Get the free FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE

Show details

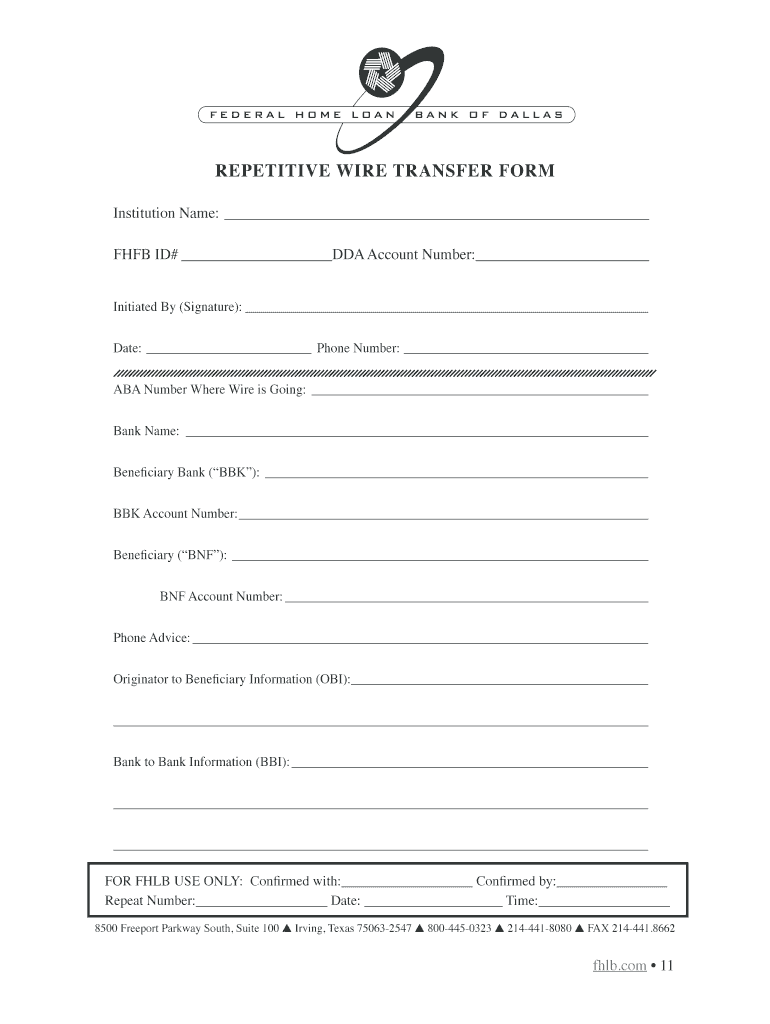

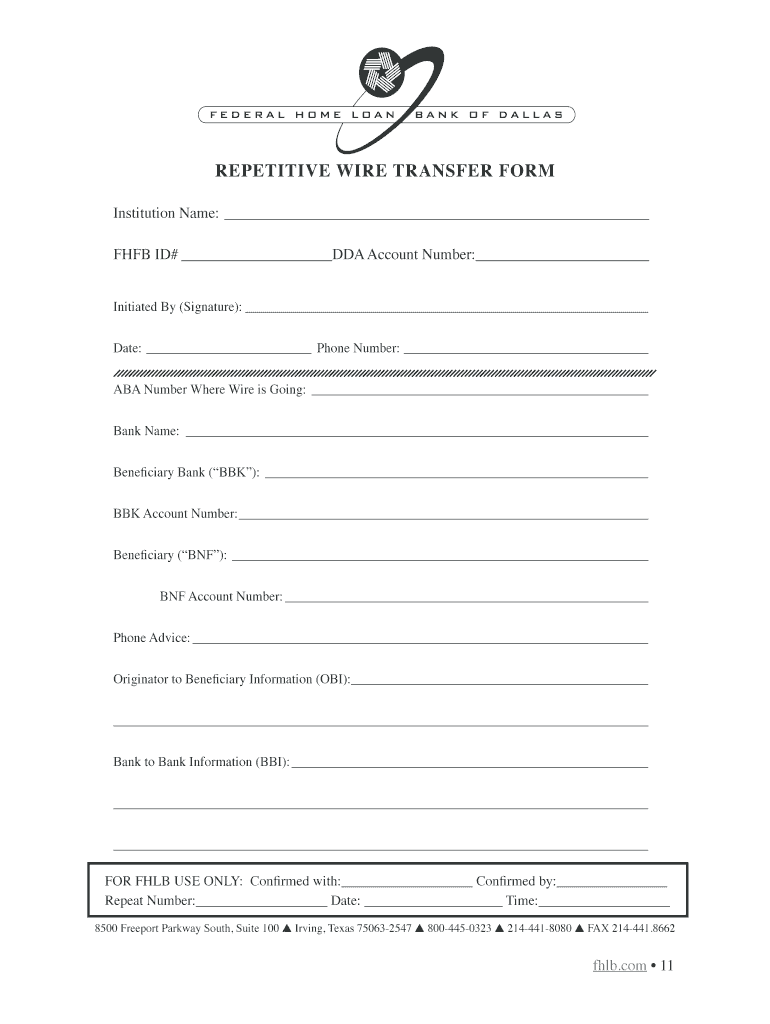

The document provides an overview of the services offered by the Federal Home Loan Bank of Dallas related to correspondent operations, including account management, wire transfer services, and reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal home loan bank

Edit your federal home loan bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal home loan bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal home loan bank online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal home loan bank. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal home loan bank

How to fill out FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE

01

Obtain the FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE from the official website or authorized distributor.

02

Review the introduction section to understand the purpose and scope of the guide.

03

Familiarize yourself with the terminology defined in the glossary section.

04

Follow the step-by-step instructions listed in each section regarding the application process and correspondent services.

05

Collect all necessary documentation as specified in the requirements section.

06

Complete the required forms meticulously, ensuring all requested information is accurate and up-to-date.

07

Submit the application along with any required documentation to the appropriate contact as indicated in the guide.

08

Keep a copy of your submission for your records and monitor for any communication from the Federal Home Loan Bank.

Who needs FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

01

Mortgage lenders looking to engage in correspondent services with the Federal Home Loan Bank of Dallas.

02

Real estate professionals and financial institutions involved in home loan financing in the Dallas region.

03

Compliance officers and administrative staff responsible for ensuring adherence to lending guidelines.

04

Anyone interested in understanding the offerings and requirements of the Federal Home Loan Bank's correspondent services.

Fill

form

: Try Risk Free

People Also Ask about

What is the role of the Federal Home Loan Bank?

The FHLBanks provide long- and short-term advances (loans) to their members. Advances are primarily collateralized by residential mortgage loans, and government and agency securities. Community financial institutions may pledge small business, small farm, and small agri-business loans as collateral for advances.

What is the Federal Home Loan Bank of Boston Advisory Council?

The FHLBank Boston Advisory Council is comprised of housing and community development leaders from throughout New England who meet quarterly with staff and representatives of the board of directors to advise on the administration of our special programs for housing and community development and collaborate to develop

What is the abbreviation for the Federal Home Loan Bank?

The FHLBs are federally chartered cooperative financial institutions, meaning that each FHLB is privately owned and capitalized by its members. Only members and certain eligible associates may receive FHLB services.

What is the purpose of the Federal Bank?

The Reserve Banks provide a wealth of information and data on conditions across the nation — information that is vital to formulating a national monetary policy that helps maintain a healthy U.S. economy and stable financial system. They also conduct independent research on the economy.

What is a major function of the Federal Home Loan Bank system?

The FHLBs' mission is to provide reliable liquidity to its member institutions to support housing finance and community investment. While the FHLBs' mission reflects a public purpose, all FHLBs are privately capi- talized and do not receive federal funding. The Federal Housing Finance Agency (FHFA) regulates the FHLBs.

What are the 5 main functions of the Federal Reserve?

It conducts the nation's monetary policy, promotes financial system stability, supervises and regulates financial institutions, fosters payment and settlement system safety and efficiency, and promotes consumer protection and community development.

What is a federal home?

The label “Federal” is applied to houses built after the Revolutionary War during the period of the new republic, a federation of states.

Why do banks borrow from the Federal Home Loan Bank?

The FHLBank System plays a stabilizing role in the U.S. financial system and is designed to provide access to on-demand liquidity, so that our member financial institutions – including banks, credit unions, insurance companies and CDFIs – can manage the risks that come with offering their customers 30-year fixed rate

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

The FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE is a comprehensive manual that outlines the policies, procedures, and products available for correspondent lending services provided by the Federal Home Loan Bank of Dallas.

Who is required to file FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

Entities that engage in correspondent lending with the Federal Home Loan Bank of Dallas are required to file and adhere to the guidelines set forth in the Correspondent Services Product Guide.

How to fill out FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

To fill out the FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE, one must follow the provided instructions within the guide, ensuring all required information is accurately completed and submitted according to the specified guidelines.

What is the purpose of FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

The purpose of the FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE is to provide guidance and standardization for mortgage lending operations, ensuring compliance, transparency, and effective partnership between lenders and the Federal Home Loan Bank of Dallas.

What information must be reported on FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE?

The information that must be reported on the FEDERAL HOME LOAN BANK OF DALLAS CORRESPONDENT SERVICES PRODUCT GUIDE includes but is not limited to borrower details, loan terms, property information, and compliance with regulatory requirements related to the lending process.

Fill out your federal home loan bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Home Loan Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.