Get the free NONCASH CONTRIBUTIONS

Show details

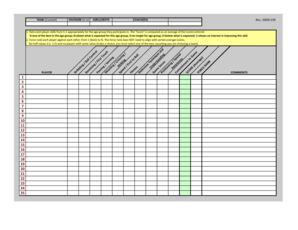

This document provides a guide for taxpayers on how to deduct the fair market value of noncash contributions made to charity, including guidelines on item condition, documentation needed, and suggested

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign noncash contributions

Edit your noncash contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your noncash contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit noncash contributions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit noncash contributions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out noncash contributions

How to fill out NONCASH CONTRIBUTIONS

01

Gather all necessary documentation for noncash contributions.

02

Identify each item being contributed and assign a fair market value to it.

03

Complete the appropriate forms, ensuring to list each noncash contribution separately.

04

Include the date of the contribution and the method of delivery.

05

Obtain a receipt or acknowledgment letter from the recipient organization for your records.

06

Review the completed forms for accuracy before submission.

Who needs NONCASH CONTRIBUTIONS?

01

Individuals who wish to claim tax deductions for noncash donations.

02

Organizations that receive noncash donations and need to document them.

03

Tax professionals assisting clients with tax filings involving noncash contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum non-cash donation without appraisal?

FMV is the price the item would sell for on the open market. For noncash contributions over $500, donors must complete IRS Form 8283 and attach it to their tax return. If the donation exceeds $5,000, an independent appraisal is generally required to substantiate the deduction.

What contributions are not deductible?

If you itemize, any non-cash contributions you make – such as clothes, food or household goods – are also subject to the new 0.5%-of-AGI floor. If you're taking the standard deduction, you won't be able to deduct your non-cash contributions since the $1,000/$2,000 limit for non-itemizers applies only to cash gifts.

What is an example of a non-cash contribution?

Keeping good records is what will always win, in case of an audit. This week we will discuss non-cash contributions. Non-cash items are furniture, clothing, home appliances, sporting goods, artwork and any item you contribute other than cash, checks, or by credit card.

How to record non-cash contributions?

If acknowledgements are not sent shortly after a gift, they typically are provided by January 31 of the following year. If a donor wants to claim a deduction for a non-cash contribution valued at more than $500, the donor must file IRS Form 8283 with his or her tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NONCASH CONTRIBUTIONS?

Noncash contributions refer to donations of goods or services rather than money. These contributions can include items like clothing, furniture, or professional services that are not given in cash.

Who is required to file NONCASH CONTRIBUTIONS?

Individuals and organizations that make noncash contributions valued above a certain threshold are generally required to report those contributions on their tax returns. This typically includes charities and non-profit entities.

How to fill out NONCASH CONTRIBUTIONS?

To fill out noncash contributions, individuals must complete Form 8283 for contributions valued over $500, detailing each item, its value, and obtaining necessary appraisals for high-value items.

What is the purpose of NONCASH CONTRIBUTIONS?

The purpose of reporting noncash contributions is to provide transparency and ensure that the value of donations is accurately accounted for in tax filings, which can help maintain the integrity of charitable contributions for tax purposes.

What information must be reported on NONCASH CONTRIBUTIONS?

When reporting noncash contributions, individuals must provide information such as the description of the property, its fair market value, the date of the contribution, and any appraisals or supporting documentation.

Fill out your noncash contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Noncash Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.