Get the free The Wealth Management Outlook

Show details

El mercado de gestión de patrimonio está creciendo a un ritmo fenomenal, con una riqueza total invertible en algunos países europeos actualmente en la región de más de 10,000 millones de libras.

We are not affiliated with any brand or entity on this form

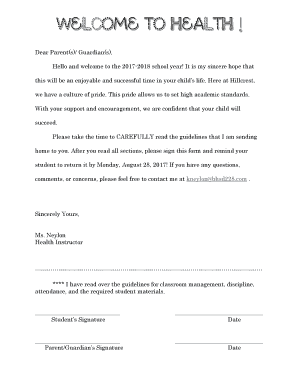

Get, Create, Make and Sign form wealth management outlook

Edit your form wealth management outlook form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form wealth management outlook form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form wealth management outlook online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form wealth management outlook. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form wealth management outlook

How to fill out The Wealth Management Outlook

01

Gather all relevant financial documents, including income statements, tax returns, and investment portfolios.

02

Identify your financial goals, such as retirement planning, wealth preservation, or growth.

03

Analyze your current financial situation to understand your net worth and cash flow.

04

Research market trends and economic forecasts that may affect your investment strategies.

05

Fill out each section of The Wealth Management Outlook, providing detailed information on assets, liabilities, and personal objectives.

06

Review your completed outlook to ensure accuracy and completeness.

07

Submit your Wealth Management Outlook to your financial advisor for a thorough review.

Who needs The Wealth Management Outlook?

01

Individuals seeking to create a comprehensive financial plan for the future.

02

Investors looking to assess their current financial position and make informed investment decisions.

03

Financial advisors who need a structured format to evaluate client portfolios and strategies.

04

Anyone interested in understanding market trends and how they can impact personal finances.

Fill

form

: Try Risk Free

People Also Ask about

What is wam in ey?

Wealth & Asset Management. We help investment firms anticipate what's after what's next. Wealth and asset managers are experiencing a time of exponential change.

What is rank 32 in EY?

EY grade/level: Manager (Rank 32) Specific duties/responsibilities: • Collaborating with the operations lead in daily activities such as project management, resolution of escalations, and payroll governance.

What are the 5 steps of wealth management?

Master Your Money: 5 Key Pillars of Smart Wealth Management Financial planning: Your wealth roadmap. Asset allocation: Balance risk and reward. Estate Planning: Pass it on, the smart way. Tax accounting: Keep more of what you earn. Asset management: Let the pros handle it.

What is wealth management in English?

It is a comprehensive process and service that encompasses several facets of financial services, like asset management, tax planning, accounting, investment optimisation, and risk management, to name a few. Strategic wealth management often goes beyond these to cater to clients' unique financial requirements and goals.

Which country is best for wealth management?

Best Countries For Asset Management Cyprus. Cyprus offers a great entry into the EU for offshore wealth management. Singapore. Singapore is one of the largest and most popular offshore financial centers in the world. Luxembourg. Gibraltar. United Arab Emirates.

What are the four divisions of EY?

Assurance. Consulting. Strategy and Transactions. Tax. EY Private.

What is wam EY?

Wealth & Asset Management EY - US. Trending. Shaping the future of sports with confidence.

What is rank 42 in EY?

EY Rank There are generally 4 Ranks i.e. 44 denotes to Staff, 42 denotes to Senior, 32 denotes to Manager, 21 denotes to Senior Manager. However, there are some more in some departments i.e. 66 denotes to Associate, 65 denotes to Senior Associate, 64 denotes to Supervising Associate, 63 denotes to A…

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The Wealth Management Outlook?

The Wealth Management Outlook is a report that assesses current trends in wealth management, providing insights and forecasts about market conditions, client behaviors, and the future direction of financial services in wealth management.

Who is required to file The Wealth Management Outlook?

Financial institutions and wealth management firms that provide comprehensive services to clients are typically required to file The Wealth Management Outlook to ensure compliance and to reflect their strategic planning.

How to fill out The Wealth Management Outlook?

To fill out The Wealth Management Outlook, firms must gather relevant data on their client portfolios, market analyses, and performance metrics, then use the structured format provided in the report guidelines to convey this information accurately.

What is the purpose of The Wealth Management Outlook?

The purpose of The Wealth Management Outlook is to provide a comprehensive analysis of the wealth management industry, helping stakeholders make informed decisions, identify opportunities, and understand potential risks in the market.

What information must be reported on The Wealth Management Outlook?

The Wealth Management Outlook must report on key metrics such as asset allocation, client demographics, market trends, financial performance, regulatory changes, and projected economic conditions affecting wealth management.

Fill out your form wealth management outlook online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Wealth Management Outlook is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.