Get the free 2012 TAX DEDUCTION FINDER

Show details

This document is designed to help individuals gather relevant financial information and documents needed for tax preparation and to identify potential tax deductions for the 2012 tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 tax deduction finder

Edit your 2012 tax deduction finder form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 tax deduction finder form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 tax deduction finder online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 tax deduction finder. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 tax deduction finder

How to fill out 2012 TAX DEDUCTION FINDER

01

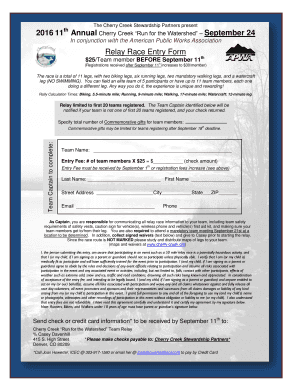

Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses.

02

Access the 2012 TAX DEDUCTION FINDER template or online tool.

03

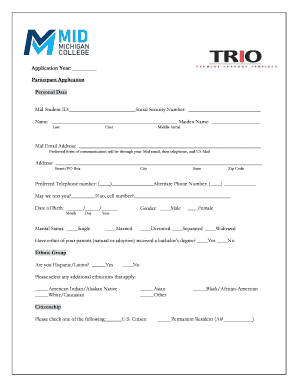

Begin filling out your personal information, such as name, address, and social security number.

04

List your income sources as indicated, ensuring all amounts are correct.

05

Proceed to the deductions section and input your qualifying expenses, like mortgage interest, medical expenses, and charitable donations.

06

Review the deduction eligibility criteria provided in the finder to ensure you meet them.

07

Calculate the total deductions using the tool's functionality.

08

Follow any additional instructions for e-filing or print out your completed finder for your records.

Who needs 2012 TAX DEDUCTION FINDER?

01

Individuals filing taxes for the year 2012.

02

Taxpayers looking for potential deductions to reduce their tax liability.

03

Those who have significant deductible expenses related to work, education, or health.

04

Accountants and tax professionals assisting clients with their 2012 tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What was the standard deduction before 2017?

The 2017 Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for taxpayers who are married filing jointly. The amount was indexed to inflation for future years.

What is the most overlooked tax break?

The 10 Most Overlooked Tax Deductions State sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC) State tax you paid last spring.

What is the most frequently overlooked tax deduction?

In order to maximize the credits and deductions to which you are entitled, here is a quick list for you to keep in mind this tax season. STATE SALES TAX. OUT-OF-POCKET CHARITABLE CONTRIBUTIONS. STUDENT LOAN INTEREST PAID BY MOM AND DAD. AMERICAN OPPORTUNITY CREDIT. COLLEGE CREDIT FOR THOSE LONG GRADUATED FROM COLLEGE.

What are the biggest tax mistakes people make?

Avoid These Common Tax Mistakes Credits. Deductions. Not Being Aware of Tax Considerations for the Military. Not Keeping Up with Your Paperwork. Not Double Checking Your Forms for Errors. Not Adhering to Filing Deadlines or Not Filing at All. Not Fixing Past Mistakes. Not Planning for Next Year.

What is the best tax break?

25 popular tax deductions and tax breaks Home office deduction. Educator expenses deduction. Electric vehicle tax credit (limited) Home energy tax credits (limited) Senior bonus deduction. Car loan interest deduction. Tip income deduction. Overtime pay deduction.

What is a tax deduction?

A deduction is an amount you subtract from your income when you file so you don't pay tax on it. By lowering your income, deductions lower your tax. You need documents to show expenses or losses you want to deduct. Your tax software will calculate deductions for you and enter them in the right forms.

What deduction can I claim without receipts?

While receipts are the easiest record to keep, there are some scenarios in which you can take tax deductions without them. Tax deductions you can claim without a receipt. Home office expenses. Eligible retirement plan contributions. Health insurance premiums. Self-employment taxes. Cell phone expenses.

What is the most you can claim without receipts?

Use caution when claiming on tax without receipts If you don't have much in the way of deductible claims to make on your tax, you should not automatically claim an amount up to the $300 limit just because you can. The same applies for the $150 limit for laundry and the small expenses limit of $200.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 TAX DEDUCTION FINDER?

The 2012 Tax Deduction Finder is a tool designed to help individuals identify potential tax deductions they are eligible for in the 2012 tax year.

Who is required to file 2012 TAX DEDUCTION FINDER?

Any taxpayer who is filing a tax return for the 2012 tax year and wishes to maximize their deductions may utilize the 2012 Tax Deduction Finder.

How to fill out 2012 TAX DEDUCTION FINDER?

To fill out the 2012 Tax Deduction Finder, users should gather relevant financial documents, input required data such as income, expenses, and any qualifying deductions, and follow the provided prompts to complete the finder.

What is the purpose of 2012 TAX DEDUCTION FINDER?

The purpose of the 2012 Tax Deduction Finder is to assist taxpayers in identifying and documenting eligible deductions to potentially lower their tax liability for the 2012 tax year.

What information must be reported on 2012 TAX DEDUCTION FINDER?

Reportable information on the 2012 Tax Deduction Finder includes income details, types of expenses, specific deductions being claimed, and any relevant personal information that may affect eligibility for deductions.

Fill out your 2012 tax deduction finder online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Tax Deduction Finder is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.