Get the free Putnam County Business Tax Receipt

Show details

This document serves as an application for obtaining a local Business Tax Receipt in Putnam County, Florida, along with necessary information regarding the business and exemptions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign putnam county business tax

Edit your putnam county business tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your putnam county business tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit putnam county business tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit putnam county business tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

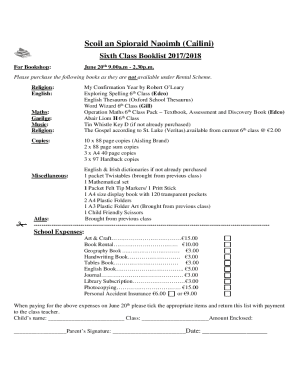

How to fill out putnam county business tax

How to fill out Putnam County Business Tax Receipt

01

Obtain the Putnam County Business Tax Receipt application form from the county website or local government office.

02

Fill in your business name, address, and contact information accurately.

03

Select the type of business entity (sole proprietorship, partnership, corporation, etc.) you are registering.

04

Provide details about your business activities and expected hours of operation.

05

Include any required licenses or permits that you already possess or are applying for.

06

Attach any necessary documentation such as identification or proof of business location.

07

Calculate the appropriate fee based on your business type and size as specified by the county.

08

Submit the completed application along with payment to the appropriate county office, either in person or via mail.

Who needs Putnam County Business Tax Receipt?

01

Any individual or entity operating a business within Putnam County requiring official recognition.

02

New entrepreneurs starting a business in Putnam County.

03

Existing businesses that need to renew their business tax receipts annually.

04

Businesses that require specific licenses or permits in compliance with local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Florida local business tax receipt?

Local Business Tax Receipts What is a local business tax receipt? The method by which the City Council grants the privilege of engaging in or managing any business, profession or occupation within its jurisdiction.

What is the sales tax in Putnam County Florida?

Putnam County sales tax details The minimum combined 2025 sales tax rate for Putnam County, Florida is 7.0%. This is the total of state, county, and city sales tax rates. The Florida sales tax rate is currently 6.0%.

How much is the local business tax?

Local business Tax Rates With gross sales or receipts for the preceding calendar year in the amount of:Amount of Tax Per Annum Less than Php10,000 Php165 Php10,000-Php14,999 Php220 Php15,000 -Php19,999 Php202 Php20,000-Php29,999 Php44016 more rows

What is the purpose of a local business tax receipt?

The Local Business Tax Receipt grants the privilege of engaging in or managing a business. Issuance of a Flagler County Business Tax Receipt does not confirm current compliance with any city, county, state or federal requirements that must be met in conjunction with operating your business.

Do small businesses pay local taxes?

The two most common types of state and local tax requirements for small business are income taxes and employment taxes.

Why do I need a local business tax receipt?

A Local Business Tax Receipt is required for each location you operate your business from, and one for each category of business you conduct. When you pay a Local Business Tax, you receive a Local Business Tax Receipt, which is valid for one year, from October 1 through September 30.

Is a business tax receipt the same as a business license in Florida?

A BTR is a tax for the privilege of engaging in or managing a business, profession, or occupation within the town limits. (The Florida Legislature enacted legislation which amended references to Occupational License. On January 1, 2007, the term “Occupational License was amended to read “Business Tax Receipt”.)

What is Putnam County sales tax?

A county sales tax is a common surcharge on retail sales that is collected from residents and non-residents who make purchases in Putnam County. Putnam County's is currently set at 8 3/8%, which includes the state share of the sales tax (4%), the current county share (4%), and an added MTA tax (3/8).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Putnam County Business Tax Receipt?

The Putnam County Business Tax Receipt is a permit that businesses must obtain to legally operate within Putnam County, providing local government a record of all business activities.

Who is required to file Putnam County Business Tax Receipt?

All businesses operating within Putnam County, including sole proprietors, partnerships, corporations, and non-profits, are required to file for a Business Tax Receipt.

How to fill out Putnam County Business Tax Receipt?

To fill out the Putnam County Business Tax Receipt, businesses must complete the application form available from the county’s business services, providing details such as business name, type, ownership information, and physical address.

What is the purpose of Putnam County Business Tax Receipt?

The purpose of the Putnam County Business Tax Receipt is to regulate and monitor local businesses, ensuring compliance with local ordinances and collecting applicable taxes.

What information must be reported on Putnam County Business Tax Receipt?

The information that must be reported on the Putnam County Business Tax Receipt includes business name, owner’s name, business address, type of business, and any other relevant identification numbers.

Fill out your putnam county business tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Putnam County Business Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.