Get the free Form 4563

Show details

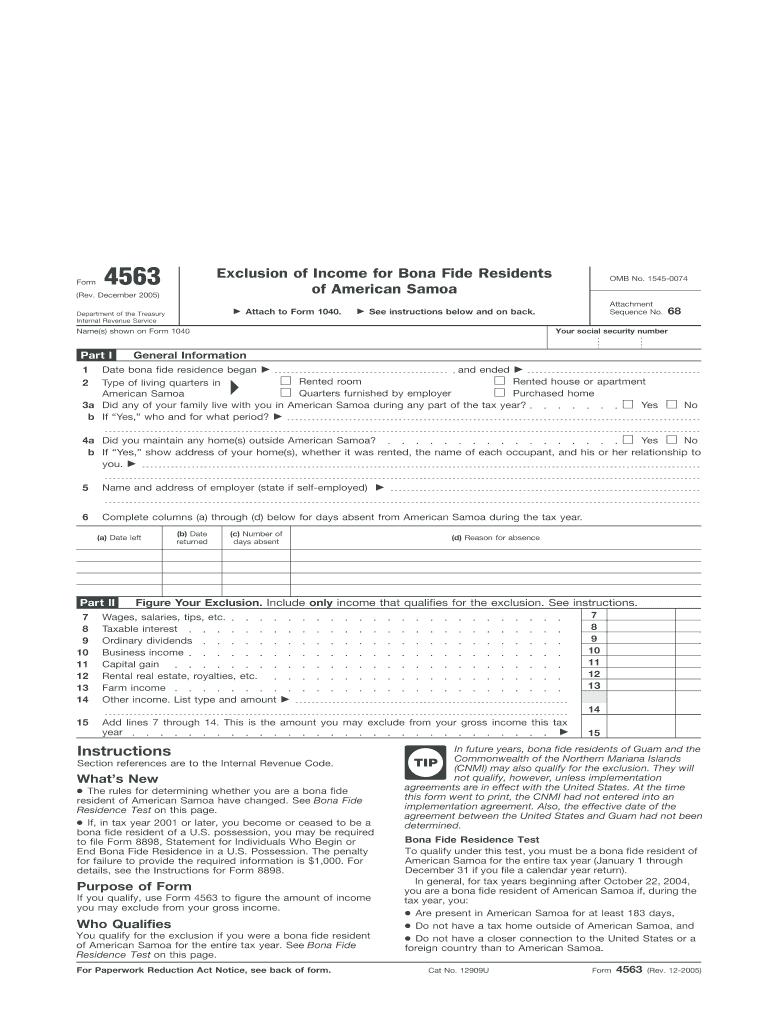

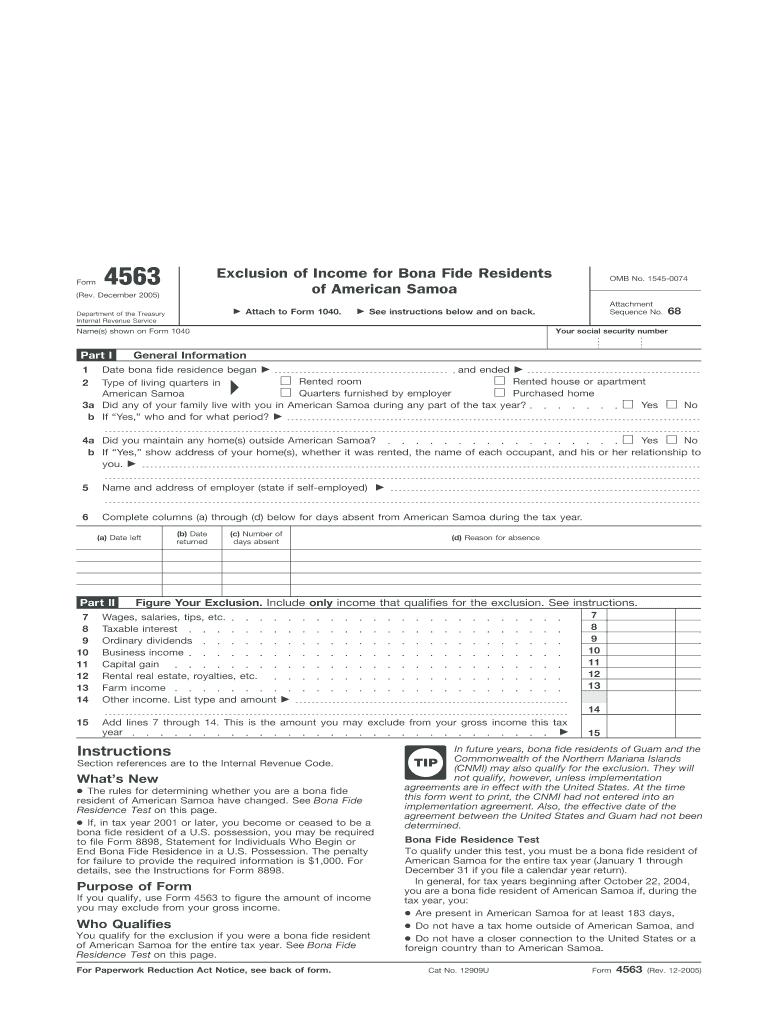

This form is used to figure the amount of income that bona fide residents of American Samoa may exclude from their gross income for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 4563

Edit your form 4563 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4563 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 4563 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 4563. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 4563

How to fill out Form 4563

01

Obtain Form 4563 from the IRS website or your local tax office.

02

Read the instructions accompanying the form carefully.

03

Enter your name and social security number at the top of the form.

04

Indicate your residency status for the tax year in question.

05

Fill in the necessary information regarding your sources of income.

06

Complete any additional sections that apply to your situation.

07

Review your entries for accuracy.

08

Sign and date the form before submission.

Who needs Form 4563?

01

Individuals who are claiming exemption from U.S. tax on foreign earned income.

02

U.S. citizens and resident aliens living abroad.

03

Taxpayers who meet certain qualifications under the Foreign Earned Income Exclusion.

Fill

form

: Try Risk Free

People Also Ask about

What is a common reason for filing a 1040x?

Form 1040-X, Amended U.S. Individual Income Tax Return, should be filed by taxpayers who need to make corrections or changes to their previously filed income tax return. Common reasons to file an amended return include changes in filing status, dependents, income, deductions, or credits.

What is the purpose of the form 1065?

Form 1065: U.S. Return of Partnership Income is a tax document issued by the IRS used to declare the profits, losses, deductions, and credits of a business partnership.

When should I file a 1040x?

To avoid delays, file Form 1040-X only after you've filed your original return. Generally, for a credit or refund, you must file Form 1040-X within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later.

What is the purpose of the 1040X form?

Use Form 1040-X to correct a previously filed Form 1040, 1040-SR, or 1040-NR, or to change amounts previously adjusted by the IRS. You can also use Form 1040-X to make a claim for a carryback due to a loss or unused credit or make certain elections after the deadline.

What IRS forms are needed for rental property?

Report your rental income and expenses on Part I, Income or Loss From Rental Real Estate Royalties on Supplemental Income and Loss, Schedule E (IRS Form 1040) .

What is the purpose of form 4563?

Form 4563 determines the amount of income earned in American Samoa that can be excluded from a taxpayer's gross income. If a taxpayer earns income from outside and inside American Samoa, all wages, salaries, or tips from outside are not included in Form 4563.

Does filing a 1040x trigger an audit?

Submitting an amended tax return does not inherently raise red flags, but it does prompt the IRS to take a second look at your filing. The IRS receives thousands of Form 1040-X submissions each year, and most are processed without issue.

What is the 1040x tax form used for?

An amended return captures all the original information when you first filed but includes anything you needed to change. To get those new details to the Internal Revenue Service (IRS), you'll use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 4563?

Form 4563 is used by individuals to report the income of U.S. citizens and residents who are non-resident aliens for tax purposes.

Who is required to file Form 4563?

Individuals who are U.S. citizens or residents and have foreign income or are claiming exemptions under certain tax treaties must file Form 4563.

How to fill out Form 4563?

To fill out Form 4563, provide personal information, report foreign income, and claim any applicable tax treaties. Make sure to follow the instructions provided for accurate reporting.

What is the purpose of Form 4563?

The purpose of Form 4563 is to allow taxpayers to report foreign income and claim any exemptions available under tax treaties to ensure correct tax obligations.

What information must be reported on Form 4563?

Form 4563 requires the reporting of personal identification details, income sources, amounts earned from foreign sources, and any deductions or credits you wish to claim based on tax treaties.

Fill out your form 4563 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4563 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.