Get the free Business Expense Policy

Show details

This document outlines the Business Expense Policy for the Metropolitan Washington Airports Authority, providing guidance on allowable and non-allowable business expenses, approval processes, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business expense policy

Edit your business expense policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business expense policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business expense policy online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business expense policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

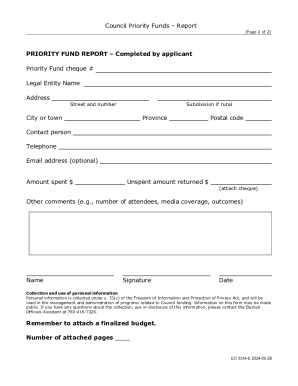

How to fill out business expense policy

How to fill out Business Expense Policy

01

Read the Business Expense Policy document thoroughly to understand the guidelines.

02

Gather all necessary receipts and documentation for the expenses you wish to claim.

03

Fill out the designated expense report form accurately, ensuring all fields are completed.

04

Categorize each expense according to the policy categories (e.g., travel, meals, lodging).

05

Specify the purpose of each expense and how it relates to business activities.

06

Total all eligible expenses and ensure it aligns with company limits and guidelines.

07

Submit the completed expense report along with receipts to your manager for approval.

08

Follow up on the status of your claim to ensure timely reimbursement.

Who needs Business Expense Policy?

01

Employees who incur business-related expenses while performing their job duties.

02

Management personnel who oversee budget and financial compliance.

03

Finance and accounting teams responsible for processing expense reports.

04

New hires who require guidance on company policies regarding business expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is an expense policy?

An expense policy is a document that outlines how your company handles business expenses incurred by your employees.

What is a business expense reimbursement policy?

An Expense Reimbursement Policy is a formal document created by a company that outlines the specific rules, procedures, and guidelines for employees seeking reimbursement for business-related expenses they have paid for out-of-pocket.

What is an example of a reimbursement policy?

It is the policy of [OrganizationName] to reimburse only reasonable and necessary expenses actually incurred by Personnel. When incurring business expenses, [OrganizationName] expects Personnel to: Exercise discretion and good business judgment with respect to those expenses.

How to write an expenses policy?

Crafting Your Expenses Policy: A Step-by-Step Guide Define Expense Categories & Types. Set Clear Guidelines for Allowable & Non-Allowable Expenses. Establish a Clear Process for Expense Approval & Reimbursement. Detail the Requirements for Documentation & Receipt Management. Policy Introduction. Scope and Applicability.

What is the office expense policy?

An expense policy sets clear boundaries on what employees can spend and how much they can spend. This helps businesses to budget effectively, track expenditures, and prevent excessive or unnecessary spending, ensuring that financial resources are used responsibly.

What is the T&E policy?

What is T&E? Travel and expense, or travel and entertainment, are any employee's spending while traveling for work (a business trip) or entertaining a client. T&E expenses include travel costs, fees for renting meeting spaces, accommodation, business meals, overseas phone charges, and more.

What are expense policies?

An expenses policy is a written statement from a company that expresses which types of expenses it covers and which may be the responsibility of an employee. The policy also explains which types of expenses are reimbursable and includes the reasoning behind the management team's decision.

How to write an expense policy?

How to create an expense policy Step 1: Identify and Assemble Key Stakeholders. Step 2: Define Expense Categories. Step 3: Set Budgets and Parameters for Each Category. Step 4: Determine Reimbursement Procedures. Step 5: Determine Employee Responsibility and Compliance. Step 6: Address Expenses that Aren't Covered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Expense Policy?

A Business Expense Policy is a set of guidelines that outline the types of expenses that can be reimbursed or compensated by a company, as well as the procedures for submitting expense claims.

Who is required to file Business Expense Policy?

Employees who incur business-related expenses while performing their job duties are typically required to file under the Business Expense Policy.

How to fill out Business Expense Policy?

To fill out a Business Expense Policy, employees should gather receipts, complete the expense report form, categorize each expense, provide necessary documentation, and submit the form to the appropriate department for approval.

What is the purpose of Business Expense Policy?

The purpose of the Business Expense Policy is to ensure consistency, fairness, and compliance in the reimbursement of business expenses, as well as to help in budgeting and financial planning.

What information must be reported on Business Expense Policy?

The information that must be reported includes the date of the expense, the amount spent, the purpose of the expense, the category of the expense, and any supporting documentation, such as receipts.

Fill out your business expense policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Expense Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.