Get the free Mortgage Sale Agreement

Show details

This document outlines the terms for the sale and purchase of mortgage loans and their related securities between The Bank of Nova Scotia, Scotiabank Covered Bond Guarantor Limited Partnership, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage sale agreement

Edit your mortgage sale agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage sale agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage sale agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage sale agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

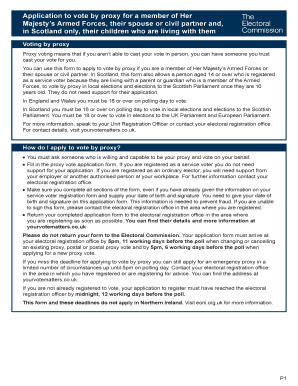

How to fill out mortgage sale agreement

How to fill out Mortgage Sale Agreement

01

Begin by providing the date of the agreement at the top of the document.

02

Identify the parties involved in the agreement - the seller (mortgagor) and the buyer (mortgagee).

03

Include a detailed description of the property being sold, including the address and any relevant identifiers.

04

Specify the terms of the sale, including the sale price and any deposit amount required.

05

Outline the details of the mortgage being sold, including outstanding balance and interest rates.

06

Include any contingencies that may affect the sale agreement, such as inspections or approval of financing.

07

Detail the timeline for closing the sale and transferring ownership.

08

Ensure both parties sign the agreement, including printed names and dates.

09

Consider having the document notarized for legal validity.

Who needs Mortgage Sale Agreement?

01

Individuals or entities looking to buy a property that is under a mortgage.

02

Property owners wishing to sell their property while still having an existing mortgage.

03

Real estate investors interested in purchasing properties with existing liens.

04

Lending institutions seeking to formalize the transfer of mortgage ownership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Sale Agreement?

A Mortgage Sale Agreement is a legal document that outlines the terms and conditions under which a property is sold and financed through a mortgage. It typically includes details about the borrower, lender, property, loan amount, interest rate, and repayment terms.

Who is required to file Mortgage Sale Agreement?

The borrower and lender involved in the mortgage transaction are typically required to file the Mortgage Sale Agreement. This ensures that both parties are legally recognized in the financing of the property.

How to fill out Mortgage Sale Agreement?

To fill out a Mortgage Sale Agreement, one should gather all necessary information about the parties involved, the property details, loan amounts, interest rates, and repayment terms. Then, use a standardized form or template to input this information accurately, ensuring all parties review and sign the document.

What is the purpose of Mortgage Sale Agreement?

The purpose of a Mortgage Sale Agreement is to formalize the agreement between the borrower and the lender regarding the terms of the mortgage loan. It serves as a legal record of the obligations of both parties and provides protections and rights in case of disputes.

What information must be reported on Mortgage Sale Agreement?

The Mortgage Sale Agreement must report information such as the names and contact details of the borrower and lender, property description, loan amount, interest rate, terms of repayment, and any additional conditions or clauses relevant to the sale.

Fill out your mortgage sale agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Sale Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.