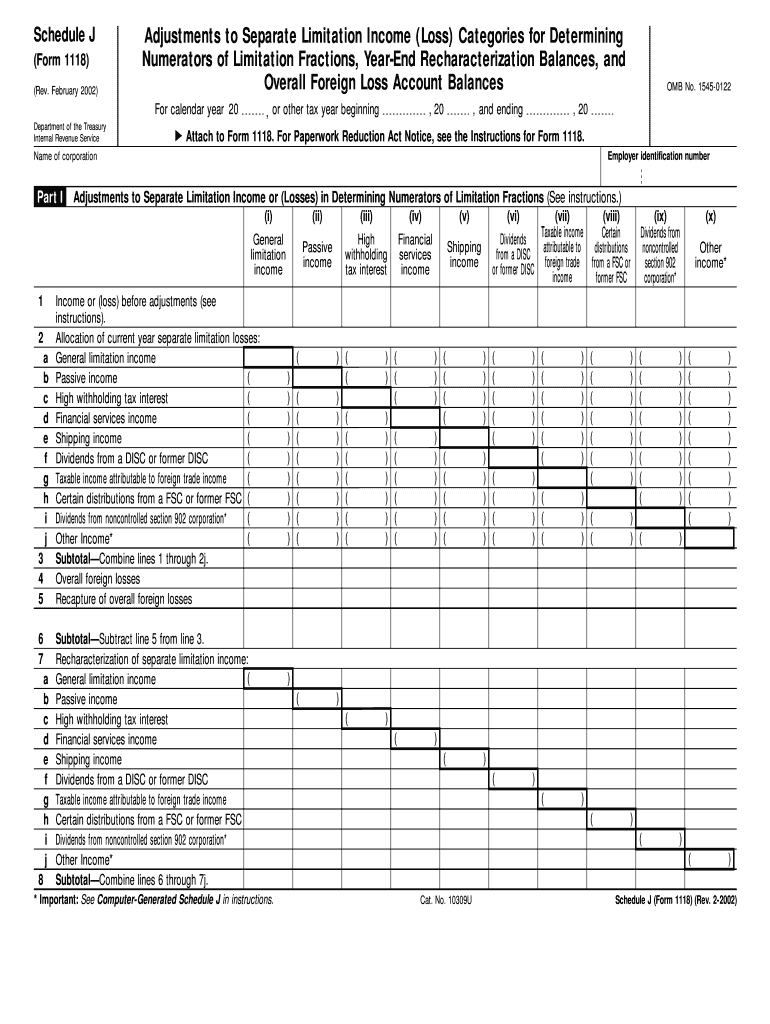

Adjustments to Separate Limitation Income (Loss) Categories for Determining Numerators of Limitation Fractions, Year-End Recharacterization Balances, and Overall Foreign Loss Account Balances

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule j

Edit your schedule j form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule j form via URL. You can also download, print, or export forms to your preferred cloud storage service.

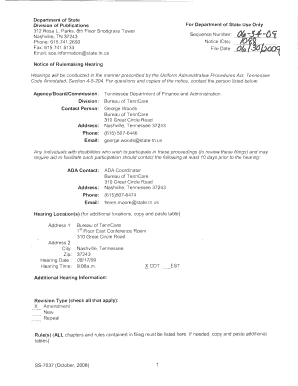

How to edit schedule j online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedule j. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule j

How to fill out Schedule J

01

Start by gathering your income information.

02

List all the expenses related to the care of dependents.

03

Fill in the names and ages of dependents in the designated sections.

04

Include all relevant medical expenses and childcare costs.

05

Ensure you have documentation for all expenses reported.

06

Review your entries for accuracy before submitting the form.

Who needs Schedule J?

01

Individuals filing for bankruptcy who have dependents.

02

Those who need to report expenses specifically for dependents when completing their bankruptcy schedules.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax code J?

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in ROTH IRA Contributions.

Who qualifies for Schedule J?

In order to qualify for this election, you aren't required to have been in the business of farming or fishing during any of the base years. You may elect to average farming or fishing income even if your filing status wasn't the same in the election year and the base years.

What is a Schedule J?

Schedule J (Form 1040) provides a valuable option for farmers and fishermen to level out their income and manage their tax liabilities effectively. By averaging income over a three-year period, eligible individuals can benefit from lower tax rates and improved financial stability.

What does j mean in taxes?

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in ROTH IRA Contributions.

What does J filing status mean?

Married Filing Jointly filing status You are married and both you and your spouse agree to file a joint return. (On a joint return, you report your combined income and deduct your combined allowable expenses.)

Who must be reported on Schedule J?

Schedule J (Form 990) is used by an organization that files Form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization.

What is J on federal income tax?

When it comes to taxation, the Internal Revenue Service (IRS) offers various provisions and forms to ensure fairness and flexibility for different professions. One such provision is Schedule J (Form 1040), which provides income averaging specifically for farmers and fishermen.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule J?

Schedule J is a form used by certain taxpayers to report income from farming, fishing, and other types of businesses, detailing how income and expenses are allocated.

Who is required to file Schedule J?

Farmers and fishermen who report their income on a cash basis and have income that fluctuates significantly may be required to file Schedule J.

How to fill out Schedule J?

To fill out Schedule J, taxpayers must provide information about their income, expenses, and other relevant financial details, following the instructions provided by the IRS.

What is the purpose of Schedule J?

The purpose of Schedule J is to help taxpayers average their income over multiple years to smooth out fluctuations in income and manage tax liabilities more effectively.

What information must be reported on Schedule J?

Taxpayers must report information including their gross income, deductible expenses, the average income calculation, and other pertinent financial data related to the farming or fishing activities.

Fill out your schedule j online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule J is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.