Get the free Cardholder Agreement

Show details

This document outlines the terms and conditions governing the use of Scotiabank credit cards, including cardholder rights and obligations, repayment terms, and information related to rewards programs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cardholder agreement

Edit your cardholder agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cardholder agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cardholder agreement online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cardholder agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

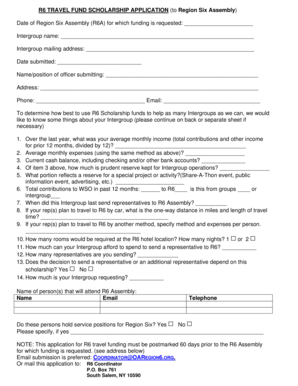

How to fill out cardholder agreement

How to fill out Cardholder Agreement

01

Start with the basic information: fill in your full name as it appears on your ID.

02

Provide your current address including street, city, state, and zip code.

03

Enter your date of birth in the specified format.

04

Fill in your Social Security number or other identification number as required.

05

Review the terms and conditions provided in the agreement.

06

Sign and date the document, confirming you understand the agreement.

Who needs Cardholder Agreement?

01

Individuals applying for a credit card or a debit card.

02

Anyone seeking to establish a credit account with a financial institution.

03

Consumers who require a formal agreement for use of a card.

04

Others who want to ensure they understand their rights and responsibilities as a cardholder.

Fill

form

: Try Risk Free

People Also Ask about

What is a card holder agreement?

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

Where can I find my Chase cardholder agreement?

Cardholder name: meaning and location The cardholder name is the name on your debit card, typically located on the front. The cardholder name identifies the person who owns and is authorized to use the bank card.

What is the purpose of a credit card agreement?

Your rights and responsibilities, and those of the creditor, are set out so that both sides can know what to expect. This will include how much interest and charges will be and what can happen if you do not pay the credit back as agreed. If you are unsure about anything, you should check your credit agreement.

What is the purpose of a card holder?

A key purpose of a card holder is to simplify the way that you carry your essentials. They focus on reducing the number of cards you carry, so you can prioritize the ones you use the most and leave the rest at home (source).

How do I find my cardholder agreement?

If you are looking for information specific to your account, contact the bank or institution that issued your card. By law, the issuer must make your agreement available to you upon request.

What is the definition of a cardholder agreement?

A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cardholder Agreement?

A Cardholder Agreement is a legal document that outlines the terms and conditions associated with a payment card, detailing the rights and responsibilities of the cardholder and the issuer.

Who is required to file Cardholder Agreement?

Typically, financial institutions and credit card issuers are required to file a Cardholder Agreement as part of regulatory compliance when offering credit cards to consumers.

How to fill out Cardholder Agreement?

To fill out a Cardholder Agreement, one must provide necessary personal information, review terms and conditions, acknowledge understanding of the agreement, and provide signatures as required.

What is the purpose of Cardholder Agreement?

The purpose of a Cardholder Agreement is to inform cardholders about the terms of use, fees, interest rates, and other important information regarding the credit card, ensuring transparency and understanding.

What information must be reported on Cardholder Agreement?

The Cardholder Agreement must report information including fees, interest rates, payment due dates, credit limit, rights under the agreement, and how disputes are handled.

Fill out your cardholder agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cardholder Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.