Get the free Occupational License Tax Application

Show details

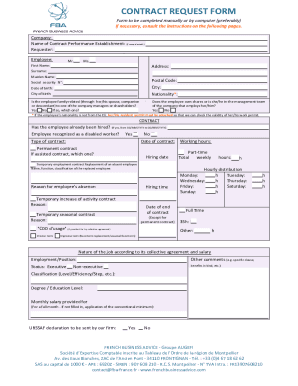

This document is an application for obtaining an occupational license in Charlotte County, detailing required information and certifications for businesses operating in the area.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational license tax application

Edit your occupational license tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational license tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occupational license tax application online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit occupational license tax application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational license tax application

How to fill out Occupational License Tax Application

01

Obtain the Occupational License Tax Application form from your local government office or website.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide details about your business type and structure (e.g., sole proprietorship, partnership, corporation).

04

Specify the nature of your business activities.

05

Indicate the location of your business operations.

06

Fill out the appropriate section regarding estimated revenues and employees.

07

Attach any necessary documentation, such as proof of insurance or zoning approval.

08

Review the application for accuracy and completeness.

09

Submit the application along with the required fees to the designated government office.

Who needs Occupational License Tax Application?

01

Individuals or businesses operating within a jurisdiction that requires a license to conduct business activities.

02

New business owners starting their ventures.

03

Existing businesses applying for renewal or modifications to their licenses.

04

Professionals offering services that require regulation or licensing.

Fill

form

: Try Risk Free

People Also Ask about

What is the business professional and occupational license tax in Virginia?

The Virginia Business Professional and Occupational License (BPOL) is a local level tax levied on businesses' gross receipts. Rates typically range from $0.03 to $0.58 per $100 of gross receipts, depending on the locality and industry classification.

Can you operate a business in Georgia without a license?

Keep in mind, almost every business also needs a city or county business license, and some types of businesses must obtain licenses from the federal government to operate, while other businesses, occupations, and professions are licensed and regulated by the state.

What is the city of Atlanta professional occupational tax?

For each class, of the eight classes, the tax is $50.00 for any amount of gross receipts up to $10,000. Then, depending on the business' class, the tax rate is $0.60 to $2.15, per-$1,000 of gross receipts over $10,000. In addition to the tax, the City of Atlanta imposes a $75 administrative fee.

How to get a business license in Alexandria, VA?

Obtaining a business license in Alexandria is generally a three-step process: Step 1: Registration of the business entity. 866.722.2551 or 804.371.9733. Step 2: Apply for an Employer Identification Number (EIN) Step 3: Submit the Completed Application with Your Tax Payment and all Necessary Approvals and Documentation.

Do I need a Seattle business license?

Anyone doing business in Seattle must have a Seattle business license tax certificate, also known as a business license or general business license. In addition to obtaining a business license tax certificate, business owners must renew this certificate each year by Dec. 31.

What type of business license do I need in Georgia?

While many Georgia businesses are required to register with the Corporations Division, businesses often need local operating licenses, federal operating licenses depending on the business, and/or state-level professional licenses. In certain cases, employees may need to be individually licensed as well.

Do I need a business license in GA to sell online?

If you want to sell a service or product, whether within Georgia or out of state, you'll need a sales tax permit. This is also true of an online business. Turning your home into a child care center or a family child learning home requires specific licenses at both the state and local levels.

What is a GA occupational tax certificate?

An Occupational Tax Certificate (also known as a business license) is a certificate issued by government agencies. The certificate is evidence that an individual or company has paid an occupation tax as required by the local ordinance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Occupational License Tax Application?

The Occupational License Tax Application is a form that businesses must file to obtain a license to operate legally within a specific jurisdiction. It outlines the type of business, its location, and other relevant information.

Who is required to file Occupational License Tax Application?

Typically, any individual or business that is engaged in a trade, profession, or occupation within the jurisdiction that imposes the tax is required to file an Occupational License Tax Application.

How to fill out Occupational License Tax Application?

To fill out the Occupational License Tax Application, you need to provide details such as your business name, address, type of business, and owner information, and then submit it along with any required fees to the relevant local authority.

What is the purpose of Occupational License Tax Application?

The purpose of the Occupational License Tax Application is to ensure that businesses comply with local regulations and taxation requirements, thereby allowing cities and counties to generate revenue for public services.

What information must be reported on Occupational License Tax Application?

The information that must be reported typically includes the business name, physical address, nature of the business, owner's personal information, estimated revenue, and any required tax identification numbers.

Fill out your occupational license tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational License Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.