Get the free CREDIT LIFE POLICY CHECKLIST

Show details

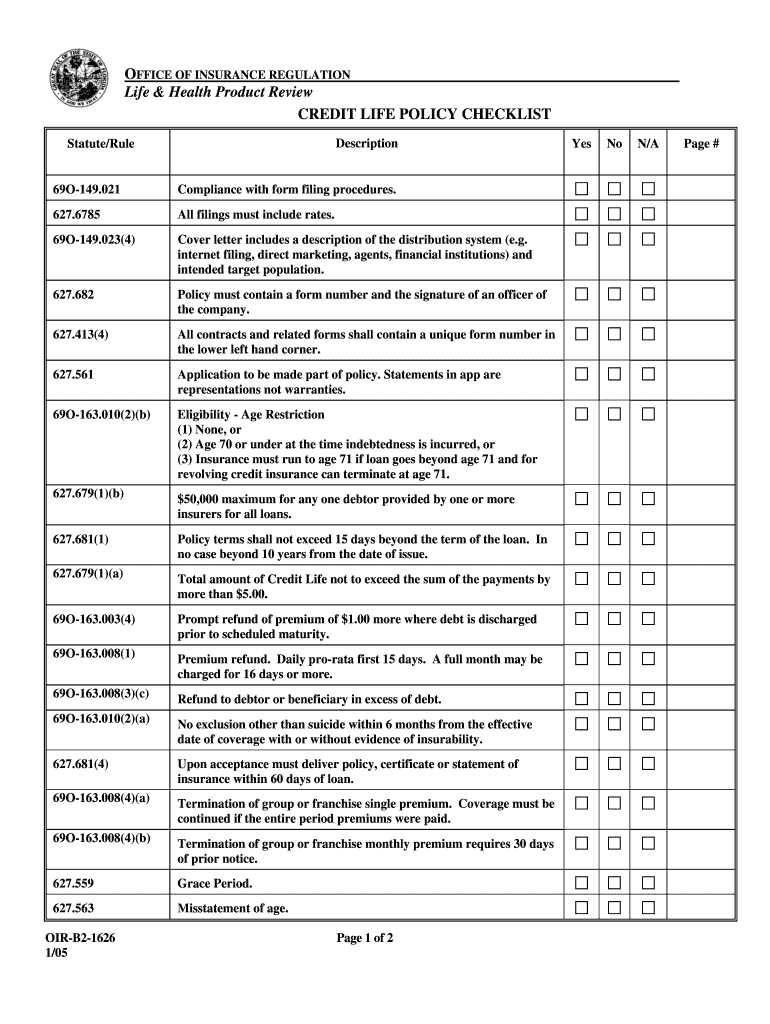

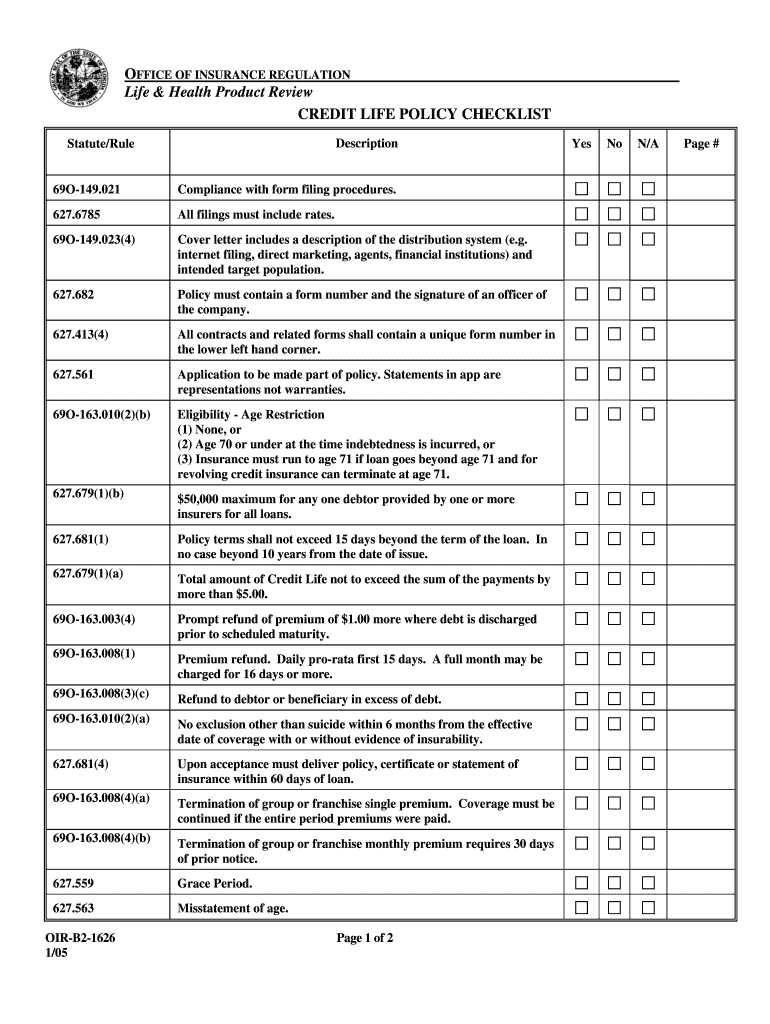

This document serves as a checklist for compliance with various statutes and rules regarding Credit Life Policies, providing guidelines on required elements and conditions for filings.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit life policy checklist

Edit your credit life policy checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit life policy checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit life policy checklist online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit life policy checklist. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit life policy checklist

How to fill out CREDIT LIFE POLICY CHECKLIST

01

Begin by gathering all necessary personal information, such as your name, address, and contact details.

02

Identify the loans or debts that the credit life policy will cover, including the type of loan and outstanding balance.

03

Review the terms and conditions of each loan to determine the coverage amount needed.

04

Fill out the policy checklist by inputting relevant details regarding the insured parties, loan information, and coverage amounts.

05

Double-check all entered information for accuracy to ensure that it reflects your financial obligations correctly.

06

Submit the completed checklist to your insurance provider for review and to obtain the credit life policy.

Who needs CREDIT LIFE POLICY CHECKLIST?

01

Individuals who have outstanding debts or loans, such as mortgages, car loans, or personal loans, and want to ensure their debts are paid off in the event of their death.

02

Families that seek financial security and peace of mind knowing that their loved ones will not be burdened with debt.

03

Borrowers who are required by lenders to secure life insurance as part of their loan agreement.

Fill

form

: Try Risk Free

People Also Ask about

What is a credit life policy?

Credit life insurance is a policy that covers specific debts after an event that ends your ability to earn an income.

What is a credit insurance policy?

Credit insurance is a policy of insurance purchased by a borrower to protect their lender from loss that may result from the borrower's insolvency, disability, death, or unemployment.

How to use life insurance for credit?

Determine how much you can borrow: You can generally borrow up to 90% of the cash value of your policy. Request a loan from your life insurance company: The policy provides complete collateral for your loan, so there's no need for credit approval, and you can request a loan for any reason.

What is the maximum credit life insurance allowed in terms of the regulations?

Thankfully, the new regulations ensure that “a monthly credit insurance limit of R4. 50 for each R1,000 owed on all credit agreements except mortgages. Ordinary mortgage agreements have a R2 limit for each R1,000 owed.

What is a credit life insurance policy?

Credit life insurance is a specialized life insurance policy designed to pay off large loans, such as a mortgage, if the policyholder dies. You buy credit life insurance through your lender, and payouts of the insurance policy are made directly to the lender.

What is the difference between life insurance and credit life insurance?

Unlike regular life insurance, which can be used for any purpose, credit life insurance is specifically tied to a loan. The payout goes directly to the lender to cover the outstanding debt.

What is a credit policy?

A credit policy contains the guidelines for granting credit to customers. The policy plays a crucial role in managing credit risk and ensuring a business receives payments on time. Businesses create credit policies to protect themselves from potential financial losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT LIFE POLICY CHECKLIST?

The CREDIT LIFE POLICY CHECKLIST is a document used to outline the necessary information and requirements related to credit life insurance policies, ensuring that all relevant details are considered and documented.

Who is required to file CREDIT LIFE POLICY CHECKLIST?

Lenders, insurance companies, and financial institutions that offer credit life insurance to borrowers are generally required to file the CREDIT LIFE POLICY CHECKLIST.

How to fill out CREDIT LIFE POLICY CHECKLIST?

To fill out the CREDIT LIFE POLICY CHECKLIST, one should gather all relevant policy information, complete each section with accurate details regarding the insured, the loan, and coverage, and ensure to review for completeness and compliance with regulations.

What is the purpose of CREDIT LIFE POLICY CHECKLIST?

The purpose of the CREDIT LIFE POLICY CHECKLIST is to ensure that all necessary information regarding a credit life insurance policy is documented, facilitating compliance, and providing a thorough review process for lenders and insurers.

What information must be reported on CREDIT LIFE POLICY CHECKLIST?

The CREDIT LIFE POLICY CHECKLIST must include information such as the borrower's details, loan amount, policy coverage details, terms of the insurance, premium costs, and any exclusions or limitations applicable to the policy.

Fill out your credit life policy checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Life Policy Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.