Get the free Hypothec - Collateral

Show details

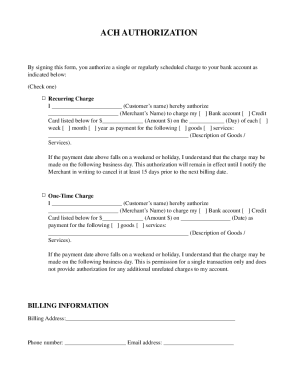

This document is a hypothec agreement between The Bank of Nova Scotia and the borrower, detailing the secured obligations, property descriptions, and rights and responsibilities of both parties in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hypoformc - collateral

Edit your hypoformc - collateral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hypoformc - collateral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hypoformc - collateral online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hypoformc - collateral. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hypoformc - collateral

How to fill out Hypothec - Collateral

01

Gather necessary documents, including proof of ownership of the asset.

02

Obtain the correct Hypothec form from your local authorities or financial institution.

03

Fill out the personal information required, such as your name, address, and identification number.

04

Provide details about the collateral, including a description of the asset and its estimated value.

05

Specify the amount of the loan or obligation that the Hypothec is securing.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed form to the relevant authority or lender for processing.

Who needs Hypothec - Collateral?

01

Individuals seeking a loan or credit secured against an asset.

02

Businesses that need to borrow money using company property as collateral.

03

Property owners looking to leverage their property to obtain financing.

Fill

form

: Try Risk Free

People Also Ask about

What is a hypothec in English?

Also known as a hypothecation. A form of security, often with similar characteristics to a charge, where possession of the secured asset stays with the person providing the security. In some jurisdictions (for example, Scotland) hypothecs may be taken over tangible moveable property.

Is a mortgage the same as a hypotheque?

A mortgage is a guarantee that financial institutions usually ask for in exchange for loaning you money. In Quebec law, the official name for a mortgage is a hypothec.

What is hypothecation of collateral?

Hypothecation means offering an asset as collateral to back a loan. If you default on the debt, the lender can take the asset to recoup their money. Common uses for hypothecation include mortgages, auto loans and investment margin accounts.

What is an example of a hypothec?

The property on which a hypothec is given is called the property “charged” with a hypothec. A loan repayment guaranteed by a hypothec is called a hypothecary loan. For example, imagine that Marc grants the bank a hypothec (mortgage) on his house to guarantee that he will pay back a $100,000 loan he got from the bank.

What is a hypothecary creditor?

Definition : Hypothecary creditor. Natural or legal person holding a hypothec on a fraction of co-ownership.

What is a hypothec collateral?

Hypothecation is the practice where a debtor pledges collateral to secure a debt or as a condition precedent to the debt, or a third party pledges collateral for the debtor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Hypothec - Collateral?

Hypothec is a legal mechanism that allows a lender to secure a loan by taking a claim over specific assets of the borrower, which can be seized if the borrower defaults on the loan.

Who is required to file Hypothec - Collateral?

Individuals or entities that are securing a loan against specific assets are typically required to file a hypothec to establish the lender's rights over the collateral.

How to fill out Hypothec - Collateral?

To fill out a hypothec, one must provide details about the borrower and lender, a description of the collateral, the loan amount, and any relevant terms and conditions.

What is the purpose of Hypothec - Collateral?

The purpose of hypothec is to provide security for a loan, ensuring that the lender has a legal right to the collateral in case the borrower fails to meet their repayment obligations.

What information must be reported on Hypothec - Collateral?

The information that must be reported includes the names and addresses of the borrower and lender, a detailed description of the collateral, the amount of the secured debt, and the terms of the agreement.

Fill out your hypoformc - collateral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hypoformc - Collateral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.