Get the free Schedule C (Form 5713)

Show details

Este formulario es utilizado para calcular la pérdida de beneficios fiscales atribuibles a la participación en o cooperación con un boicot internacional.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule c form 5713

Edit your schedule c form 5713 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c form 5713 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule c form 5713 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule c form 5713. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c form 5713

How to fill out Schedule C (Form 5713)

01

Obtain Schedule C (Form 5713) from the IRS website or the appropriate tax authority.

02

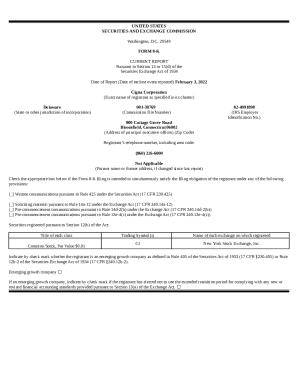

Enter your name, address, and taxpayer identification number at the top of the form.

03

Fill out Part I to report your income from self-employment or business activities.

04

Move to Part II and list your business expenses. Ensure you have all receipts and documentation ready.

05

Complete the additional parts as applicable, such as Part III for information on your business vehicle.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the designated locations.

08

Submit the completed Schedule C along with your main tax return.

Who needs Schedule C (Form 5713)?

01

Self-employed individuals or sole proprietors who need to report their business income and expenses.

02

Individuals who are engaged in activities that qualify as a business for tax purposes.

03

Taxpayers who have received income from freelancing, consulting, or other self-employment activities.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 5713 used for?

U.S. persons file Form 5713 to report: Operations in or related to boycotting countries.

What is a Schedule C form 5713?

What is Form 5713 (Schedule C)? Schedule C (Form 5713) is used to compute the loss of tax benefits attributable to participation in or cooperation with an international boycott.

Where can I download Schedule C?

You can find and download all versions of Schedule C on the IRS website. You can also use H&R Block Online, to access Schedule C and complete your tax return. Or if you work with a tax preparer, they will help you access and complete Schedule C.

How can I get a copy of my schedule C online?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

Does Form 5713 need to be signed?

Form 5713 is due when your income tax return is due, including extensions. Attach the original copy of the Form 5713 (and Schedules A, B, and C, if applicable) to your income tax return. Do not sign the copy that is attached to your income tax return.

Can I file a schedule C myself?

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs.

Who is required to file form 5713?

The receipt of boycott requests and boycott agreements made. You must file Form 5713 if you are a U.S. person (defined in section 7701(a)(30)) that has operations (defined later) in or related to a boycotting country, or with the government, a company, or a national of a boycotting country.

Where can I download a Schedule C form?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

Who fills out a schedule C form?

Schedule C is typically for people who operate sole proprietorships or single-member LLCs. A Schedule C is not the same as a 1099 form. Although, you may need IRS Form 1099 (a 1099-NEC or 1099-K in particular) to fill out a Schedule C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule C (Form 5713)?

Schedule C (Form 5713) is a supplemental form used by U.S. taxpayers to report income from certain foreign sales, ensuring compliance with the Foreign Sales Corporation (FSC) rules.

Who is required to file Schedule C (Form 5713)?

Taxpayers who claim benefits under the Foreign Sales Corporation provisions must file Schedule C (Form 5713), typically including businesses engaged in exporting goods.

How to fill out Schedule C (Form 5713)?

To fill out Schedule C (Form 5713), taxpayers need to provide details regarding foreign sales, income allocations, and expenses related to the foreign trade activities as specified in the form instructions.

What is the purpose of Schedule C (Form 5713)?

The purpose of Schedule C (Form 5713) is to allow taxpayers to report income derived from foreign sales and to claim any applicable deductions or credits under the Foreign Sales Corporation rules.

What information must be reported on Schedule C (Form 5713)?

Schedule C (Form 5713) requires reporting of gross receipts from foreign sales, related deductions, details of qualified foreign trade income, and any expenses related to the foreign trade activities.

Fill out your schedule c form 5713 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule C Form 5713 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.