Get the free RETAIL COLLATERAL MORTGAGE

Show details

This document serves as a retail collateral mortgage for securing loans against land in accordance with the Land Titles Act, detailing the obligations of mortgagors and mortgagees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retail collateral mortgage

Edit your retail collateral mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retail collateral mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

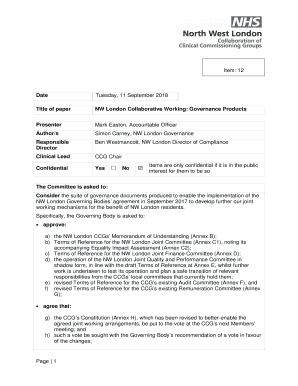

How to edit retail collateral mortgage online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit retail collateral mortgage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

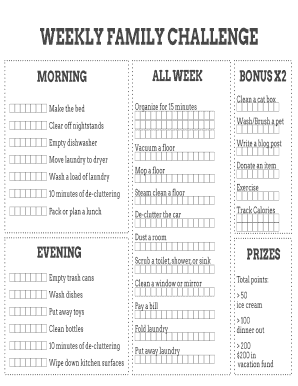

How to fill out retail collateral mortgage

How to fill out RETAIL COLLATERAL MORTGAGE

01

Gather required documentation, including proof of income, credit history, and property details.

02

Obtain and fill out the RETAIL COLLATERAL MORTGAGE application form carefully.

03

Provide necessary identification and legal documents as specified in the application form.

04

Calculate the loan amount based on the value of the collateral, ensuring it meets lender requirements.

05

Review the terms and conditions of the mortgage, including interest rates and repayment plans.

06

Submit the completed application along with all supporting documents to the lender.

07

Schedule an appraisal of the collateral property if required by the lender.

08

Await approval from the lender, which may take several days to weeks.

09

Sign the mortgage agreement and complete any additional documentation required.

10

Make any necessary payments for closing costs and begin payment on the mortgage as agreed.

Who needs RETAIL COLLATERAL MORTGAGE?

01

Individuals or businesses looking to finance the purchase of retail properties or expand their retail operations.

02

Property investors seeking to leverage their retail property as collateral for financing.

03

Entrepreneurs needing funds for business expansion through retail space acquisition.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between collateral and mortgage?

A mortgage is a type of loan that finances the purchase of a property. Collateral is an asset that provides the backing for a loan — any sort of loan. You almost always need collateral to get a mortgage, and that collateral is almost always the property you're buying with the loan.

Is it smart to do a collateral loan?

If you're not approved for an unsecured loan, the lender may offer you a secured loan, which is a lower risk to them because you are offering collateral to back the loan. Collateral can improve your chances of getting approved for a loan, even if your credit is less than perfect.

What are the disadvantages of a collateral mortgage?

Collateral mortgage cons: This is because the mortgage is transferable. A collateral mortgage however is nontransferable. With that, it cannot be simply switched to another lender for a more competitive interest rate at renewal. In this situation to move lenders it would trigger a refinance.

What does a collateral mortgage mean?

A collateral mortgage allows you to use your home as security for a loan or more than one loan and, potentially, borrow additional funds.

What is collateral on a mortgage?

A mortgage is a type of loan that finances the purchase of a property. Collateral is an asset that provides the backing for a loan — any sort of loan. You almost always need collateral to get a mortgage, and that collateral is almost always the property you're buying with the loan.

What does collateral mortgage mean?

A collateral mortgage is a way for you to obtain a loan amount equal to or even greater than the total value of your property. It's a way to get additional financing at a lower rate. It's often used for new construction projects or for major renovations that will affect the property value.

What is a retail mortgage lender?

Retail mortgages are originated directly to borrowers from lending institutions. Retail lenders use their own funds to finance the mortgages, and borrowers have a direct relationship with the lender throughout the loan process.

What is a collateral in mortgage?

Collateral guarantees a loan, so it needs to be an item of value. For example, it can be a piece of property, such as a car or a home, or even cash that the lender can seize if the borrower does not pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RETAIL COLLATERAL MORTGAGE?

A Retail Collateral Mortgage is a type of mortgage that allows homeowners to use their property as collateral for a line of credit or loan, often providing flexible access to funds while retaining potential home equity.

Who is required to file RETAIL COLLATERAL MORTGAGE?

Typically, lenders and financial institutions that offer retail collateral mortgages are required to file the relevant documents, along with homeowners who are seeking to secure such a mortgage.

How to fill out RETAIL COLLATERAL MORTGAGE?

To fill out a Retail Collateral Mortgage, borrowers must provide personal identification, property details, loan amount, terms, and financial information, which can usually be done through a loan application form provided by the lender.

What is the purpose of RETAIL COLLATERAL MORTGAGE?

The purpose of a Retail Collateral Mortgage is to provide homeowners with access to credit by leveraging the equity in their property while offering the flexibility to borrow against that equity as needed.

What information must be reported on RETAIL COLLATERAL MORTGAGE?

Information that must be reported includes borrower details, property information, mortgage amount, terms of the loan, interest rates, and any repayment conditions associated with the collateral mortgage.

Fill out your retail collateral mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retail Collateral Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.