Get the free cms deposit slip

Fill out, sign, and share forms from a single PDF platform

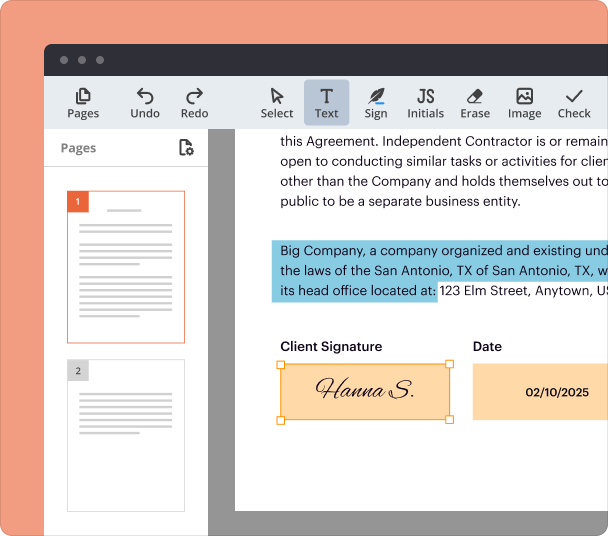

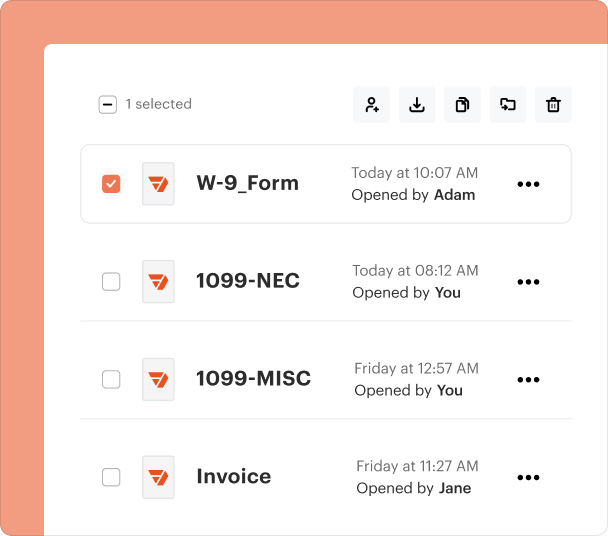

Edit and sign in one place

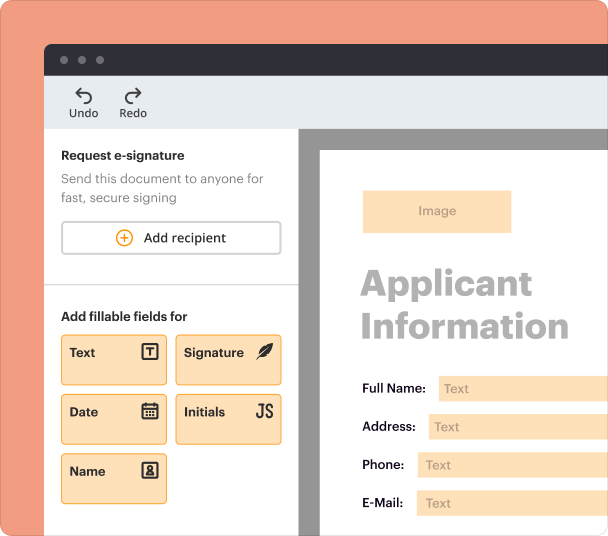

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

HDFC Bank Cheque Deposit Form Guide

To fill out an HDFC Bank cheque deposit form, you need to provide specific details about your cheque and account. Follow the steps outlined below to ensure you fill out the form accurately and submit it successfully.

Understanding the HDFC Bank cheque deposit process

-

HDFC Bank allows customers to deposit cheques through various channels including bank branches and ATM machines, making the process highly convenient.

-

Accurate completion of the cheque deposit form is critical to avoid processing delays or rejections. Make sure to double-check all entered information.

-

Be prepared to provide your identification if required. It's essential to understand the timelines involved for cheque clearance as well.

Essential components of the HDFC Bank cheque deposit form

-

Important fields to fill include the account number, deposit amount, and the cheque details. Ensure all fields are appropriately filled.

-

It's crucial to understand which product and service segments your deposit pertains to. Corporate clients may have distinct requirements.

-

Corporate clients must provide specific identifiers such as CMS client name and code to facilitate advanced processing.

Step-by-step instructions for filling out the cheque deposit form

-

Clearly write the date of the deposit and the branch or ATM location you are using for the transaction.

-

Sequentially number your deposits and indicate how many instruments you are submitting to ensure proper tracking.

-

Fill in the cheque number, the date on the cheque, the name of the drawing bank, and the name of the drawer accurately.

-

Make sure to write the drawn amount in figures and words. Include any additional notes as necessary.

Navigating pdfFiller for cheque deposit form management

-

Access pdfFiller's platform to easily upload your filled-out cheque deposit form. It allows you to manage documents efficiently.

-

Utilize pdfFiller's features to make necessary changes to your form and digitally sign it for submission.

-

Take advantage of cloud collaboration to share your deposit form with others for review, ensuring all information is correct.

Working with different types of deposits: High Value vs Non-High Value

-

High-value deposits usually refer to amounts above a certain limit set by the bank, often requiring additional scrutiny.

-

Ensure you provide the correct documents based on the type of deposit you are making to comply with bank requirements.

-

Be aware that high-value deposits may incur higher transaction fees and can take longer for clearance.

Finalizing your HDFC Bank cheque deposit

-

Your signature is key for validation, so ensure it matches what's on file with HDFC Bank to avoid complications.

-

Once completed, submit the form either at a bank branch or through their online platform, depending on your convenience.

-

After submission, make sure to follow up and obtain a receipt confirming your deposit was successful.

Common issues and solutions when depositing cheques

-

Understand the reasons for rejection and how you can address them. Sometimes, minor errors can lead to non-acceptance.

-

Always check that the amount written matches what is filled in. If discrepancies arise, clarify with the bank immediately.

-

If issues persist, don't hesitate to reach out to HDFC Bank's customer service for advice and potential resolution paths.

Additional compliance notes for corporate clients

-

Know Your Customer (KYC) regulations are crucial for banks to verify identities and often require more information from corporate clients.

-

Ensure your corporate records are always updated to avoid penalties or complications when making deposits.

-

High-value deposits may require specific documentation to adhere to compliance regulations, so prepare accordingly.

Frequently Asked Questions about hdfc bank cheque deposit slip fillable form

What is the purpose of the HDFC Bank cheque deposit form?

The HDFC Bank cheque deposit form is used by customers to provide important information regarding the cheque they are depositing. It ensures accurate processing and receipt of funds.

How do I fill out the deposit amount?

When filling out the deposit amount, make sure you write it both in numbers and in words. This helps prevent any misinterpretation during processing.

What should I do if my cheque gets rejected?

If your cheque is rejected, review the reasons given by the bank, and ensure all details are accurate. Contact customer service for further assistance.

Can corporate clients use the same form as individual clients?

While both may use the same HDFC Bank cheque deposit form, corporate clients must provide additional information and adhere to specific documentation requirements.

How long does it take for funds to clear after a deposit?

The clearance period for cheque deposits varies and can take from one to several business days depending on various factors, including the cheque's amount and the bank's policies.

pdfFiller scores top ratings on review platforms